Jump to ...

Store Closures Will Decline and Openings Will Rise in 2026

7 Development, Investment and Financing Updates From GBT Realty, Concorde, Simon and GGP

4 Mixed-Use Updates: Las Vegas, L.A., Atlanta and D.C.

11North Partners and Cullinan Announce C-Suite Updates

Store Closures Will Decline and Openings Will Rise in 2026

The outlook for store closures and openings in 2026 is sunnier than it was last year, according to Coresight Research’s U.S. Store Tracker Extra: Store Openings and Closures 2025 Review and 2026 Outlook. Coresight estimated that 7,900 stores will close this year, down 4.5% from the 2025 total, and that 5,500 stores will open, up 4.4% from last year’s count. The tallies exclude single-store independent retailers. So far this year, drugstores, home retailers, office stores and clothing retailers are driving closures, while discount and grocery retailers are leaders in openings.

MORE FROM C+CT: Which Categories Will Lead New-Store Growth

A few recent updates on retailers’ plans:

Simon Will Add 21 Pop Mart Stores Across Its U.S. Portfolio

Simon is more than doubling the number of its retail centers where Pop Mart is a tenant. The Chinese toy and entertainment brand, whose lineup includes the wildly popular Labubu, will set up shop at 21 Simon properties in 2026. Pop Mart currently operates stores at 13 Simon properties, a spokesperson for the REIT said. Those are among the 47 permanent U.S. locations of Pop Mart. Modern Retail reported in 2024 that Pop Mart aimed to operate 200 U.S. stores eventually. According to Chain Store Age, the retailer is raising its Canadian store count this year to three.

MORE FROM C+CT: Retail Tenants to Watch in 2026

Pop Mart’s U.S. footprint includes this store at Simon’s Mills at Jersey Gardens in Elizabeth, New Jersey. Photo above and at top courtesy of Simon

Starbucks Unveils Long-Term Plan To Open as Many as 10,000 More U.S. Stores

Declaring that “Starbucks is back,” the coffee shop chain envisions opening as many as 5,000 U.S. locations in its fiscal year 2028 and beyond. Starbucks’ 2028 fiscal year will end in the fall of 2028. At its recent Investor Day event, the company said that number could double to 10,000 in tandem with the growth of average unit volumes, or per-store revenues. That would represent a 59% increase in its U.S. store count compared with the 16,900 as of Dec. 28, when the first quarter of its 2026 fiscal year ended. Starbucks also plans to open about 400 company-operated stores in the U.S. in fiscal year 2027, which ends in October 2027.

FROM THE C+CT ARCHIVE: Walmart and Starbucks Are Doing It: 3D Concrete Printing Is About To Take Off

Starbucks envisions opening 5,000 to 10,000 U.S. stores in fiscal year 2028 and beyond. Photo courtesy of Starbucks

Amazon Will Both Open and Close Stores

Amazon is planning both store openings and closures. Though it’s erasing its Amazon-branded brick-and-mortar grocery footprint, it isn’t giving up on a physical presence. Amazon has about 60 Amazon Fresh and 15 Amazon Go stores, according to Business Insider, and plans to replace some of them with Whole Foods Market-branded locations. The retailer foresees opening more than 100 Whole Foods locations over the next few years. And in the next year, the number of small-format Whole Foods Market Daily Shop locations will double from five to 10. Whole Foods operates more than 550 stores, primarily in the U.S.

MORE FROM C+CT: Amazon Proposes 229K-SF Retail Center Near Chicago

Amazon is shuttering about 60 Amazon Fresh stores and 15 Amazon Go stores. Photo courtesy of Amazon

Saks Global Is Winding Down Off-Price Stores

After declaring Chapter 11 bankruptcy on Jan. 13, luxury retail conglomerate Saks Global is closing 57 off-price Saks Off 5th stores and all five of its Neiman Marcus Last Call stores, the Dallas Business Journal reported. Twelve Saks Off 5th stores will remain open. The company said its 70 full-line Saks Fifth Avenue, Neiman Marcus and Bergdorf Goodman stores are conducting business as usual. Subject to court approval, A&G Real Estate Partners will auction off 59 Saks Off 5th and Last Call store leases totaling 1.7 million square feet.

This Neiman Marcus Last Call in Grapevine, Texas, is one of five Last Call locations closing. Photo courtesy of A&G Real Estate Partners/PR Newswire

7 Development, Investment and Financing Updates From GBT Realty, Concorde, Simon and GGP

Owners are putting up money to reposition, redevelop and build.

GBT Realty Plans $1.3B of Retail Development and Acquisitions

GBT Realty plans to spend $1.3 billion over the next year-and-a-half to develop build-to-suit retail and to acquire shopping centers, aiming to bring the worth of its assets under management above $3 billion, according to Bisnow. The outlet also reported that AEW will be a capital partner.

Investment Firm Launches Fund To Reposition Grocery-Anchored Centers in the Sunbelt

Real estate investment firm Concorde recently launched an investment fund that will buy and reposition grocery-anchored shopping centers in Sunbelt markets. It aims to raise around $300 million, a spokesperson told C+CT. Concorde anticipates an initial close of the fund later this year and additional closes on a rolling basis as the firm raises and spends capital, the spokesperson said. Concorde Essential Properties Fund will target neighborhood and community centers benefiting from population growth, business migration and limited new retail supply, the firm said. Its website highlights 10 Sunbelt states for potential acquisitions. Concorde’s current portfolio consists of one property in Georgia, two in Florida and three in the United Arab Emirates.

MORE FROM C+CT: $1B Joint Venture Will Build East Coast Grocery-Anchored Centers With Multifamily Components

Simon Will Spend $250M Redeveloping 3 Luxury Properties in Nashville, Denver and Tampa

Simon is spending more than $250 million to upgrade three upscale retail centers it acquired last year when it assumed full ownership of Taubman. Among the updates will be a 50,000-square-foot open-air expansion at International Plaza in Tampa, Florida; revamped storefronts at Cherry Creek Shopping Center in Denver; and “jewel box” spaces for luxury boutiques at The Mall at Green Hills in Nashville, Tennessee. Construction is expected to start this year.

Improvements at The Mall at Green Hills in Nashville, Tennessee, will include two-story “statement” entrances and “elevated arrival moments,” according to Simon. Rendering courtesy of Simon

Elsewhere in the Nashville area, Simon is developing a 100-acre mixed-use center called Sagefield. During Simon’s fourth-quarter earnings call on Tuesday, president and CEO David Simon said the development cost could reach $500 million.

GGP Refinances Tysons Galleria With $435M Loan

Brookfield Properties’ newly rebranded GGP retail division has secured a $435 million, five-year, fixed-rate refinancing loan for its Tysons Galleria superregional mall in the Washington, D.C., suburb of McLean, Virginia. The interest-only mortgage carries an assumed rate of 4.9%, according to ratings agency S&P Global. Tenants of the 740,847-square-foot high-end mall include Saks Fifth Avenue, Neiman Marcus, Chanel, Crate & Barrel, Gucci, Louis Vuitton and Prada.

MORE FROM C+CT: Brookfield Revives GGP Brand

Tysons Galleria’s 260,000-square-foot Macy’s was converted into an entertainment and retail hub in 2023. Photo courtesy of TVS

4 Mixed-Use Updates: Las Vegas, L.A., Atlanta and D.C.

A price tag and delivery date are now known for the Bally’s Corp. mixed-use development being paired with the new A’s baseball stadium in Las Vegas. The 26-acre project will cost nearly $1.2 billion and should be completed by the end of 2030, according to the Las Vegas Review-Journal. The $2 billion ballpark, on 9 acres, will open in 2028.

Three more mixed-use updates:

Shopoff Realty Acquires Rest of L.A.-Area Mall for 83-Acre Mixed-Use Project

Shopoff Realty Investments finalized its purchase of the 1.3 million-square-foot Westminster Mall in the Los Angeles suburb of Westminster for a planned mixed-use redevelopment. Shopoff bought from WPG the remaining 57 acres it didn’t already own. In 2022, Shopoff acquired the 14-acre former Sears parcel and 12-acre former Macy’s parcel. The 83-acre Bolsa Pacific at Westminster redevelopment will include more than 220,000 square feet of retail, a 15,000-square-foot food hall, 2,250 residential units and more than 120 hotel rooms. Shopoff expects entitlement plans to be approved and demolition of the shuttered mall to start this year.

The planned Bolsa Pacific at Westminster mixed-use project in Southern California will offer more than 220,000 square feet of retail. Rendering courtesy of Shopoff Realty Investments

2.2M-SF Atlanta Office Park Slated for Mixed-Use Redevelopment

The 2.2 million-square-foot, 46-acre Piedmont Center office park in Atlanta’s Buckhead will become a mixed-use destination. Owner CP Group plans to anchor the redevelopment with new retail, restaurant and hospitality elements, including a street-level retail and dining corridor featuring at least six new restaurants. Office space will remain a fixture at the site, which currently comprises 14 buildings.

FROM THE C+CT ARCHIVE: Master-Planned Community Near Atlanta Will Include 600 Acres of Retail and Residential

The revamped Piedmont Center will include a street-level retail and dining corridor. Rendering courtesy of CP Group

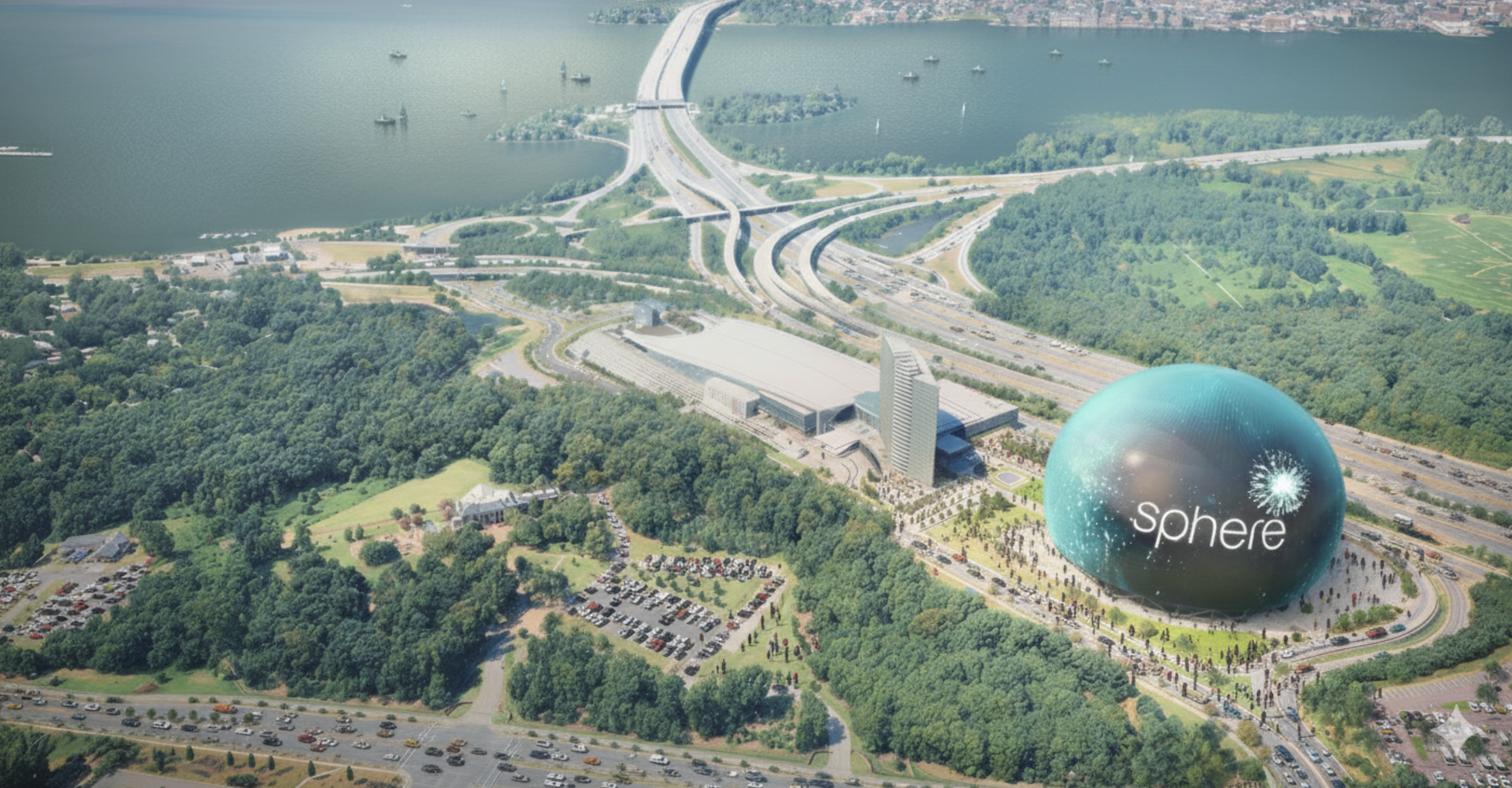

Sphere at National Harbor Could Boost Sales for Tanger Outlet Center

Tanger’s outlet center at the Washington, D.C. area’s National Harbor could benefit significantly from a proposed attraction for the mixed-use complex in Prince George’s County, Maryland. It would be the second Sphere in the U.S., following the 2023 opening of the immersive entertainment venue’s larger location in Las Vegas. Featuring massive indoor and outdoor LED displays, National Harbor’s Sphere, smaller than the one in Las Vegas, would seat 6,000 guests for concerts, movies and other events.

A 6,000-seat version of Las Vegas’ Sphere is proposed for the National Harbor mixed-use development in Prince George’s County, Maryland. Rendering courtesy of Sphere Entertainment/Peterson Cos.

Tanger operates an 85-store outlet center at National Harbor. The outlet center could see a spillover effect from the Sphere, attracting shoppers before and after they visit the entertainment venue. National Harbor already draws 15 million visitors a year, a number that could climb as the Sphere gains a following.

Eighty-five stores operate at the Tanger National Harbor outlet center. Photo courtesy of Experience Prince George’s

11North Partners and Cullinan Announce C-Suite Updates

Ekta Patel COO became COO of 11North Partners on Tuesday, joining from Bain Capital. In April 2024, 11North and Bain formed a platform to invest in in open-air centers in the U.S. and Canada, and in December 2025, they closed a capital raise of up to $1.6 billion. Patel also has held leadership roles at AEW and Brookfield.

And investment and development firm Cullinan Properties has promoted Wayne Wozniak to CFO. He joined the firm in 2024 as senior vice president of accounting.

—Additional reporting by Commerce + Communities Today editor-in-chief Amanda Metcalf

By John Egan

Contributor, Commerce + Communities Today