Jump to ...

3 Retailers Looking for a Combined 1,100 Locations

Amazon Proposes Second Big-Box Store

2 Major Malls Being Demolished for Mixed-Use

NFL- and MLB-Related Projects Will Anchor Mixed-Use Districts in Texas and Florida

$596M Refi for Mixed-Use Crescent in Dallas

RealAdvice Adds President Role

3 Retailers Looking for a Combined 1,100 Locations

Mike’s Red Tacos, Dutch Bros Coffee and Circle K are in hypergrowth mode.

Dave’s Hot Chicken Veterans Back 200-Unit Expansion for Mike’s Red Tacos

Mike’s Red Tacos, now just a two-store operation, is eyeing more than 200 franchised restaurants in the U.S. Mike’s, which specializes in buzz-generating Mexico-inspired birria tacos, launched in a food truck in 2021. A year later, it opened its first brick-and-mortar location in San Diego, and a second San Diego spot followed in 2024.

Mike’s Red Tacos is adding franchisee-owned locations in markets like Chicago, Dallas, Miami and Southern California. Photo above and at top courtesy of Mike’s Red Tacos

Backed by Dave’s Hot Chicken veterans Andrew Feghali and Bill Phelps, Mike’s initially will target major markets like Southern California, Seattle, Phoenix, Las Vegas, Chicago, Miami, Dallas and Austin, Texas. The first franchisee-owned stores are scheduled to open by the end of this year, and a third company-owned store is supposed to open in March in San Diego. Each restaurant measures 2,200 to 2,400 square feet.

Dutch Bros Plans 181 New Coffee Shops This Year

Dutch Bros Coffee plans 181 new coffee shops this year, which would eclipse its 2025 total of 154. The 2026 goal includes 20 in the Carolinas that it acquired from Clutch Coffee Bar for $20 million, executives said during Dutch Bros’ fourth-quarter earnings call. The chain closed out 2025 with a shop count of 1,136. It aims to reach 2,029 stores by 2029.

MORE FROM C+CT: From Pizza to Apparel: 5 Retailers Expanding Their Footprints

Dutch Bros Coffee began trading on the New York Stock Exchange in 2021. Photo courtesy of New York Stock Exchange

Circle K Owner Reveals 750-Store Expansion

Targeting growth in the U.S., Canada-based convenience store operator Alimentation Couche-Tard aims to add 750 company-operated Circle K locations over the next five years. Couche-Tard executives laid out the expansion plan at the company’s annual investor meeting. The new stores will be a combination of new builds and small acquisitions, a Couche-Tard spokesperson told C-Store Dive. The first 100 new builds will deliver this year, president and CEO Alex Miller said, according to C-Store Dive. As of Oct. 12, Alimentation Couche-Tard operated nearly 17,300 stores, including more than 7,300 in the U.S. and almost 2,100 in Canada.

Alimentation Couche-Tard will add 750 Circle K stores over five years. Photo courtesy of Timmons Group

Last year, Couche-Tard dropped its $47.2 billion takeover bid for Japan-based Seven & i Holdings, Restaurant Business reported. With the Alimentation Couche-Tard bid in the rearview mirror, Seven & i is focusing on a 2026 IPO for its 7-Eleven business in North America and the addition of 1,300 large-format stores in the U.S. by 2030.

Amazon Proposes Second Big-Box Store

Amazon is upping the ante in its gamble on big-box retail. The Chicago suburb of Oak Brook, Illinois, has received a proposal to build a 225,000-square-foot Amazon store and a 150,000-square-foot Ashley furniture store on a 22-acre site, according to the Chicago Tribune. Seven office buildings would be torn down to accommodate the project. This is the second big-box Amazon store planned in the Chicago suburbs. On Jan. 19, the village board in Orland Park gave the go-ahead for a 229,000-square-foot Amazon store. As Amazon scales up its big-box ambitions, it’s scaling back its brick-and-mortar grocery presence, closing all its Amazon Go and Amazon Fresh stores, some of which will convert to Amazon’s Whole Foods Market format.

Amazon wants to build a 225,000-square-foot store in Oak Brook, Illinois. Rendering courtesy of Amazon

2 Major Malls Being Demolished for Mixed-Use

Portland, Oregon’s Lloyd Center and the Nashville, Tennessee, metro’s RiverGate will come down to make room for major mixed-use projects.

7M-SF Mixed-Use Project Will Replace 66-Year-Old Mall in Portland, Oregon

Portland, Oregon’s nearly 1.2 million-square-foot Lloyd Center mall, which opened 66 years ago, is being torn down to make way for as much as 7 million square feet of mixed-use space. The mall will close this year, Fox 12 Oregon reported.

Urban Renaissance Group and KKR Real Estate Finance Trust envision a mixed-use project at the 29-acre site of the soon-to-be-demolished Lloyd Center mall. Rendering courtesy of Urban Renaissance Group

As envisioned by Lloyd Center owners Urban Renaissance Group and KKR Real Estate Finance Trust, the 29-acre project would comprise retail, restaurant, residential and office space.

In a separate but related project, entertainment companies AEG Presents and Monqui Presents are developing a 68,000-square-foot, 4,250-capacity music venue at the site of the mall’s former Nordstrom. AEG and Monqui broke ground last October on the $70 million venue, which is expected to open in 2027, according to KGW 8 and KOIN 6.

A 4,250-capacity music venue is rising at the site of a former Nordstrom at Portland, Oregon’s Lloyd Center. Rendering courtesy of Works Architecture

$450M Mixed-Use Project Will Replace Suburban Nashville Mall

Merus bought the 55-year-old RiverGate Mall in Goodlettsville and plans to tear down the property and redevelop it into a 57-acre mixed-use district with new streets and infrastructure. The estimated cost is $450 million. “Our focus is taking a property designed for a different era and reimagining it as a walkable, active district where people can live, work, gather and spend time,” said Patrick Poole, Nashville market leader for Merus.

The existing mall is 514,000 square feet, according to Franklin Street, which represented the seller, Hendon Properties. Merus plans to begin demolition this spring. The new development employs tax-increment-financing packages from the city of Goodlettsville and from Metro Nashville, which is the governing body of the city of Nashville and Davidson County. At full buildout, the project will include 135,000 square feet of retail and dining, 700 multifamily units, 100 townhomes, 80 seniors housing units, a center green and plaza and land for future rapid bus transit.

MORE FROM C+CT: 4 Mixed-Use Updates: Las Vegas, L.A., Atlanta and D.C.

NFL- and MLB-Related Projects Will Anchor Mixed-Use Districts in Texas and Florida

Sports-anchored mixed-use projects are fueling pipelines in Houston and Tampa-St. Petersburg, Florida.

Houston Texans’ New HQ Will Anchor 83-Acre Mixed-Use District

Similar to a recently unveiled project for the Kansas City Chiefs, a new headquarters and training facility for the Houston Texans will anchor a proposed 83-acre mixed-use district. The NFL team’s headquarters and training facility will occupy 22 acres in the Toro District, which will rise at Howard Hughes Communities’ 11,500-acre master-planned Bridgeland, in the Houston suburb of Cypress. The headquarters-and-training complex will encompass 325,000 square feet, according to the Houston Chronicle. Backers said the Toro District will include retail, restaurant, hotel, entertainment, commercial and medical space. The headquarters and practice facility are now at Houston’s NRG Park, which also serves as the Texans’ home field.

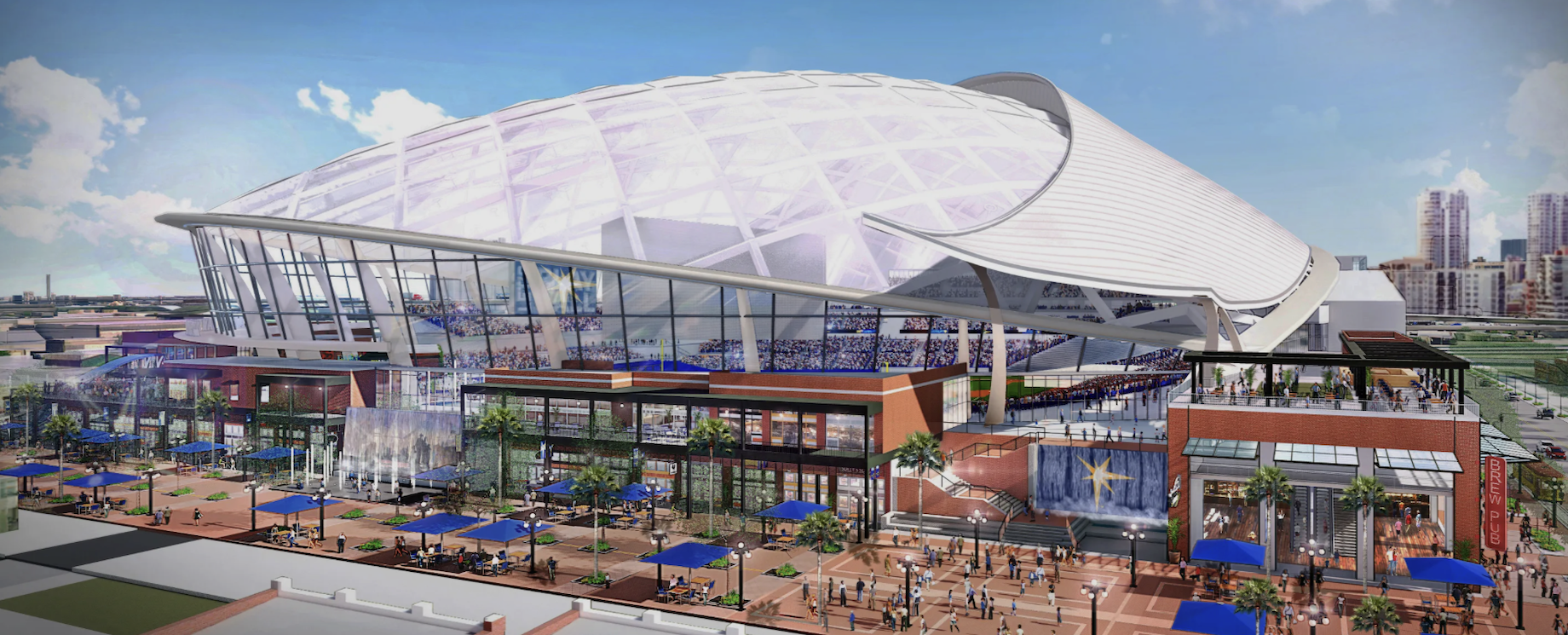

Tampa Mixed-Use Project Will Pair With Proposed $2.3B Ballpark

A proposed MLB ballpark and mixed-use district in Tampa, Florida, are gaining traction. Hillsborough College has agreed tentatively to partner with the Tampa Bay Rays to develop the stadium and mixed-use project on a 113-acre college campus. The 31,000-seat ballpark alone would cost an estimated $2.3 billion, according to USA Today.

The Tampa Bay Rays expect their new ballpark to be ready for the 2029 MLB season. Rendering courtesy of Tampa Bay Rays

The Rays currently play home games at Tropicana Field in St. Petersburg, which opened in 1990. The development could include retail, restaurant, hotel and multifamily space, as well as sports- and health-related buildings.

MORE FROM C+CT: Where Fans, Food and Foot Traffic Meet: Stadium Districts’ Retail Appeal

$596M Refi for Mixed-Use Crescent in Dallas

Crescent Real Estate has obtained a $596 million refinancing loan for its mixed-use property in the high-end Uptown Dallas submarket. JLL arranged the three-year, floating-rate loan for the two office towers, including ground-floor retail, totaling 1.2 million square feet, and a 67,510-square-foot, three-story building that houses retailers and restaurants.

The Crescent mixed-use property sits in Dallas’ high-end Uptown submarket. Photo courtesy of JLL

RealAdvice Adds President Role

Commercial real estate tax and transaction advisory services company RealAdvice promoted Alexis Vennes from COO to president and COO. She is the company’s first president. She will continue to oversee operations and will take on enterprise strategy, organizational alignment and external leadership.

Alexis Vennes has become RealAdvice’s first president. Photo courtesy of RealAdvice

—Additional reporting by Commerce + Communities Today editor-in-chief Amanda Metcalf

By John Egan

Contributor, Commerce + Communities Today