Jump to …

Blackstone-Led Group Taking Hawaiian Retail Landlord Alexander & Baldwin Private in $2.3B Transaction

Canadian Investor Oxford Breaks Into U.S. Open-Air Sector

DLC and DRA Expand Footprint With $429M, 8-Property Portfolio Buy

Texas Retail Momentum Continues With 2 Big Sales in San Antonio and Houston Suburbs

Hines Buys Clay Terrace Near Indianapolis in $199M Deal

Bain Capital and 11North Close $1.6B Fund for Open-Air Retail Acquisitions

15 to 20 Bloomie’s Stores Coming in Next 5 Years

Large-Scale Mixed-Use Projects Advance in Southeast

London’s Bond Street Claims Top Spot as World’s Priciest Retail Real Estate Corridor

CBRE Promotes 3 Executives in Its C-Suite

Blackstone-Led Group Taking Hawaiian Retail Landlord Alexander & Baldwin Private in $2.3B Transaction

Hawaiian commercial real estate owner, operator and developer Alexander & Baldwin is going private in a $2.3 billion deal engineered by Blackstone Real Estate, DivcoWest and MW Group. A&B is the largest owner of grocery-anchored retail centers in Hawaii. Funds affiliated with Blackstone, in tandem with DivcoWest and MW Group, are paying $21.20 per share in cash to acquire A&B, including its outstanding debt. The deal represents a 40% premium to the Dec. 8 closing price of A&B’s stock.

The Shops at Kukuiula, above, and Queens’ Marketplace, at top, are among the 21 retail properties in Alexander & Baldwin’s portfolio. Photos above and at top courtesy of Alexander & Baldwin

A&B’s portfolio in Hawaii comprises 4 million square feet across 21 retail centers, 14 industrial properties and four office properties. A&B also owns fee interests for 146 acres of ground-lease assets. The acquisition is expected to close in the first quarter of 2026. Once the deal is done, the investor group plans to spend more than $100 million on upgrades across the A&B portfolio.

DLC and DRA Expand Footprint With $429M, 8-Property Portfolio Buy

Retail property owner, operator and manager DLC teamed up with real estate investment and management firm DRA Advisors to buy a 2.1 million-square-foot retail portfolio for $429 million. The off-market deal adds eight retail centers in Arizona, Florida, North Carolina, Oklahoma and Texas to the firms’ portfolios.

Portofino Shopping Center in Shenandoah, Texas, is among eight properties that DLC and DRA Advisors purchased for $429 million. Photo courtesy of DLC

DLC and DRA said the portfolio’s occupancy rate is 91.3%. Tenants include Dick’s Sporting Goods, HomeGoods, Marshalls, Nordstrom Rack, REI, Ross Dress for Less, Total Wine & More, T.J.Maxx and Ulta Beauty.

In October, their initial joint venture purchased a 10-property West Coast retail portfolio for $625 million. DLC has more than $3 billion worth of open-air centers under management. As of Sept. 30, DRA had about $11.6 billion in assets under management.

Canadian Investor Oxford Breaks Into U.S. Open-Air Sector

Toronto-based commercial real estate owner, developer and manager Oxford Properties Group has broken into the U.S. open-air retail market with its joint venture purchase two properties in the Austin, Texas, metro. In its first joint-venture deal with retail real estate owner and operator Pine Tree, Oxford acquired the 633,000-square-foot Wolf Ranch in Georgetown and the 386,000-square-foot Lakeline Plaza & Village in Cedar Park.

Target is one of the tenants at Wolf Ranch in Georgetown, Texas. Photo courtesy of Oxford Properties Group

The JV bought the portfolio from WPG for about $250 million, PERE reported. Tenants in the portfolio, which Oxford and Pine Tree said is almost fully occupied, include T.J.Maxx and Ulta Beauty. Oxford is the real estate arm of the Ontario Municipal Employees Retirement System.

Best Buy is among the tenants at Lakeline Plaza & Village in Cedar Park, Texas. Photo courtesy of Oxford Properties Group

The sale is among several recent deals by WPG as the REIT disposes of its more than 70 remaining retail properties. WPG, now owned by investment firm SVPGlobal, emerged from Chapter 11 bankruptcy in 2021.

Texas Retail Momentum Continues With 2 Big Sales in San Antonio and Houston Suburbs

In San Antonio, Dhanani Private Equity Group bought the 635,000-square-foot Park North for $115 million from Sterling Organization, which had purchased the property in 2016 for $81 million.

San Antonio’s Park North has sold for $115 million. Photo courtesy of Sterling Organization

And a new joint venture between Big V Property Group and Principal Asset Management bought the 355,000-square-foot Fairfield Town Center in the Houston suburb of Cypress. The property was previously owned by WPG.

A joint venture between Big V Property Group and Principal Asset Management bought San Antonio’s Fairfield Town Center, whose occupancy rate is 99.5%. Photo courtesy of Big V Property Group

Hines Buys Clay Terrace Near Indianapolis in $199M Deal

Hines Global Income Trust purchased the 493,000-square-foot Clay Terrace open-air center in the Indianapolis suburb of Carmel, Indiana. Commercial Property Executive reported that WPG sold the property for $199 million. Tenants include Whole Foods Market, Dick’s Sporting Goods, Lululemon, Sweetgreen and Sephora. The property’s occupancy rate is 95%, Hines said.

Clay Terrace in Carmel, Indiana, spans 493,000 square feet. Photo courtesy of Hines

Bain Capital and 11North Close $1.6B Fund for Open-Air Retail Acquisitions

Commercial real estate investors Bain Capital Real Estate and 11North Partners closed on a $1.6 billion investment fund dedicated to buying open-air centers in the U.S. and Canada. The money will go toward acquiring core-plus and value-add properties. Coupled with Bain Capital Real Estate Fund III, the partnership between Bain Capital Real Estate and 11North is now armed with more than $2 billion in investable equity, the firms said. In April 2024, Bain and 11North launched a joint venture to buy grocery-anchored open-air centers. In two recent deals, the JV has spent more than $600 million to purchase 13 retail centers in Florida, Oklahoma and South Carolina.

The Triangle at Classen Curve is among three open-air centers in Oklahoma City’s Nichols Hill suburb that Bain Capital and 11North Partners acquired this year for $212 million. Photo courtesy of Bain Capital Real Estate and 11North Partners

15 to 20 Bloomie’s Stores Coming in Next 5 Years

The small-format Bloomie’s concept from upscale department store chain Bloomingdale’s is, shall we say, blossoming. At ICSC NEW YORK, Bloomingdale’s senior director of real estate and small-store formats James Cregan said Bloomie’s is on track to add 15 to 20 locations over the next five years. The new stores will open in markets that are unserved or underserved by Macy’s-owned Bloomingdale’s, Cregan said.

The second Bloomie’s opened on Nov. 17, 2022, at Westfield Old Orchard in the Chicago suburb of Skokie, Illinois. Photo credit: MKPhoto - stock.adobe.com

The four existing Bloomie’s stores complement 31 full-line Bloomingdale’s stores, which average 150,000 to 200,000 square feet. Each Bloomie’s measures roughly 20,000 to 55,000 square feet, carrying a selection curated from the merchandise one would find at a larger Bloomingdale’s. The first Bloomie’s opened in 2021 at the Mosaic District mixed-use development in Merrifield, Virginia, a suburban community near Washington, D.C.

Large-Scale Mixed-Use Projects Advance in Southeast

A proposed $9.4 billion development in downtown Memphis, Tennessee, and a more than $500 million development near downtown Richmond, Virginia, are gaining traction.

Memphis Plans $9.4B, AI-Focused District Downtown

An artificial intelligence-centered mixed-use project is in the works in Memphis, Tennessee. Commercial Appeal reported the development carries a $9.4 billion price tag. The more than 1.7 million-square-foot project in downtown Memphis would blend 200,000 square feet of retail with a private, AI-friendly cloud-computing network; a 120,000-square-foot innovation center; 800 hotel rooms; and 700 apartments. Commercial real estate investment firm Legacy Power Capital is developing the Neural Nexus campus, which the firm announced on Dec. 10 in partnership with the Greater Memphis Chamber of Commerce and Memphis-based delivery giant FedEx. Legacy Power Capital said its Neural Nexus business model “turns underused land into AI-anchored districts.” The project — encompassing two city blocks adjacent to the FedExForum arena, the AutoZone Park baseball stadium and the Beale Street entertainment district — would be the largest-ever development in downtown Memphis, according to the Greater Memphis Chamber of Commerce.

Midtown64 Breaks Ground With 130,000 SF of Retail Near Downtown Richmond

In Virginia, commercial real estate developer Greenberg Gibbons broke ground on a more than $500 million, 46-acre mixed-use project near downtown Richmond. Trader Joe’s will be among the retail tenants, Richmond BizSense reported. The 2 million-square-foot Midtown64 development will feature as much as 130,000 square feet of retail, up to 300,000 square feet of office, nearly 1,000 apartments, 194 townhomes and a 226-room hotel. Shamin Hotels is a joint-venture partner. Midtown64 is being built on the former headquarters site of Genworth. The first phase, including retail, is scheduled to be completed in 2028.

The 2 million-square-foot Midtown64 mixed-use project in Richmond, Virginia, will include 130,000 square feet of retail space. Rendering courtesy of Greenberg Gibbons

London’s Bond Street Claims Top Spot as World’s Priciest Retail Real Estate Corridor

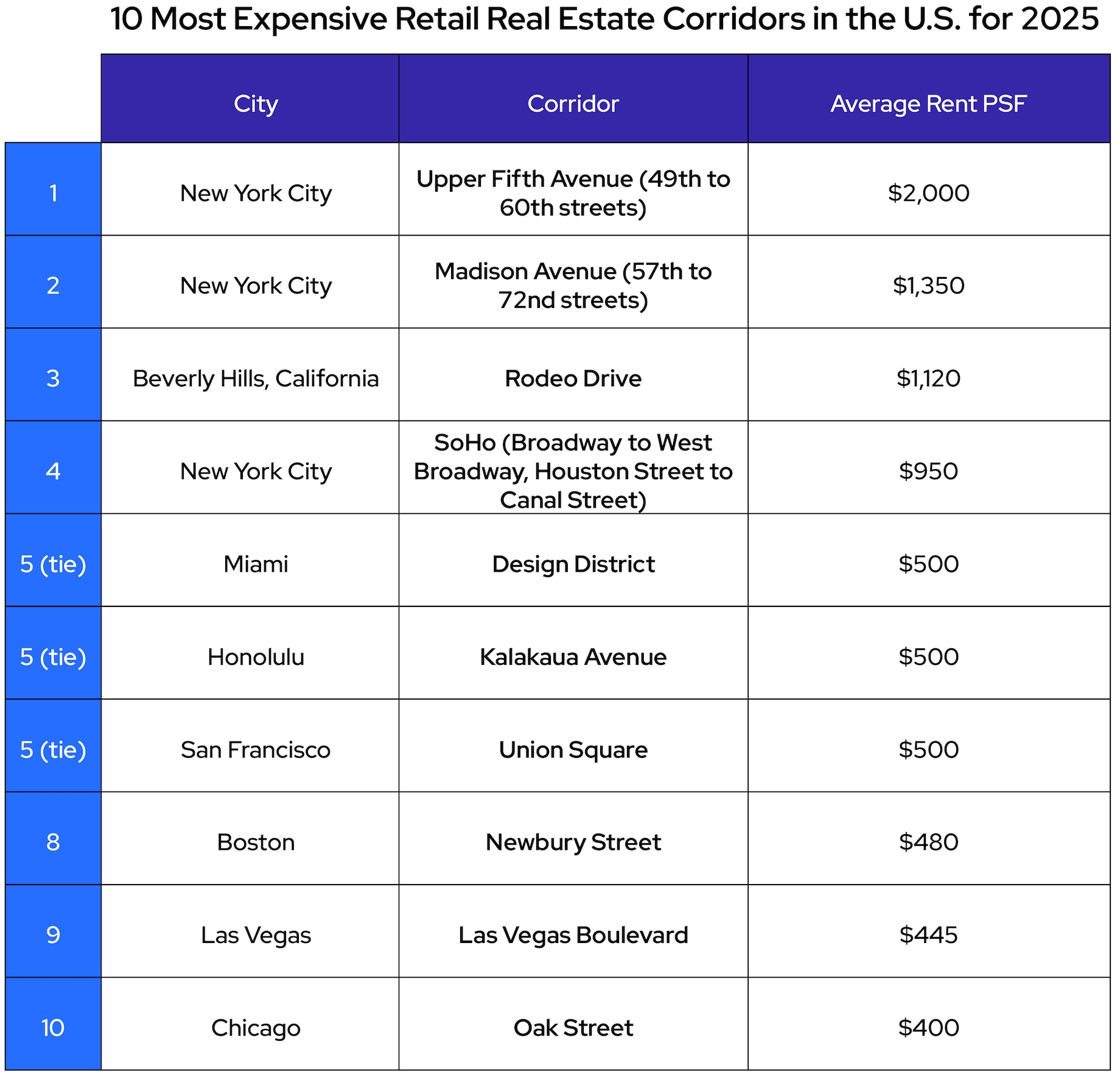

Cushman & Wakefield’s Main Streets Across the World 2025 report crowned a new king among the most upscale retail destinations. London’s Bond Street leapfrogged 2024’s priciest destination, Milan’s Via Montenapoleone, and New York City’s Upper Fifth Avenue to capture this year’s No. 1 spot. While the average per-square-foot rent in the Montenapoleone and Upper Fifth Avenue retail districts remained flat in the past year — $2,179 and $2,000, respectively — average rent along Bond Street soared 22% to $2,231 per square foot, the report said. The report analyzed the 141 top urban retail locations in the world, ranking them based on average rent per square foot.

The 10 priciest retail real estate corridors in the U.S. include three in NYC.

Source: Cushman & Wakefield’s Main Streets Across the World 2025 report | Graphic: Commerce + Communities Today

CBRE Promotes 3 Executives in Its C-Suite

CBRE has made three C-suite promotions. Andy Glanzman has been promoted to CEO of CBRE’s real estate investment business. In that role, Glanzman oversees CBRE real estate development subsidiary Trammell Crow and its CBRE Investment Management subsidiary. He was named co-CEO of CBRE Investment Management last December and continues to serve in that capacity alongside Adam Gallistel. In other moves, Adam Nims has been promoted to CEO of Trammell Crow, and Adam Saphier has been promoted to global COO of CBRE’s advisory services business. Trammell Crow’s previous CEO, Danny Queenan, is now the subsidiary’s executive group president.

Andy Glanzman Photo courtesy of CBRE

By John Egan

Contributor, Commerce + Communities Today