Jump to …

Simon–Turnberry JV Buys $131M Retail Center Adjacent to Aventura Mall in Florida

Haverford Retail Partners Acquires 770,000-SF Portfolio of 3 Neighborhood Centers for $126M

Whole Foods Will Anchor Sarasota Square Redevelopment, a 530,000-SF Mixed-Use Mall Redo in Florida

Black Friday Foot Traffic Leaders: Luxury Categories and Value Retailers Drive In-Store Visits

3D Concrete Printing Expands in Retail Construction With New Walmart Projects

Executive Moves: Leadership Changes at Brixmor, URW, Inland, Trademark and Safehold

Simon–Turnberry JV Buys $131M Retail Center Adjacent to Aventura Mall in Florida

A joint venture between Simon and Turnberry has purchased a 219,000-square-foot open-air center adjacent to Florida’s 2.8 million-square-foot Aventura Mall, which the partners also own.

Simon and Turnberry are the new owners of a retail center adjacent to Aventura Mall in South Florida. Photo above and at top courtesy of Turnberry

They bought Esplanade Aventura from Seritage Growth Properties for $131 million and plan to upgrade the property. Rebranded as The Abbey at Aventura, it has more than 15 retail, dining and experiential tenants, including Industrious, Lego, North Italia, Pura Vida, STK Steakhouse and Sweetgreen. Anatomy Fitness and ice cream shop Salt & Straw are among the tenants coming to the property.

Commerce + Communities Today profiled Turnberry CEO Jackie Soffer in 2022: The Woman Behind One of the Most Influential Malls in the U.S. — and What Else She’s Doing

Haverford Retail Partners Acquires 770,000-SF Portfolio of 3 Neighborhood Centers for $126M

Haverford Retail Partners has acquired a nearly 770,000-square-foot portfolio of three neighborhood shopping centers from Site Centers for $126 million. The portfolio, which boasts a 99% occupancy rate, comprises East Hanover Plaza in New Jersey, Stow Community Shopping Center in Ohio and Southmont Plaza in Easton, Pennsylvania. Anchor tenants across the portfolio include Best Buy, Dick’s Sporting Goods, Hobby Lobby, HomeGoods, Homesense and Kohl’s.

Stow Community Shopping Center in Ohio is one of three retail properties purchased by Haverford Retail Partners. Photo courtesy of JLL

Whole Foods Will Anchor Sarasota Square Redevelopment, a 530,000-SF Mixed-Use Mall Redo in Florida

Torburn Partners has nailed down Whole Foods Market and five other tenants for a 96-acre mixed-use project in Sarasota, Florida. Sarasota Square is being built at the former site of Sarasota Square Mall, which has been torn down. Sarasota Square eventually will comprise 530,000 square feet of retail, restaurants and commercial space, along with 1,200 apartments.

Whole Foods Market will anchor the 98-acre Sarasota Square mixed-use development in Sarasota, Florida. Image courtesy of Torburn Partners

Whole Foods will anchor the first phase of the project’s retail component, taking 35,828 square feet. Other retailers that have signed leases are Homesense, at 24,214 square feet; fast-casual restaurants Cava, Chipotle and Joe & the Juice, with a combined 5,163 square feet; and Charles Schwab, at 5,163 square feet.

Holly Cohen joined the project in April to advise Torburn and guide merchandising and tenant strategy. She will work with Jamestown, which has come onboard to handle leasing, operations, marketing, placemaking and master planning. Jamestown is known for retail-driven mixed-use redevelopment like New York City’s Chelsea Market and Industry City, San Francisco’s Ghirardelli Square and Atlanta’s Ponce City Market and Buckhead Village. “Jamestown will concentrate on attracting lifestyle-oriented retailers, chef-driven food-and-beverage operators, health-and-wellness concepts, quality service providers and immersive entertainment uses,” according to a media release from Jamestown and Torburn.

The first retail building has gone vertical, and retailers are scheduled to occupy space in 2026 and 2027, a Torburn spokesperson said. The development will be built in three phases.

Black Friday Foot Traffic Leaders: Luxury Categories and Value Retailers Drive In-Store Visits

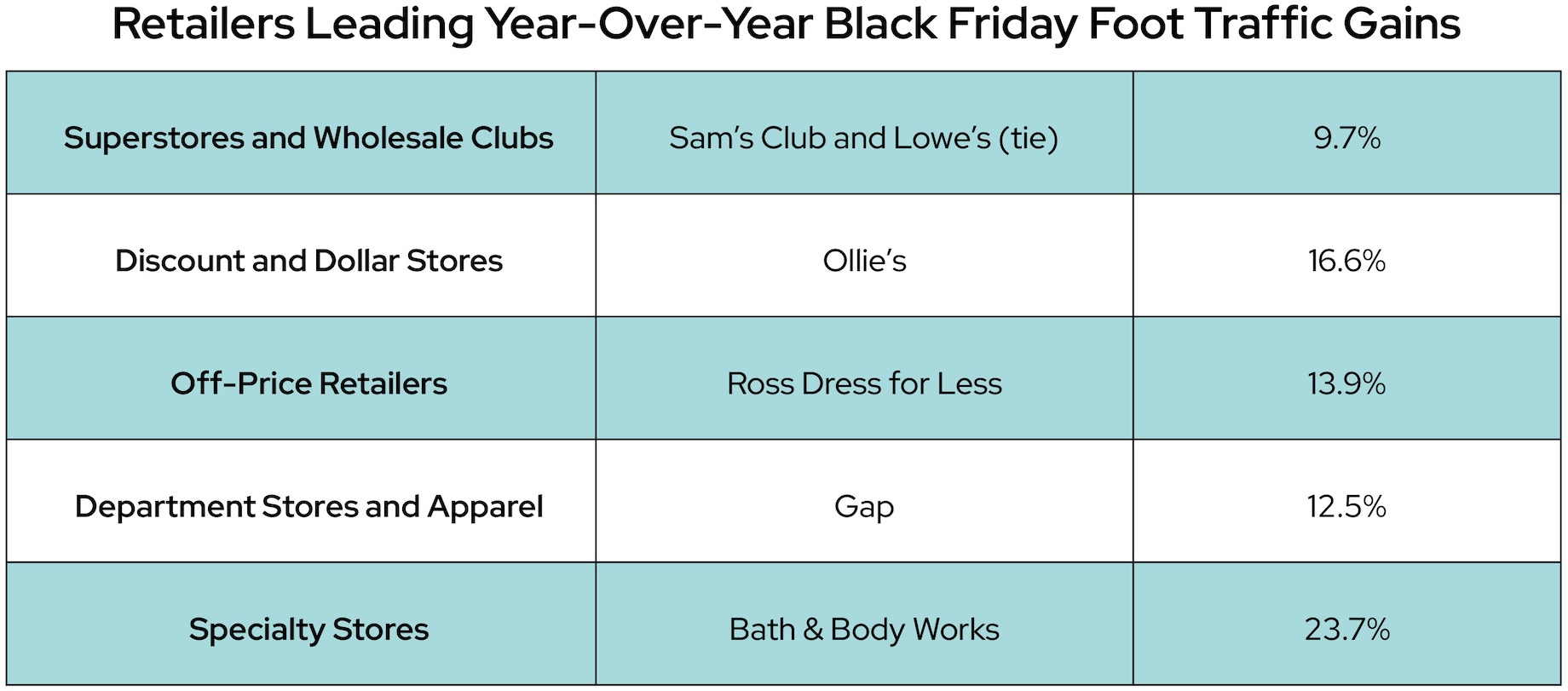

On Black Friday, affluent consumers drove visits to luxury categories, “while lower- and middle-income consumers sought out deals to stretch their household budgets,” said Placer.ai head of analytical research R.J. Hottovy. Retailers promoting smaller-ticket gifts under $100 appear to be the early winners this holiday season, according to Placer.ai.

Source: Placer.ai | Graphic: Commerce + Communities Today

3D Concrete Printing Expands in Retail Construction With New Walmart Projects

Alquist recently completed a 3D-printed construction project to expand a Walmart in Alabama. Photo courtesy of Alquist/Business Wire

After Alquist and FMGI 3D-concrete-printed a 5,000-square-foot expansion of a Walmart in Owens Cross Roads, Alabama, in just 75 hours earlier this year, Alquist has a pipeline of over a dozen more 3DCP projects in the U.S. for Walmart and other retailers. The 3D construction company and FMGI, a general contractor, have partnered with construction and industrial equipment rental dealer Hugg & Hall to meet demand.

FROM THE C+CT ARCHIVE: Walmart and Starbucks Are Doing It: 3D Concrete Printing Is About To Take Off

Their first new project is Alquist and FMGI’s third collaboration with Walmart, at a Lamar, Missouri, location. In addition to the Alabama project, they also worked on an Athens, Tennessee, Walmart in 2024.

Executive Moves: Leadership Changes at Brixmor, URW, Inland, Trademark and Safehold

Five commercial real estate companies recently filled roles in their executive ranks.

Brian Finnegan Will Succeed Jim Taylor as CEO of Brixmor

Brixmor president and COO Brian Finnegan will become CEO of the retail REIT when Jim Taylor retires on Jan. 1. Finnegan has been interim CEO since Oct. 16, when Taylor began what Brixmor called a temporary medical leave of absence. Finnegan, who will remain president, also will replace Taylor on the board of directors. Taylor has been CEO since 2016. Brixmor operates a U.S. portfolio of 354 open-air centers comprising roughly 63 million square feet.

Brian Finnegan will become CEO of Brixmor on Jan. 1. He also will retain his role as president. Photo courtesy of Brixmor

Today, Finnegan also assumes the role of chair of the ICSC Foundation. He had been vice chair of the Foundation’s board of directors since 2023.

Kathleen Verelst Will Assume Role of Chief Investment Officer at URW

Unibail-Rodamco-Westfield has named Kathleen Verelst chief investment officer and a member of its management board effective Jan. 1. She will succeed incoming CEO Vincent Rouget. Between 2021 and 2024, she was a senior adviser to URW’s supervisory and management boards to help guide the sale of 17 U.S. properties valued at $3.3 billion. Verelst previously spent 22 years at Morgan Stanley, most recently as managing director and senior adviser. Among other properties, URW operates 66 retail centers in 11 countries.

Inland Names Lou Kruk as Leader of Its Institutional Asset Management Platform

Inland has hired Lou Kruk as president and CEO of Inland Institutional, its institutional asset management platform, whose formation Inland announced in June. Inland has about $16 billion in assets under management. Kruk most recently was senior vice president and managing director at MetLife Investment Management, where he helped create MetLife’s third-party real estate investment management platform.

Inland has named Lou Kruk president and CEO of its institutional asset management platform. Photo courtesy of Inland/Businesswire

Trademark Hires Scott Elrod as CFO

Trademark has tapped Scott Elrod as CFO. He previously worked at CBRE, USAA and Clarion Partners. Trademark operates a 19-property retail and mixed-use portfolio exceeding 11 million square feet in the U.S.

Scott Elrod has joined Trademark as CFO. Photo courtesy of Trademark

Michael Trachtenberg Joins Safehold as President

Safehold, a REIT that specializes in ground leases for mixed-use and other property types, has hired Michael Trachtenberg as president. He previously was president of real estate fund manager Lubert-Adler and earlier was an analyst at Merrill Lynch.

By John Egan

Contributor, Commerce + Communities Today