Jump to …

Nuveen Real Estate Has Assembled More Than $2.5B To Invest in Grocery-Anchored and Other Necessity-Based Retail

KPR Centers Buys Chicago-Area Grocery-Anchored Retail Center for $40M

Submarine Maker Will Convert Connecticut Mall Into Office Campus

Forge Atlanta Mixed-Use Project Lands More Than $220M in Public Incentives

At Home Emerges From Bankruptcy With Most Stores Intact as Carter’s Plans 150 Closures

Cresa Acquires Fischer To Strengthen Tenant Advisory Services

Nuveen Real Estate Has Assembled More Than $2.5B To Invest in Grocery-Anchored and Other Necessity-Based Retail

Nuveen Real Estate is sitting on more than $2.5 billion earmarked for one of the hottest segments of retail real estate: necessity-based properties. Nuveen Real Estate global head Chad Phillips told CNBC that so far this year, his company has raised $1.4 billion in equity with leverage, or borrowed capital, to put toward buying necessity-based retail properties, namely grocery-anchored centers. That puts the company at over $2.5 billion of buying power for its necessity-based-retail strategy, he said.

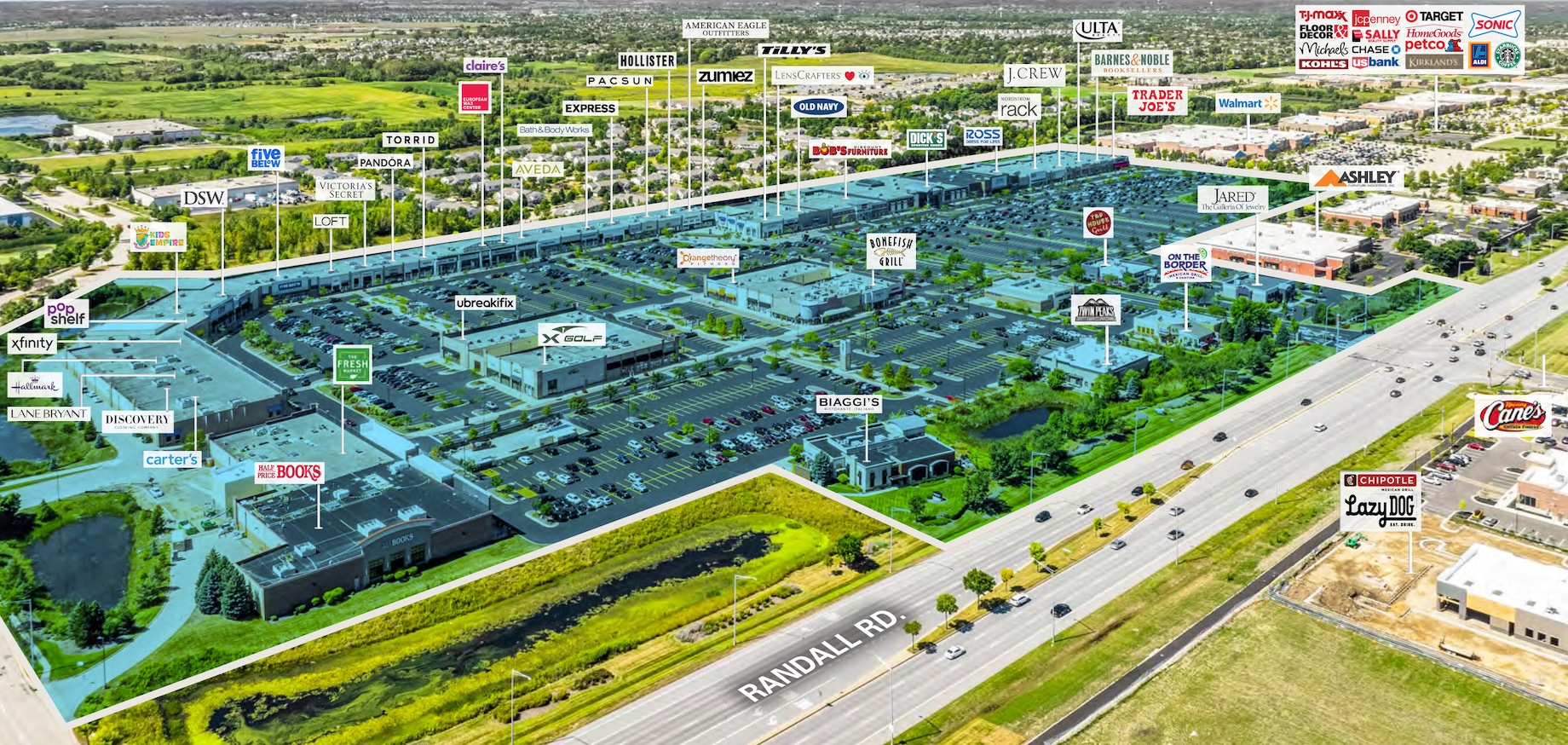

In a deal announced Oct. 6, Nuveen Real Estate acquired the repositioned Algonquin Commons from Red Mountain Group for $100 million. Grocers Trader Joe’s and The Fresh Market are among the tenants of the 548,000-square-foot shopping center. Image above and at top courtesy of Red Mountain Group

Phillips oversees more than $140 billion worth of commercial real estate equity and debt investments in 22 countries, including the Chicago area’s dual-grocery-anchored Algonquin Commons, which Nuveen recently acquired for $100 million.

Related Stories From C+CT

Grocery Stores’ Enduring Appeal to Shoppers, Investors and Developers

CMBS Activity Underscores Surge in Grocery-Anchored Activity

Nuveen Real Estate Raises $320 Million for Its U.S. Cities Retail Fund

Big V and Equity Street Capital Create $1.2 Billion Fund for Retail Centers

$1B Joint Venture Will Build East Coast Grocery-Anchored Centers With Multifamily Components

Money Is Moving Again in Retail Real Estate — and Fast

KPR Centers Buys Chicago-Area Grocery-Anchored Retail Center for $40M

KPR Centers, meanwhile, bought the 195,000-square-foot Pointe Plaza in Niles, Illinois, for $40 million. Fresh Farms is among the tenants at the 94% leased property, which is shadow-anchored by Walmart. Over the past 20 months, KPR has paid nearly $450 million for 13 shopping centers totaling more than 3 million square feet, including the Cub-anchored Shoppes at Knollwood.

FROM THE C+CT ARCHIVE: National Retailers Aren’t Flying Over Rural America Anymore

KPR Centers has acquired Pointe Plaza. It is KPR’s second Chicago-area shopping center, joining Schaumburg Corners. Photo courtesy of KPR Centers

Submarine Maker Will Convert Connecticut Mall Into Office Campus

General Dynamics Electric Boat has purchased Crystal Mall in Waterford, Connecticut, except for the former Sears, and plans to convert it into office space. The mall’s previous owner was Namdar Realty Group, according to Patch.

Electric Boat also bought the mall’s former Macy’s in June. Together, the two acquisitions will produce 542,000 square feet of office for 4,000 to 5,000 engineering, training and software development employees. Electric Boat said it will occupy the space as early as mid-2027.

The 42-acre mall site is about 5.5 miles from Electric Boat’s shipyard in Groton, Connecticut. The company said it will work with the mall’s remaining tenants on “next steps.” The current vacancy rate is 65% to 70%, Eyewitness News 3 reported.

MORE FROM C+CT: How a TIF Helped Transform an Empty AT&T Campus Into Bell Works Chicagoland

Forge Atlanta Mixed-Use Project Lands More Than $220M in Public Incentives

A mixed-use development in Atlanta just got a multimillion-dollar boost. The board of Develop Fulton, an economic development agency for Fulton County, Georgia, has approved a $223.7 million incentive package for the $756 million first phase of the Forge Atlanta mixed-use project. The first phase will include 60,500 square feet of retail and entertainment space, about 300 hotel rooms and a meeting and event venue. Develop Fulton didn’t provide incentives for the condo component of the first phase.

The first phase of the Forge Atlanta development will cost $756 million. Rendering courtesy of Forge Atlanta Asset Management

Forge Atlanta Asset Management, whose majority owner is real estate and cryptocurrency company Webster Technology Group, is the developer of Forge Atlanta. The 10-acre site can accommodate up to 15 million square feet. “Forge Atlanta represents a forward-looking, landmark investment in the future of our growing city and thriving region,” said Develop Fulton chair Kwanza Hall.

At Home Emerges From Bankruptcy With Most Stores Intact as Carter’s Plans 150 Closures

Home decor retailer At Home will maintain most of its brick-and-mortar presence after emerging from Chapter 11 bankruptcy, while children’s apparel retailer Carter’s will shutter roughly 15% of its stores in North America.

At Home Exits Chapter 11 Bankruptcy With 229 Stores and New Ownership

At Home is entering a leaner era with most of its store count intact. Funds affiliated with At Home lenders Redwood Capital Management, Farallon Capital Management and Anchorage Capital Advisors recently completed their court-approved purchase of At Home. As part of its exit from Chapter 11 bankruptcy, the retailer slashed nearly all of its $2 billion in debt and secured a roughly $500 million loan. At Home continues to operate 229 stores in 39 states. After filing for bankruptcy in June, the chain closed 31 stores, PennLive reported.

Photo credit: JHVEPhoto - stock.adobe.com

Carter’s Will Close 150 Underperforming Children’s Stores as It Tests New Concepts

Carter’s, a retail chain that sells apparel for babies and young children, plans to close about 150 underperforming stores in North America over the next three years as leases expire. Collectively, the stores account for about $110 million in annual sales, the company said. Carter’s made the store closure announcement in conjunction with the release of its third-quarter earnings. The company said about 100 of those 150 stores will be shuttered during the 2025 and 2026 fiscal years. The 150-store plan exceeds the previous closure target of 100 stores. The retailer operates more than 1,000 stores in the U.S., Canada and Mexico.

Photo credit: M. Suhail - stock.adobe.com

As it sheds locations, Carter’s is testing new store concepts. On the company’s third-quarter earnings call, CEO Doug Palladini said it is pausing expansion of its current U.S. store model, a 4,000- to 5,000-square-foot co-branded Carter’s and OshKosh B’Gosh format. The company said it is testing new store concepts.

Cresa Acquires Fischer To Strengthen Tenant Advisory Services

Tenant advisory firm Cresa has acquired tenant advisory firm Fischer. Both serve the retail industry. Fischer founder and CEO Cliff Fischer, president Ted Uzelac and executive vice president Chris Joyner are among the 110 Fischer employees joining Cresa. Over the past 18 months, Cresa has made five other acquisitions: tenant advisory firms Vogel Advisors, Fritsche Anderson Realty Partners and Axis Tenant Advisors and project management firms Pacific Program Management and NorthStar Owners Representation.

—Additional reporting by C+CT editor-in-chief Amanda Metcalf

By John Egan

Contributor, Commerce + Communities Today