Should stores that sell pot, vape pens or cannabidiol (CBD) get the go-ahead to operate at shopping centers? Survey results published in April reveal mixed attitudes about such businesses among the 5,200 brokers, lawyers, retailers and landlords who responded.

Green Growth Brands opened its first shop in March, at Simon's Castleton Square Mall, in Indianapolis

“We were curious as to the perception in the industry about whether these should be permitted uses,” said James Savard, executive vice president of leasing and management at real estate firm Metro Commercial, which conducted the online survey. Metro Commercial manages about 75 shopping centers in the Northeast and leases space at roughly 400 properties, totaling upwards of 30 million square feet.

Recreational cannabis, already legal in 10 U.S. states and Canada, appears to be on the fast track in two important markets for Metro Commercial: Pennsylvania and New Jersey. Meanwhile, the popularity of hemp-derived, non-psychoactive CBD continues to affect shopping center leasing across North America, Savard notes. According to a Cohen & Co. survey published in February, the U.S. CBD market could hit about $16 billion by 2025. “When Congress declassified hemp as a prohibited Schedule 1 substance last year, it sort of opened the floodgates for CBD to go mainstream,” Savard said.

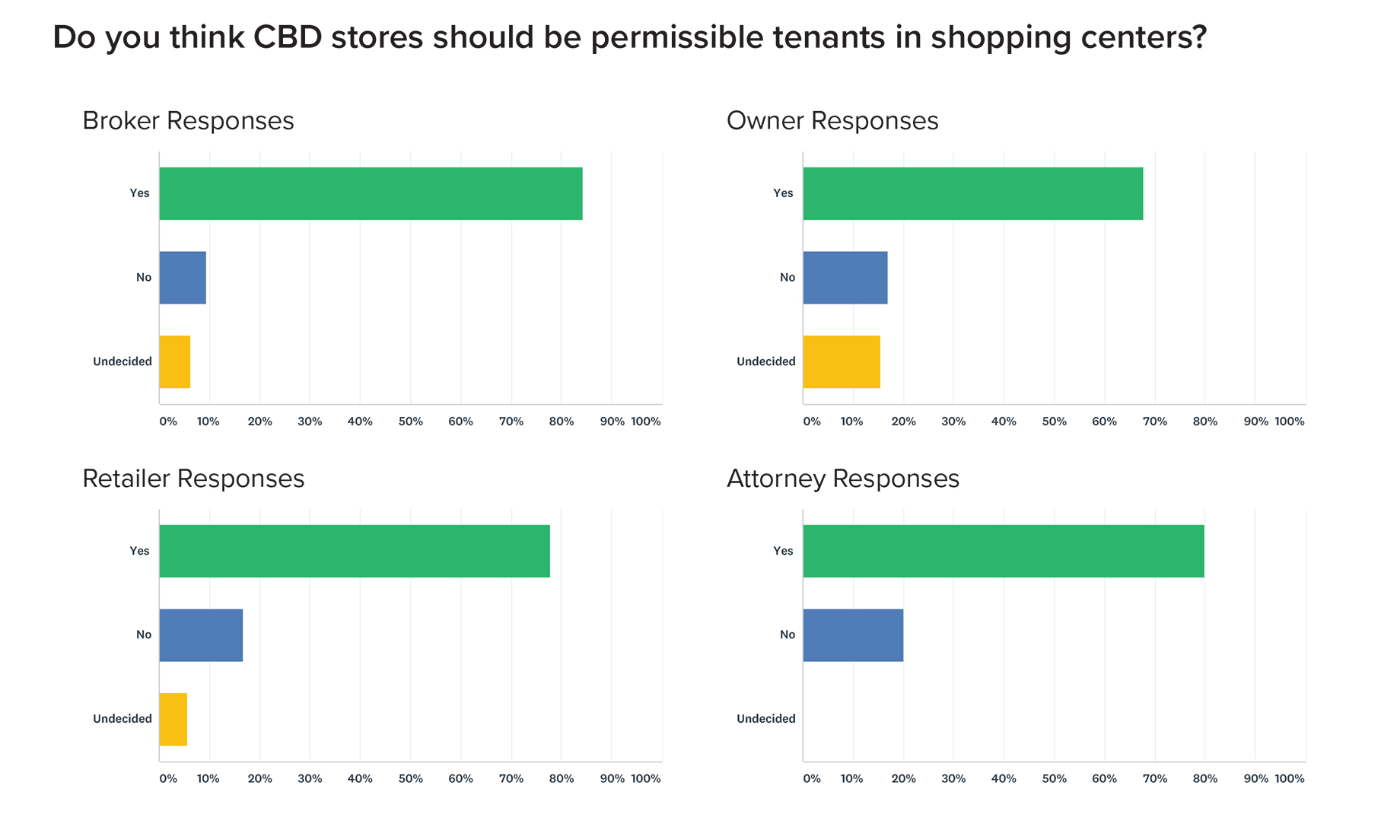

Asked whether CBD stores should be considered permissible tenants in shopping centers, 84 percent of the survey respondent brokers, 68 percent of the property owners and 78 percent of the retailers replied in the affirmative.

Besides these generally favorable attitudes, the survey reveals that retailers rarely maintain specific policies against co-locating with cannabis-related tenants, Savard notes. But as written, many retail leases could easily be interpreted to exclude these types of uses, he says. Metro Commercial asked brokers and retailers whether they would support the inclusion of a CBD store in a retail tenant lineup, and about 80 percent of the brokers and roughly 70 percent of the retailers said they would.

As for vape stores, though they might not sell cannabis or even CBD, the vaporizers they do carry are often used to smoke cannabis, and many of these stores also sell pot-related paraphernalia. In recognition of this, the Metro Commercial survey included questions about these tenants as well. Asked whether they consider vape products and stores to be mainstream and generally acceptable among consumers, 68 percent of the brokers and 58 percent of the retailers and 68 percent of the owners responded that they did.

The respondents were generally more accepting of CBD and cannabis retailers than they were of vape stores, Savard notes. The owners and managers of higher-tier shopping centers in particular should avoid leasing space to vape tenants with onerous head-shop aesthetics, he says. “The way we saw vape stores roll out initially, they were grungy and did not present well,” Savard said. “By contrast, in many cases medical and recreational marijuana dispensaries are upping their game.” Fortunately for landlords, some vape stores are doing the same by displaying their products in much the same way as fine jewelers might show off watches or rings, he points out. “Vape stores that present a first-class, ‘fine jewelry’ approach to merchandising will have a better chance of leasing in class-A centers,” said Savard.

None of this is to suggest that industry professionals unanimously support pot-related tenants. Metro Commercial asked respondents whether they would support including cannabis-related retail stores if it were legal in their state. While 80 percent of brokers and 70 percent of retailers answered in the affirmative, the number was just 48 percent for the landlords.

“In addition to lender-related issues, landlords have to think a lot harder about the effects of any one tenant on the others, as well as security or other risks,” Savard said, “and so it makes sense that they would be a bit more cautious about signing leases with retailers that actually sell cannabis.”

View the survey results here.

By Joel Groover

Contributor, Commerce + Communities Today