Jump to …

Regency’s $357 Million SoCal Deal Highlights Wave in Large Retail Acquisitions

Discount Chains Expand as Value Shopping Rises

Fitness Chains Stand Out in June’s Foot Traffic Rankings

Retail Vacancy Holds Near Historic Low in Q2

Stockdale Capital Targets Distressed Real Estate With $700 Million Fund

Green Street’s Mall Outlook

Aventura Mall Visionary Don Soffer Dies at 92

Regency’s $357 Million SoCal Deal Highlights Wave in Large Retail Acquisitions

Regency Centers has closed a $357 million acquisition of five suburban shopping centers — Bridgepark Plaza, Mercantile West, Mercantile East, Terrace Shops and Sendero Marketplace — totaling nearly 630,000 square feet within the 23,000‑acre Rancho Mission Viejo master‑planned community in Orange County, California. The portfolio is 97% leased and features a strong tenant mix of grocers, restaurants and health, wellness and personal‑service providers, according to a release from the company. Grocery sales across the properties average nearly $800 per square foot, backed by a 3‑mile average household income of $200,000.

Regency Centers has sold almost 630,000 square feet of retail within Orange County, California’s Rancho Mission Viejo master-planned community. The five properties include Mercantile East, above, and Mercantile West, at top. Photos above and at top courtesy of Regency Centers

Regency deployed a combination of operating partnership units — REIT equity stakes often used as a tax-efficient alternative to cash — valued at $72 each, along with $150 million in assumed mortgage debt and $7 million in cash. The company expects the deal to boost core earnings in 2025 and enhance per-share profitability. Regency described the acquisition as a strong fit for its capital strategy, citing its focus on “accretion to earnings, quality and growth,” according to West region president and chief investment officer Nick Wibbenmeyer.

The deal adds to a recent wave of retail real estate deals that top $300 million. Simon recently closed a $548.7 million acquisition of the outstanding 75% stake in the retail and parking components of Brickell City Centre in downtown Miami, expanding its coastal mixed-use portfolio. Around the same time, Lucky Strike Entertainment bought the real estate underlying 58 of its venues across 16 states — including five that Lucky Strike called key markets: California, Illinois, Georgia, Arizona and Colorado — for $306 million.

MORE FROM C+CT: Money Is Moving Again in Retail Real Estate — and Fast

Discount Chains Expand as Value Shopping Rises

Photo courtesy of Five Below

Amid economic and inflation concerns, U.S. shoppers are hunting for bargains, and some retailers are expanding in hopes of capturing that business. More than half of U.S. consumers, 55%, said in a March survey commissioned by shopping platform Rakuten that they’d prioritize low-price products when shopping in the coming months. And nearly one-third of retailers surveyed by Rakuten, 32%, thought shoppers would shift their purchases to discount retailers that offer their favorite brands.

Some proof of this pattern: Placer.ai reported that Trader Joe’s saw an 11.95% year-over-year lift in foot traffic for the first half of 2025. Meanwhile, Aldi experienced a 7.1% year-over-year bump.

Those two grocers are among several discount retailers that are adding U.S. locations to meet demand from deal-oriented shoppers:

• On its “opening soon” webpage, Trader Joe’s lists 31 new stores that are supposed to come online this year.

• Aldi indicates on its website that 35 new stores are “coming soon.”

• Dollar Tree said in March that it was on track to open 300 new stores by the end of 2025.

• Discount retailer Daiso’s website lists 44 stores that have already opened or are scheduled to open this year.

• Five Below signaled in March that it plans to open about 150 stores during its 2025 fiscal year, which ends next February.

• Closeout merchandise retailer Ollie’s wants to open 75 stores during its 2025 fiscal year, which ends next February.

Placer.ai recently declared that discount and dollar stores have emerged as a retail “front-runner” in 2025. “Economic uncertainty and changes in consumer sentiment have pushed consumers to be even more value-oriented than we observed over the last two years,” Placer.ai said.

Fitness Chains Stand Out in June’s Foot Traffic Rankings

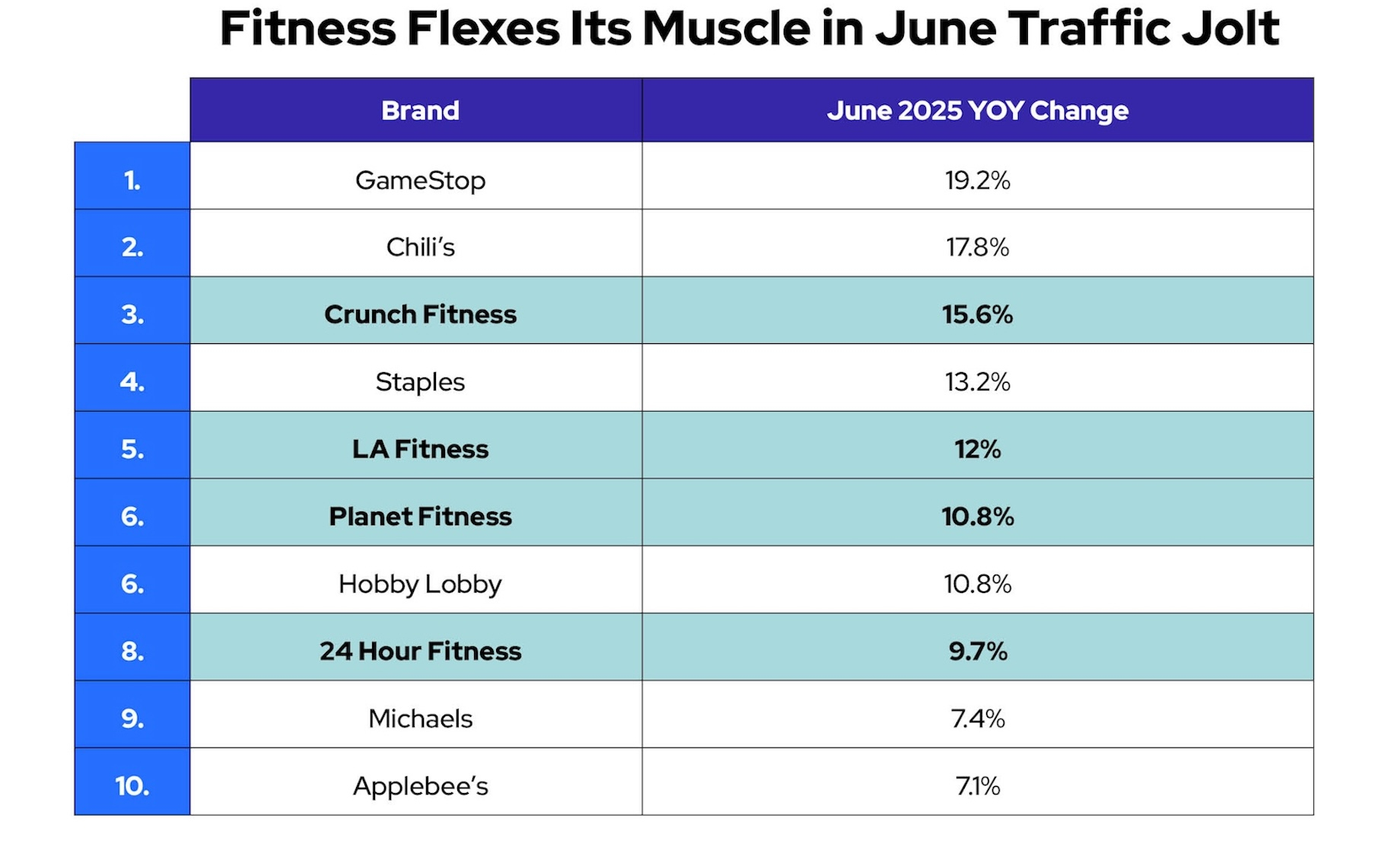

While retail foot traffic inched up by just 0.1% year over year in June, fitness centers flexed their muscle. The fitness sector blew past all other retail sectors in June with an 8.7% year-over-year jump in foot traffic, according to Colliers’ U.S. Retail Monthly Foot Traffic & Sales Analysis. Citing figures from Placer.ai, the report showed four fitness chains among the 10 top-performing retail brands in June.

Source: Colliers and Placer.ai | Graphic: ICSC Commerce + Communities Today

Retail Vacancy Holds Near Historical Low in Q2

Levin Management’s 343,000-square-foot St. Georges Crossing power center in Woodbridge, New Jersey, reached full occupancy thanks to a Burlington lease announced yesterday. Photo courtesy of Burlington Stores

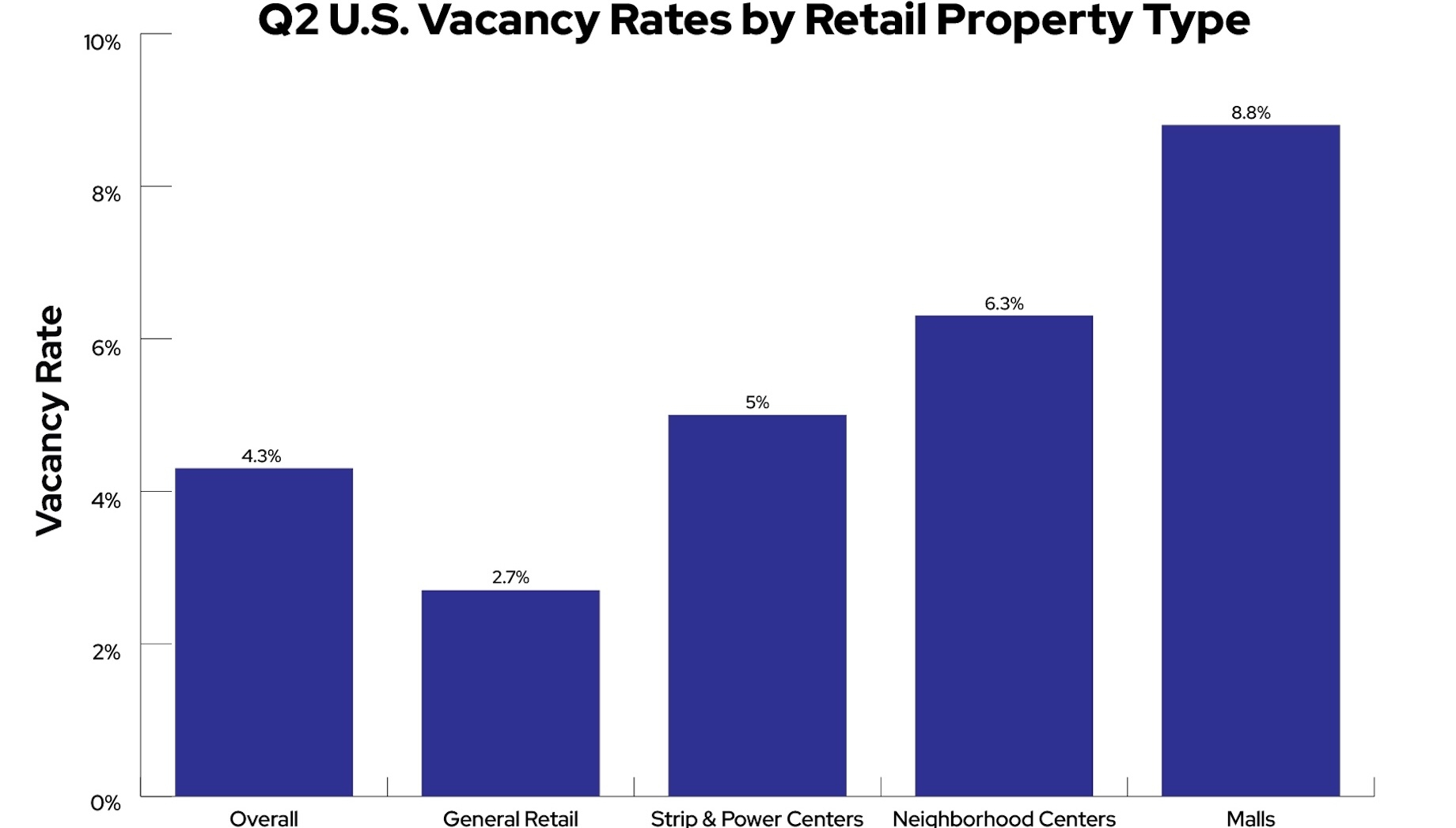

The nationwide market for retail space remained “fundamentally tight” in the second quarter of this year, according to Lee & Associates’ Q2 2025 Retail Overview. The 4.3% vacancy rate is close to the historic low. “Tenants and brokers in the field continue to report healthy competition for quality space, resulting in available space backfilling at the fastest pace in nearly 15 years,” according to the report.

Source: Lee & Associates and CoStar | Graphic: ICSC Commerce + Communities Today

Stockdale Capital Targets Distressed Real Estate With $700 Million Fund

Stockdale Capital Partners, whose portfolio includes several retail centers, has raised more than $700 million for a fund targeting distressed properties. Investors in SCP Real Estate Opportunities Fund II include public and private pension plans, endowments, foundations, family offices and financial institutions. “Our ability to invest across property types and throughout the capital stack as an operator allows us to take advantage of the widespread market dislocation,” Stockdale managing partner Dan Michaels said.

Stockdale oversees about $2.8 billion in gross assets under management. Among Stockdale’s retail holdings are Arboretum Crossing in Austin, Texas; The Shops at Northfield in Denver; and The Oaks in Thousand Oaks, California.

Green Street’s Mall Outlook

Top-tier malls and outlet centers are generally thriving, while their lower-tier counterparts are mostly struggling, according to a Green Street report released Thursday. The real estate research and analytics company’s 2025 Mall Insights report covers about 1,000 malls and outlets centers in the U.S. The one-fourth that are top-tier “continue to maintain their competitive edge.” Meanwhile, the prospects for most of the lowest-tier properties are “generally dire,” according to the report, and Green Street expects many will be repurposed over the next decade. JCPenney and Macy’s represent the most at-risk department stores, the report said. Green Street predicted 10 malls and outlet centers to close per year in the near term “until department store closures reaccelerate, which is a common catalyst for bad malls to finally shutter.”

Aventura Mall Visionary Don Soffer Dies at 92

Photo courtesy of the family of Donald M. Soffer/PR Newswire

Real estate developer Don Soffer, founder of the city of Aventura, Florida, and developer of Aventura Mall, died Sunday. He was 92.

One noteworthy achievement early in his career was the development of Monroeville Mall in his native Pennsylvania. Walmart bought the property from CBL this year. Although Soffer enjoyed success in Pennsylvania, he truly made his mark in South Florida. In 1969, he bought 785 acres of submerged swampland and built what is now the city of Aventura, according to Brandeis, his alma mater. Developed over the course of 40 years, Aventura had more than 40,000 residents as of July 2024, the U.S. Census Bureau said.

Aventura is home to Soffer’s Aventura Mall, “one of the nation’s most profitable upscale shopping malls,” Brandeis noted. USA Today’s 10BEST Readers’ Choice 2025 program recently named Aventura the country’s best mall. In 1983, Soffer secured the first Macy’s store outside New York with the opening of the mall. Soffer’s daughter Jackie, whom C+CT profiled in 2022, now oversees the property as chair and CEO of Turnberry, a commercial real estate owner and developer founded by her father. Turnberry has developed over $10 billion worth of commercial and residential properties, including about 20 million square feet of retail, more than 7,000 apartments and condos, 1.5 million square feet of office and more than 3,000 hotel rooms.

—Additional reporting by C+CT managing editor Katie Kervin

By John Egan

Contributor, Commerce + Communities Today