Sluggish M&A meant fewer retail sale-leasebacks in 2020

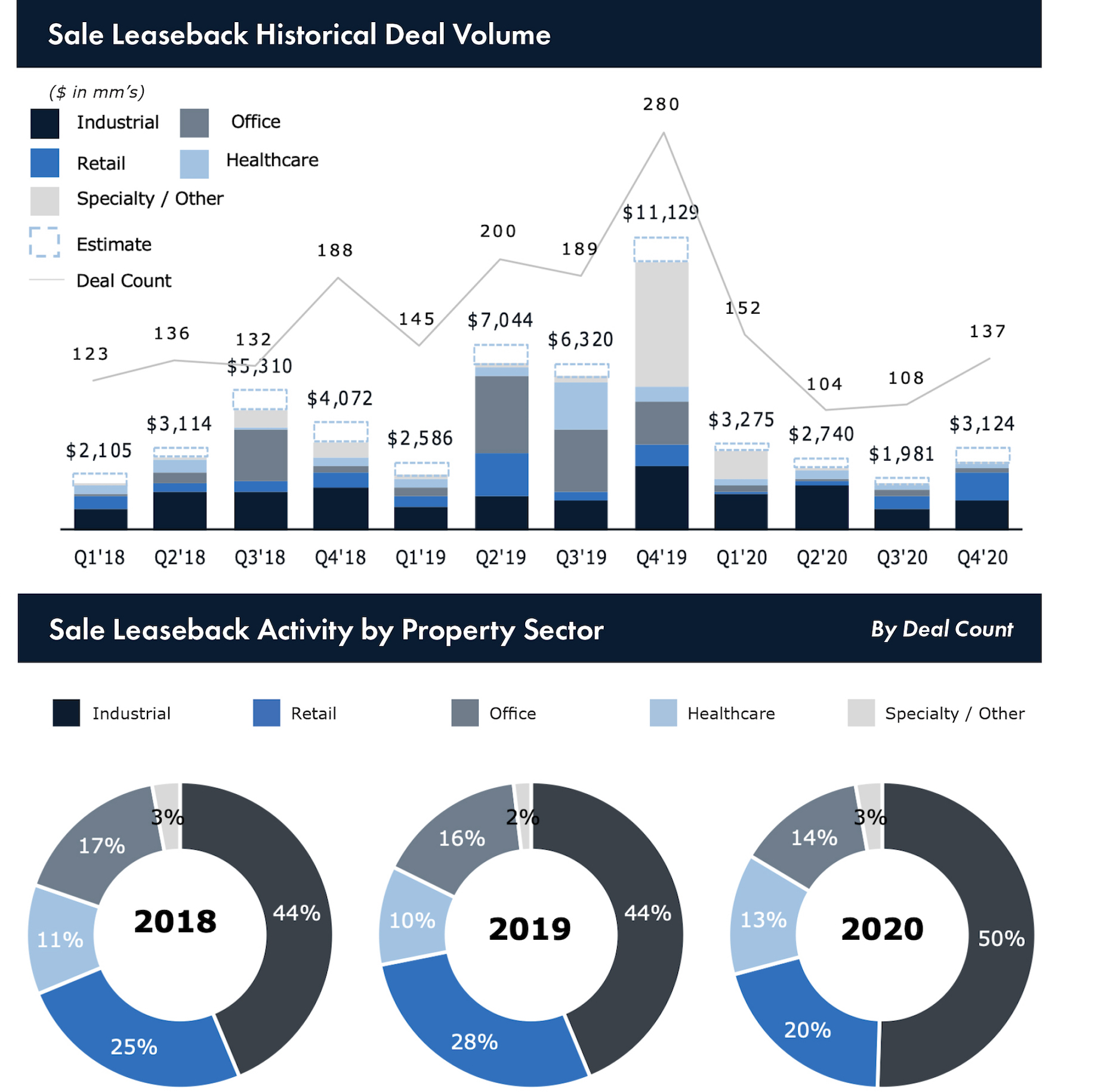

The number of retail sale-leasebacks plummeted 55 percent in 2020, compared with a 38 percent decrease across all sale-leasebacks, according to SLB Capital Advisors. Industrial properties and data centers dominated among the 137 such deals that closed in the fourth quarter, as stay-at-home measures made retail, hospitality and office less attractive to buyers.

In the past, retailers have used sale-leasebacks to free up funds to pay off debt and fund new ventures, and M&A often drives sale-leasebacks as acquiring owners trim costs. The pandemic-induced M&A slowdown in 2020 thus lowered sale-leaseback activity.

Source: CoStar and SLB Capital Advisors

In 2020’s biggest retail sale-leaseback, Save Mart offloaded 68 properties to Oak Street Real Estate Capital for $943 million. Oak Street was the buyer in the year’s second-biggest deal, as well, purchasing 85 properties from Walgreens Boots Alliance for $402 million.

SLB Capital Advisors expects the number of retail sale-leasebacks to increase as lockdowns end and more consumers are vaccinated. Demand continues to be strong for commercial real estate, as more than $362 billion in dry powder is estimated to be available. Debt capital also continues to be readily available to finance acquisitions, as funds have allocated $42 billion to finance commercial property deals. Download the full report.

Federal and Sleiman invite local merchants to pop in

As the retail market recovers from the pandemic, Federal is working to uncover fresh concepts that need some support to get started. The REIT projects a surge in interest from fledgling businesses and existing online-only retailers looking to expand and/or pivot. In the first quarter of 2021, 62 pop-ups opened across the Federal portfolio. Now, the company hopes to boost the trend with a new program: It’s offering two months of free rent for pop-ups in finished retail spaces in one of the company’s East Coast properties. The program is open to entrepreneurs who present a unique retail business concept as determined by Federal. Federal’s 101 properties include approximately 2,800 tenants in 23 million square feet.

“The most exciting merchants often start with a pop-up to test a location, gain immediate customer feedback and validate their concept,” said vice president of specialty leasing Mike Kelleher. “Our destinations are already home to both national brands and mom-and-pop stores that would mutually benefit from being alongside these creative new and growing offerings. At the same time, as America emerges from the pandemic, we have a valuable commodity that we can contribute towards the rebirth of commerce to support these new businesses.”

Additional information is available here. Federal intends to notify selected concepts by June 17, and open them in July.

Meanwhile, Florida landlord Sleiman has launched a similar incubator program for Jacksonville retail entrepreneurs and first-time business owners to open brick-and-mortar stores. Retail Incubator for Sleiman Entrepreneurs, or RISE, the program educates participants and lowers their first-year startup costs so that, by Year Two, they’re ready to sign traditional leases. Sleiman’s specialty leasing team will provide leasing guidance, sales forecasting and space design for one year. “Now is a great time for entrepreneurs to test their product and/or service, especially in a growing market like Northeast Florida,” said special projects and sales associate Andrea Johansson. “We chose the words 'incubator' and 'entrepreneur' for our program to illustrate the type of participants we are looking for, those who are truly market-testing their concept and those who are relentlessly driven toward success.”

Moorestown Mall adds healthcare use

PREIT is bringing Cooper University Health Care to its Moorestown Mall in New Jersey. The Southern New Jersey and Philadelphia healthcare system will open a specialty care facility in the former Sears, occupying 165,000 square feet. With this addition and the apartments and hotel planned for the site, the property will become a one-stop hub with dining, entertainment, fitness, retail and now an outpatient healthcare facility.

Economic rebound boosts CBL as it restructures

CBL Properties tenants’ retail sales increased by 12.5 percent year over year in the first quarter. Its same-center net operating income declined 17.2 percent for the three months that ended March 31. Mall occupancy was 83.2 percent as of March 31, a 480-basis-point decline from March 31 for the same centers. The company attributed 390 basis points of that decline to store closures related to tenant bankruptcies. “The strong rebound in the economy is benefitting our properties,” said CEO Stephen Lebovitz. “Customer traffic is returning to pre-pandemic levels, and spending levels were certainly helped by stimulus checks and tax refunds. Leasing activity is picking up as sales and traffic levels improve.” The company’s court-supervised restructuring after filing for Chapter 11 bankruptcy protection is proceeding as planned. “The court process has not slowed down the rebound in our business, and we are working diligently towards our planned emergence later this year,” Lebovitz said.

Green Lease Leaders recognizes record number of retail players

The nonprofit Institute for Market Transformation and the U.S. Department of Energy’s Better Buildings Alliance are honoring several retail landlords and shopping center tenant TD Bank for their use of green leases to spur collaborative action on energy efficiency, cost savings, improved air quality and sustainability in buildings. IMT and DOE launched the Green Lease Leader awards program in 2014 to encourage adoption of more modern leases.

“Green leases are a common-sense, proven solution to create high-performing buildings and improve our communities,” said IMT executive director Lotte Schlegel. “These leases fix split incentives with agreements that save everyone money, improve indoor air quality and lock in efficient, sustainable and smart building operations. The leaders participating in this program are setting an important example of business practices that scale up building decarbonization while improving landlord-tenant relationships, business outcomes and economic growth.”

In part “because of ICSC’s promotion of the application process, this year they have the highest number of retail leaders being recognized for advancing green leases across their portfolios,” said ICSC vice president of federal operations Jennifer Platt.

Gold winners in the landlord category

- AEW Capital Management

- Columbia Property Trust

- CommonWealth Partners

- Digital Realty

- Diversified Healthcare Trust

- Dream Office

- Empire State Realty Trust

- Federal

- First Capital

- GTIS Partners

- Iron Mountain

- Jamestown

- JBG Smith

- Kimco Realty Corp.

- Kite

- Link Logistics Real Estate

- Prologis

- Retail Opportunity Investment Corp.

- RPT

- Shorenstein

- Weingarten Realty

TD Bank Group earned gold recognition in the tenant category. Meanwhile, three groups earned gold in the team transaction recognition category: Kilroy Realty Corp., Riot Games and Allen Matkins; TD, Aimco, and Ivanhoe Cambridge; and Cushman & Wakefield and Capgemini.

Learn more about the awards program here.

CalSTRS’s first female CEO

The CalSTRS Teachers’ Retirement Board appointed Cassandra Lichnock as the first female CEO of CalSTRS. Three-quarters of the members of CalSTRS, the world’s largest educator-only pension fund, are female. Lichnock joined CalSTRS in August 2008 as HR executive officer and has served as COO since March 2013.

By Brannon Boswell

Executive Editor, Commerce + Communities Today