The Short Version

- Retail property sales hit $24.6 billion through May, a 7% increase year over year.

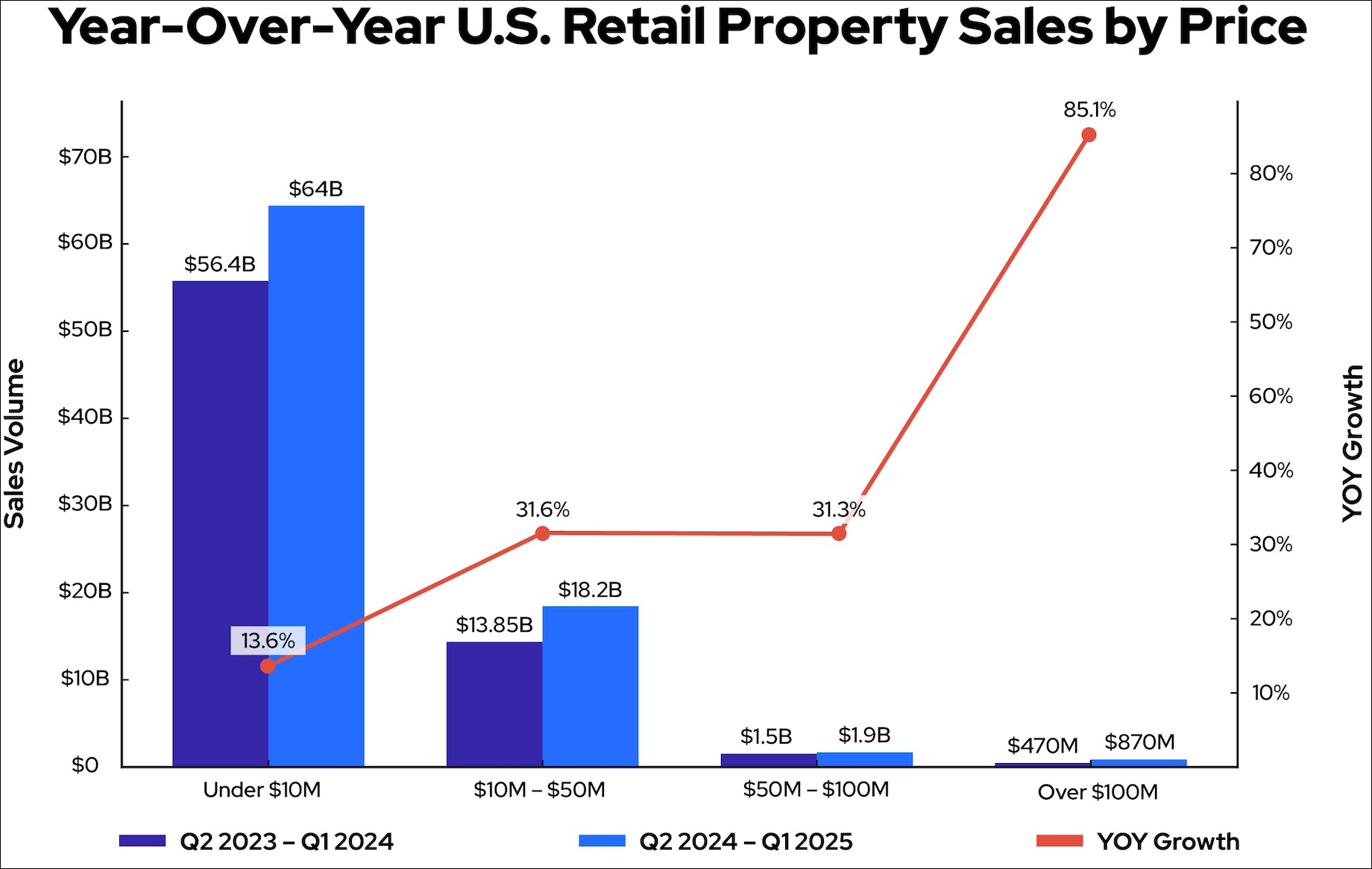

- Deals over $100 million saw the biggest jump, with volume up 85.1% compared with last year.

- Investors are gravitating toward grocery-anchored and value-add retail centers for their strong yields.

- Institutional buyers are returning to the sector, even acquiring small strip centers once dominated by private capital.

- Competition for retail assets is intensifying, with major deals closing across the U.S. this summer.

- Some investors and sellers remain cautious, awaiting clarity on interest rates and economic conditions.

Retail Investment Volume Climbs in 2024, Led by Big-Dollar Deals

Early 2024’s predictions that investors soon would snatch up retail properties are coming to fruition. Retail asset investment sales reached $24.6 billion through May this year, a year-over-year increase of 7%, according to MSCI Real Assets, a commercial real estate researcher that tracks deals of $2.5 million and up. CoStar data also reflects a boom. U.S. retail property sales rose 17.8% from $72.2 billion to $85 billion when comparing the second quarter of 2024 through the first quarter of 2025 with the same period a year earlier.

Source: CoStar

Deal volume for that period increased within each price bracket, according to CoStar. While the smallest deals continued to form the biggest dollar pile, it’s the bucket of deals topping $100 million for which the most drastic change occurred. Dollar volume for deals under $10 million rose 13.6% year over year to $64 billion, while dollar volume for deals over $100 million skyrocketed 85.1% to $870 million.

Grocery-Anchored and Value-Add Centers Lead the Comeback

The renewed interest in the sector coincides with office’s fall from favor and investors’ avoidance of multifamily and industrial properties amid supply and price concerns. The fundamentals of retail assets have improved, and shopping centers generally offer better yields than other properties, observers contend. Cap rates of stable, and well-located grocery-anchored centers are higher than for other property types: around 7% compared with 5.6% for apartments and 6.5% for warehouses of all classes, according to MSCI Real Assets. And they’re higher still for riskier bets like power centers, malls and properties in need of capital improvements.

MORE FROM C+CT: Finding Value in a Value-Already-Added World

“The stigma that has been attached to retail has finally started to lift,” said Bo Okoroji, founder and CEO of Steerpoint Capital, an opportunistic and value-add investor focused on open-air shopping centers, malls and offices. “We’re starting to see interest trickle into enclosed malls from the more-favored assets like grocery-anchored centers.”

MORE FROM C+CT: Bo Okoroji Used to Work at the Mall. Now, He Acquires Them

Steerpoint’s retail portfolio includes five shopping centers in California and the Galleria at Sunset mall in Henderson, Nevada, most of which were acquired with Bridge Group Investments, an investment firm that’s focused on revitalizing underperforming assets and that now is known as Mershops. In late 2024, Steerpoint joined with commercial real estate investment, management and design firm SteelWave to purchase California’s 456,000-square-foot Simi Valley Town Center. They propose to add housing to the site. Steerpoint also has about $150 million more in assets under contract, said Okoroji.

Steerpoint Capital and SteelWave purchased Simi Valley Town Center in California in late 2024. Photos courtesy of Steerpoint Capital

Pension Funds and Institutional Buyers Return to Retail

Pension funds and other institutional buyers that not long ago steered clear of retail assets are helping to drive investment. Northmarq reported that non-REIT institutional investors participated in 36% of multitenant shopping center acquisitions in the first quarter of 2025, up from 8% for all of 2024.

Value-add investor Sidford Capital acquired Aurora Plaza in Colorado for $16 million in June. The project is 80% occupied, which provides opportunity to boost income. Photo courtesy of JLL

Some institutions are accessing the sector by funneling money into private investment funds, remarked Dan Grooters, a principal of Sidford Capital, an investment management firm focused on value-add retail, office and industrial properties in and around Denver. He added that such investors not only are chasing stable and highly visible grocery-anchored properties but also are looking at deals as small as four-tenant strip centers filled with national brands. “You’d expect to see private capital or mom-and-pop buyers playing in that space, but we’re seeing institutions drop into it because it offers higher yields,” observed Grooters.

Sidford seeks “grittier” properties that have room for improvement, he said. In June, the firm paid $16 million for Colorado’s 115,461-square-foot Aurora Plaza with 20% vacancy. “If it’s a little outside the box, that’s where the opportunities are,” Grooters said. “If it’s a clean deal, it’s got a lot of competition.”

Major Acquisitions Span Malls, Grocery Centers and Lifestyle Retail

Sidford’s Aurora purchase was just one of several shopping center deals executed in the early days of summer by a host of buyers. Others include:

• Federal acquired two open-air centers totaling 550,000 square feet in Leawood, Kansas — Town Center Plaza and Town Center Crossing — for $289 million on July 1.

• And on June 23, the REIT sold Los Angeles’ 181,000-square-foot Hollywood Galaxy to private investors Justin and Tyler Mateen, who are brothers, for $69 million.

• Ram Realty Advisors paid $200 million for a portfolio of seven grocery-anchored properties totaling 600,000 square feet in the Southeast.

• Simon paid Swire Properties as much as $548.7 million for the outstanding 75% stake in the retail and parking at Miami’s Brickell Centre.

• Private investor and developer WS Development acquired the 200,000-square-foot, upscale, open-air Breton Village in Grand Rapids, Michigan, from a local owner.

• Another private buyer, RCG Ventures, finalized its $1.8 billion acquisition from Global Net Lease of a 14 million-square-foot shopping center portfolio across 28 states.

• Mall REIT Macerich paid $290 million for the 1.3 million-square-foot Crabtree Valley Mall in Raleigh, North Carolina, and plans to spend $60 million on redevelopment and leasing efforts.

• A one-year-old joint venture between Bain Capital and 11North Partners acquired three open-air lifestyle centers in Oklahoma City’s Nichols Hill suburb for $212 million.

• BC Wood Properties paid $12.4 million for Coolwood Plaza, a 104,234-square-foot grocery-anchored center in Valparaiso, Indiana.

• Brixton Capital purchased Civic Center Plaza in suburban San Diego. The 60,000-square-foot center is anchored by LA Fitness.

Ram Realty Advisors’ purchase of seven grocery-anchored centers in July included two assets in Durham, North Carolina: Homestead Market, anchored by Sprouts, and Bull City Market, anchored by Whole Foods. Photo credit: Ram Realty Advisors

Retail Revival Sparks Bidding Wars, Even in Secondary Markets

Westwood Financial CFO Juyuan Wei said Blackstone’s November announcement that it would pay $4 billion for grocery-anchored shopping center REIT Retail Opportunity Investments Corp. signaled renewed confidence in retail assets. The deal closed in February. Westwood Financial — which owns more than 125 community and neighborhood centers, primarily across the Sun Belt — itself purchased Charlotte, North Carolina’s Food Lion-anchored Eastway Square in February.

But in the last few weeks alone, Wei said, competition has greatly accelerated. “A lot of private buyers have been in the market for some time,” he said, “but a lot of institutional investors are no longer willing to wait on the sidelines, and they are starting to bid prices up.”

Westwood Financial acquired Eastway Square in Charlotte, North Carolina, this year. The 130,156-square-foot center is anchored by Food Lion and includes Ross Dress for Less, Wingstop and Papa Johns pizza. Photo courtesy of Westwood Financial

That growing competition hasn’t dissuaded private investor Midloch from expanding its retail holdings. The buyer focuses on value-add opportunities between $5 million and $50 million across the major property sectors, and retail makes up about 15% of the portfolio, said CEO Andy Sinclair.

Midloch recently purchased a vacant Safeway in Longmont, Colorado, he said, and has signed a lease with Vasa Fitness, a low-price gym concept located predominantly in the Midwest and West. “Every so often, it seems like the big asset in demand changes,” he said. “Twenty years ago, office was in vogue, and now it’s out of vogue. Retail was out of vogue, but it has made a comeback.”

Some Sellers Remain Cautious Amid Economic Uncertainty

The growing bullishness surrounding the retail sector has fueled a torrent of broker opinion-of-value assignments, which in turn suggests that shopping center owners are preparing to list their properties, said Ryan Roedersheimer, a senior vice president and lead broker with Northmarq in Cincinnati who specializes in multitenant assets. But he also thinks some sellers and investors are waiting to see how interest rates, inflation and tariffs shake out before they act.

Selig, a century-old family company that has amassed a 15 million-square-foot portfolio of apartment and commercial properties in the Southeast, is taking such a wait-and-see approach toward new retail investment, said chief investment officer Matt Rendle. While confidence about retail in the Sun Belt remains strong, Rendle said, Selig’s focus on development and its long-term hold strategy requires patience. “Interest rate fluctuations, tariffs and how people are reacting to these and other ripples have long-term ramifications,” he explained, “so this is not a moment where we’re out collecting a lot of retail opportunities.”

Even so, Roedersheimer explained, investors and sellers are readying themselves. “People are saying: ‘If we’re not in a position to pull the trigger, let’s at least be in a position when it’s time,” he noted.

By Joe Gose

Contributor, Commerce + Communities Today