Over the past 12 months, an eclectic mix of topics intrigued Commerce + Communities Today readers. You craved info about Gen X, stadium districts, Netflix House and burger concepts, for instance. C+CT covered these subjects and an aisle full of others in our 10 most read stories of the year.

Here, we review our 10 most popular stories in 2025 and deliver updates on some of the news we reported. Click on each headline to read C+CT’s original story. Happy New Year, and happy reading!

1

Gen X: The Overlooked Generation With Outsized Impact

An ICSC study released in October spotlighted a neglected generation in the Marketplaces Industry: Gen X. The research showed Gen X is one of retail’s most valuable yet underestimated consumer groups. Born between 1965 and 1980, Gen Xers boast the highest revenue per shopper, or average purchase, across almost every category, and they drive 31% of in-store and online spending, yet they represent just 19% of the U.S. population. The study concluded that Gen X wields outsized spending power that brands should be competing for. “Gen X is pragmatic, loyal to brands they trust, and influential decision-makers for themselves, their children and their parents,” ICSC president and CEO Tom McGee said. “For retailers, there is no bigger near-term growth opportunity than winning the loyalty and the dollars of Gen X.”

2

Where Fans, Food and Foot Traffic Meet: Stadium Districts’ Retail Appeal

New sports stadiums and arenas are popping up in major cities like Denver, Cleveland, Las Vegas, Nashville and Salt Lake City. But the days of simply building a stadium or arena are in the rearview mirror. Today, new major league sports facilities are spurring development of mixed-use districts tailored to shoppers, restaurant visitors and apartment dwellers, as we reported in our No. 2 story of 2025.

This trend seems to have legs as muscular as Norwegian soccer star Erling Haaland’s. The 2025 Team Building: The Rise of Sports-Anchored Mixed-Use Districts white paper from RBC and Klutch Sports Group said these districts “are on track to be one of the largest growth engines for the future of sports,” drawing more than $100 billion in capital investments over the next 15 years. According to the white paper, at least 37 pro sports-anchored mixed-use districts, typically with price tags in the billions of dollars, were in the North American pipeline as of December 2024.

3

$1.2B Fund Launch, New Plans for 2 Malls, Megaprojects Multiply, Expansions for 4 Chains and More

In October, Big V Property Group and Equity Street Capital announced a $1.2 billion retail property investment fund. That eye-popping figure likely prompted many of the clicks on this roundup. The new Big V Core Property Fund put seven institutional-quality, open-air centers in Alabama, Georgia, Tennessee and Texas under one investment umbrella. In conjunction with the fund’s launch, Big V secured $765 million in financing to bolster expansion plans and current operations.

Big V Property Group and Principal Asset Management recently purchased the 355,000-square-foot Fairfield Town Center in Cypress, Texas. Photo courtesy of Big V Property Group

Six months before unveiling the fund, Big V made three key executive moves: CEO Jeffrey Rosenberg assumed the additional title of chair, Kenton McKeehan was promoted to president and chief investment officer, and Greg Ix was promoted to executive vice president of leasing. A couple months after introducing the fund, Big V teamed up with Principal Asset Management to purchase the 355,000-square-foot Fairfield Town Center in Cypress, Texas, a Houston suburb.

4

Netflix House, Kid-Targeted Tenants, At Home, Bank Sale-Leasebacks, EV Charging and More

Netflix has been stirring up enough drama lately to warrant its own Netflix docuseries. In early December, the streaming service agreed to buy entertainment company Warner Bros. in an equity deal valued at $72 billion. Media and entertainment giant Paramount then mounted a $108.4 billion hostile bid for Warner Bros., Reuters reported. As of mid-December, the Netflix-Paramount drama continued, with Warner Bros. still favoring the Netflix deal.

All of that corporate maneuvering overshadows the top news item in our fourth most-read story of 2025 — Netflix’s entry into the business of immersive entertainment venues with its rollout of the Netflix House concept. Permanent Netflix House locations are now open at retail centers in suburban Philadelphia and Dallas, and a third is set to open in 2027 in Las Vegas. The Philadelphia-area and Dallas venues took over spaces formerly occupied by department stores, Bloomberg reported.

5

Why Is It So Gosh Darn Hard To Redevelop a Mall?

To get a sense of how tough it is to redevelop a mall, we spotlighted four malls in the Cincinnati area whose proposed conversions into mixed-use projects have dragged on. The hurdles these and similar redevelopments face include grappling with myriad changes in property ownership, navigating government approvals, negotiating incentives and dealing with pushback from stakeholders.

Plans for a reimagined West Ridge Mall in Topeka, Kansas, feature an open-air setting and a mix of uses. Image credit: RDC

6

Publix’s Bridgid O’Connor Discusses Store Strategy

With 1,434 stores in eight Southeastern states, Publix ranks as the fourth-largest grocery chain in the U.S. based on store count, according to Toast, a restaurant point-of-sale and management platform. So, when a Publix real estate executive speaks, C+CT readers listen. In fact, our March interview with Publix vice president of real estate strategy and operations Bridgid O’Connor claimed sixth place among C+CT’s 10 most popular stories of the year. Since the publication of our interview, O’Connor has joined the ICSC Board of Trustees. And in the nine-month period following the interview appearing online, O’Connor oversaw the opening of 36 new stores.

Publix recently opened this new store in Jacksonville, Florida. Photo courtesy of Publix

“The Publix real estate team leverages technology to learn markets and vet sites,” O’Connor told us this spring. “Technology also helps us stay connected when we are in the field. As we continue to grow, technology will help us streamline our processes for efficiencies. While we use technology for many facets of the operation, as it relates to real estate, there is no substitute for boots on the ground.”

7

Much has changed in the nine months since we reported that Arizona’s richest person had purchased a shuttered Phoenix-area mall and aimed to replace it with a huge mixed-use development.

Verde Investments, a real estate firm owned by billionaire Ernest Garcia II that purchased the former Fiesta Mall in Mesa, now plans to sell the site to a newly formed development group, the Phoenix Business Journal reported. The group announced on Dec. 17 that a women's health campus would anchor the first phase of the redevelopment, which has been rebranded from Fiesta Redefined to the Palo District. Verde envisioned that Fiesta Redefined would encompass up to 1.85 million square feet of retail and commercial space, 4,000 housing units and more than 500,000 square feet of open space.

Other than the women’s health campus, the new development group has revealed little about the project’s new direction. Potential elements of the Palo District include retail, restaurants, lodging, apartments, traditional offices, medical offices, and entertainment and sports facilities, according to the Phoenix Business Journal. Mesa Mayor Mark Freeman told 12News in November that the site could be home to a stadium for teams in professional soccer or other sports.

8

Burgers Bite Back: Rising and Established Brands Challenge Chicken’s Reign

As we told you back in October, burgers are moo-ving back onto chicken’s turf. Among the purveyors making inroads are Bobby’s Burgers by Bobby Flay, Savvy Sliders, Smalls Sliders and Skinny Louie. And burgers promise to be on the minds and menus of many Americans in the year to come. The National Restaurant Association’s 2026 What’s Hot Culinary Forecast indicated that customizable “smashed burgers” and nostalgic comfort foods like classic burgers will satisfy our cravings in the new year. In the nothing-to-cluck-about category, chicken earns no mention in the forecast.

Bobby’s Burgers by Bobby Flay operates 10 restaurants in the U.S., including this location in Orem, Utah’s University Place. In August, the chain announced a 65-location franchise deal in Canada, according to QSR magazine. Photo courtesy of Bobby’s Burgers

9

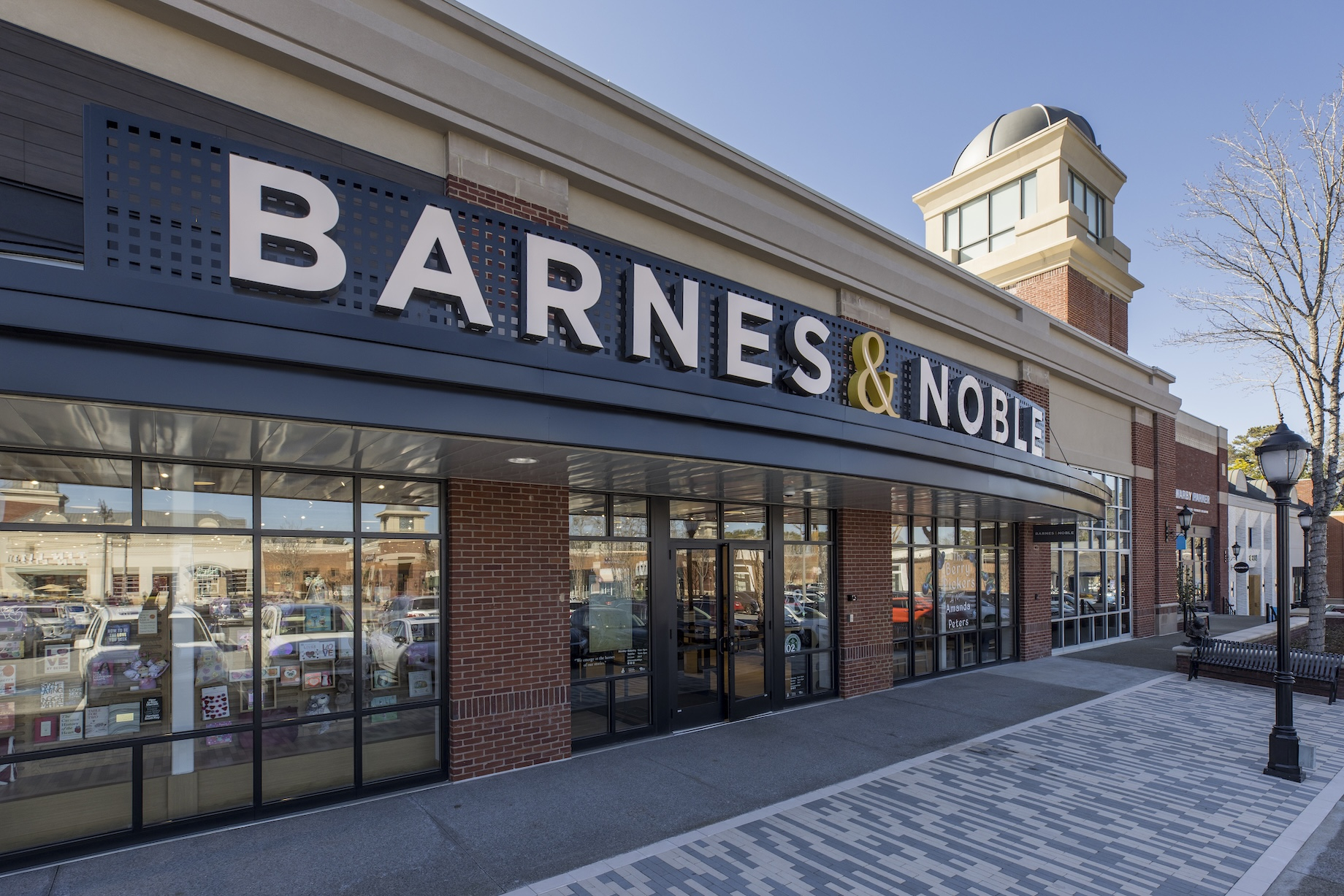

Barnes & Noble Aims for 1,000+ Stores With New Growth Strategy

Barnes & Noble has opened a new chapter in the story of American bookstores. In June, we turned the pages of Barnes and Noble’s plan to expand its national footprint to more than 1,000 stores in the coming years. Barnes & Noble opened 58 new stores this year and aims to open 60 new stores next year, a spokesperson told C+CT.

Barnes & Noble replaced Bed Bath & Beyond at Jamestown’s Avenue East Cobb in suburban Atlanta and is driving disproportionate traffic for its size there. Photo courtesy of Jamestown

The company also expanded this year with its $3.25 million acquisition of the bankrupt, nine-store Books Inc. chain in the San Francisco Bay Area. Barnes & Noble finalized the Books Inc. deal on Oct. 1, according to the spokesperson. Counting the 67 newly opened and newly acquired stores, the country’s largest book retailer now operates 708 locations, the spokesperson said.

10

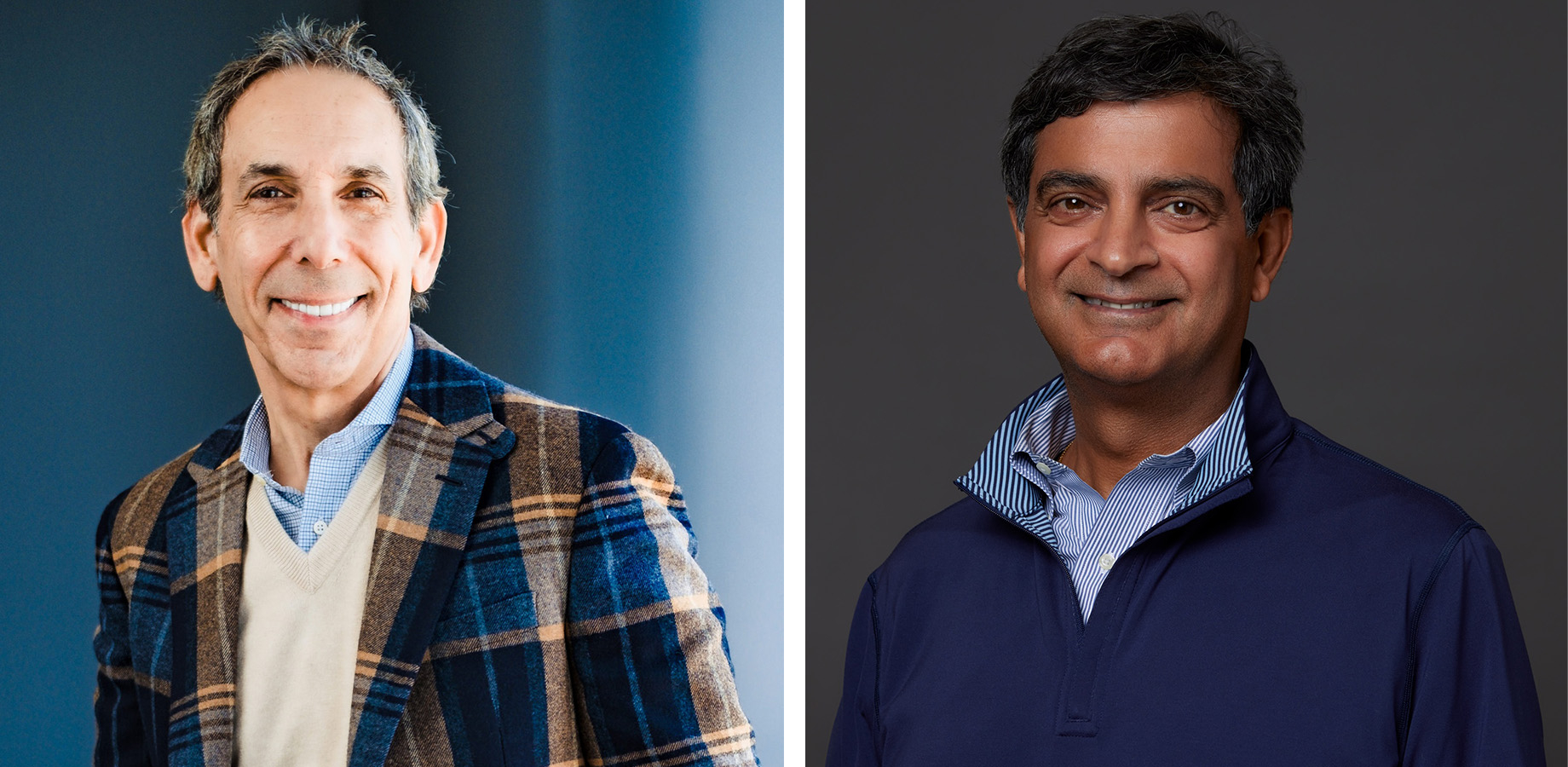

How 2 Industry Veterans Are Transforming Some of America’s Best-Known Malls

In November, we learned details about the strategy embraced by Atlas Hill RE founder Sandeep Mathrani and Centennial founder and CEO Steven Levin to acquire and redevelop high-potential, Class A malls. “When Steven and I buy an asset, we’re going to invest $100 million or $150 million, whatever it happens to be, upfront,” Mathrani told C+CT. “We’re playing a different game, which is to create great destinations. It’s what we know how to do.”

Centennial founder Steven Levin and Atlas Hill RE founder Sandeep Mathrani boast a combined 90 years of experience in the Marketplaces Industry. They’ve been occasional business partners for decades. Photos courtesy of Centennial and Atlas Hill RE

Back in September 2024, Mathrani and Levin announced they’d teamed up with Lincoln and Waterfall Asset Management to buy Maryland’s super-regional Annapolis Mall. A little over a year later, the mall’s ownership released a list of new leases accounting for 300,000 square feet at the property, with deals with Uniqlo, Swarovski, Jack & Jones, Offline by Aerie, GOAT USA, Dave & Buster’s and Dick’s House of Sport.

By John Egan

Contributor, Commerce + Communities Today