Jump to ...

3 Major Sports Retail Updates: Dick’s, Skechers and Titleist Step Up

U.S. Luxury Retail Openings Surged 65% Year Over Year in H1, JLL Reports

7-Eleven Parent Eyes $13B Investment, Including To Expand Fresh Food in U.S. and Canada

Mixed-Use Growth: 3 Projects Advance in Texas and Florida

Leadership Moves: Cullinan Properties and NAI Robert Lynn Appoint New Executives

In Memoriam: 3 Longtime ICSC Members

3 Major Sports Retail Updates: Dick’s, Skechers and Titleist Step Up

The NFL season has begun, and on cue, sports is dominating headlines. As Dick’s folds Foot Locker into its footprint, a footwear retailer and a golf gear retailer are following in the footsteps of Dick’s House of Sport with new immersive stores in the U.S.

Dick’s Completes $2.5B Foot Locker Acquisition, Adding 2,354 Stores

Dick’s Sporting Goods has completed its $2.5 billion acquisition of footwear and apparel retailer Foot Locker. The companies rang up combined sales of more than $21.4 billion in fiscal year 2024. The pairing now operates more than 3,200 stores.

Before its acquisition by Dick’s Sporting Goods, Foot Locker operated 2,354 stores in 20 countries. Credit: Foot Locker/PRNewsFotos

Through the deal, Dick’s gained 2,354 stores in 20 countries under the Foot Locker, Kids Foot Locker, Champs Sports, WSS and Atmos brands. Foot Locker posted sales of $8 billion in 2024. Dick’s plans to operate Foot Locker as a standalone business and to maintain its brands. At the close of fiscal year 2024, Dick’s operated nearly 890 stores under the banners of Dick’s Sporting Goods, Dick’s House of Sport, Golf Galaxy, Golf Galaxy Performance Center, Public Lands and Going Going Gone. Dick’s generated sales of more than $13.4 billion in its last fiscal year.

Skechers Opens First U.S. Performance Store with Immersive Sports Features

Footwear and apparel retailer Skechers, taken private by 3G Capital today, has opened its first U.S. Skechers Performance store. The 26,017-square-foot unit, located in Miami’s Dolphin Mall outlet center, is the world’s largest Skechers outlet store. It offers immersive features like a running track, basketball court, pickleball court, golf green and soccer zone and sells footwear, apparel and accessories for basketball, running, soccer, golf, pickleball and outdoor activities. The Miami location joins Skechers Performance stores in Belgium, Canada, Chile and Germany. Skechers also operates about 5,300 traditional Skechers stores.

Skechers has opened its first U.S. Skechers Performance store in Miami’s Dolphin Mall. Photo courtesy of Skechers

Titleist Debuts First U.S. Store With Golf Fitting Experience

Golf equipment company Titleist said its first U.S. store, which has just opened steps from the iconic 18th green at North Carolina’s revered Pinehurst No. 2 course, offers “an immersive fitting and retail experience.” The Titleist Shop at Padgett Center includes club and ball fitting, instant ball customization, access to practice tees and a variety of balls, clubs and gear available for purchase. The store measures more than 3,600 square feet, according to the Sports Business Journal.

Titleist’s first U.S. store has just opened, at North Carolina’s Pinehurst Resort. Photo courtesy of Titleist

MORE GOLF FROM C+CT: PGA Frisco: A Public-Private Partnership Driving North Texas’ Mega Mixed-Use Development

Luxury Retail Openings Surged 65% Year Over Year in H1, JLL Reports

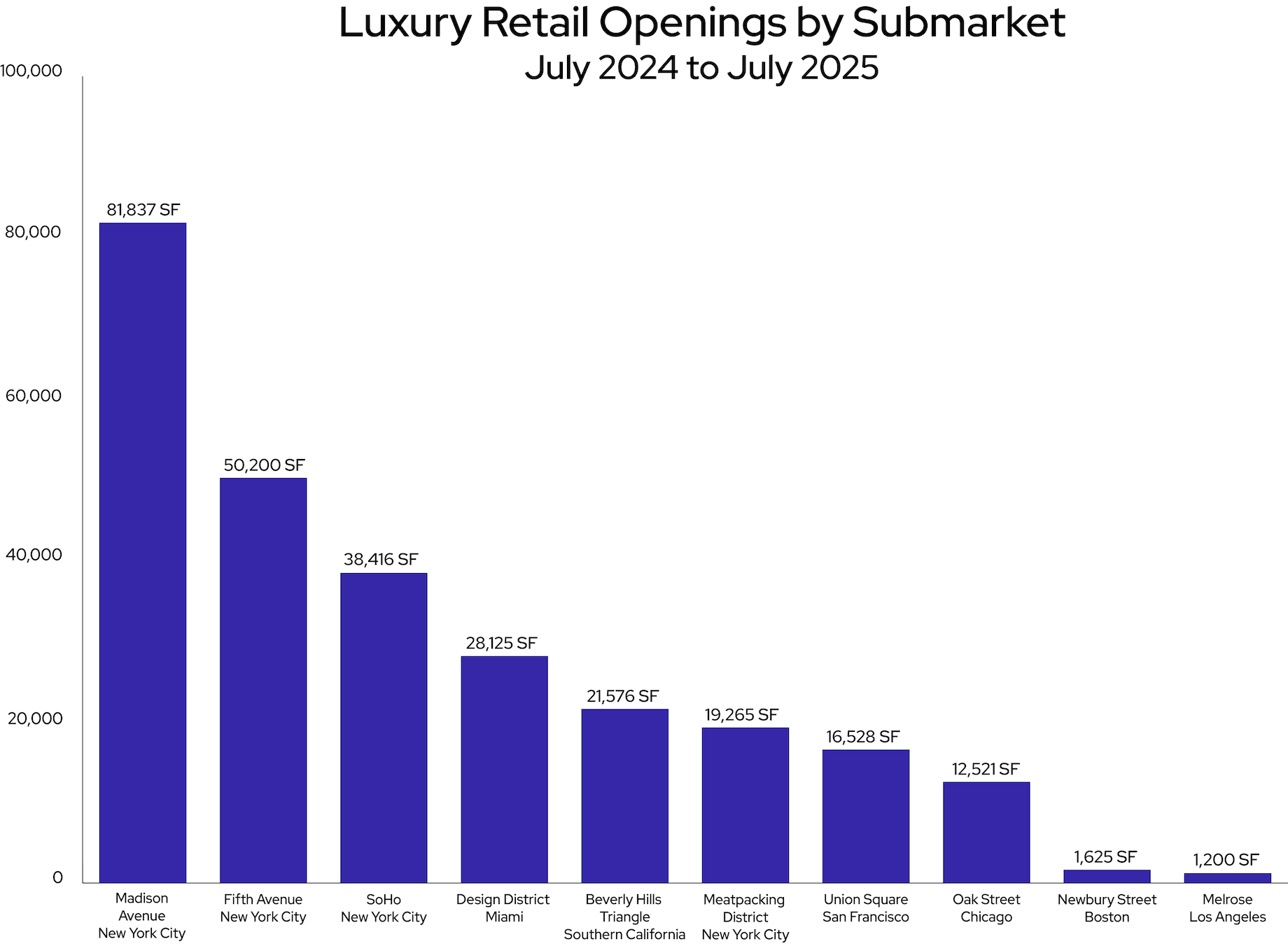

Luxury retail space is almost as coveted as Louis Vuitton’s iconic Speedy handbag. JLL’s Luxury Retail Report 2025 indicated that 226,513 square feet of luxury retail space opened in the U.S. in the first half of 2025, compared with 137,186 in the first half of 2024, a 65% increase.

JLL reported that among luxury stores that opened from July 2024 to July 2025:

- locations of 2,000 square feet and smaller represented the biggest share, 38%

- 59.5% were street level and 32.2% were in malls

- New York City dominated with 42 stores, followed by nine in Miami and nine in Costa Mesa, California

Source: JLL Luxury Retail Report 2025 | Graphic: ICSC Commerce + Communities Today

7-Eleven Parent Eyes $13B Investment, Including To Expand Fresh Food in U.S. and Canada

On March 21, the chilled shelves at a 7-Eleven in Tokyo offered ready-to-eat bento boxes, packaged Japanese meals and beverages. Photo credit: Mdv Edwards - stock.adobe.com

The Japanese parent company of 7-Eleven is weighing a more than $13 billion investment over the next five years to expand. In North America, Seven & I Holdings’ initiative would refresh current convenience stores, add more than 1,000 in-store restaurants and set up infrastructure to sell more 7-Eleven-brand foods, The New York Times reported.

Japanese c-stores are known for next-level food options, and Seven & I’s efforts would bring that quality to the more than 13,000 stores in the U.S. and Canada that 7-Eleven operates, franchises or licenses.

The chain’s fresh-food push comes as more U.S. consumers are picking up freshly prepared food at c-stores. A survey conducted last year by Acosta Group — a collective of retail, marketing and foodservice agencies — showed 27% of c-store shoppers were buying freshly prepared foods more frequently than they had a year earlier.

Mixed-Use Growth: 3 Projects Advance in Texas and Florida

Mixed-use developments in Texas and Florida have reached critical junctures.

$1.7B Westside Village in Fort Worth Will Break Ground in 2026

Construction will kick off next year on the first phase of the $1.7 billion mixed-use Westside Village in Fort Worth, Texas. The first phase will feature a 100,000-square-foot office building with ground-floor retail and two restaurants, along with 308 apartments and a private social club, the Dallas Business Journal reported.

Westside Village Image credit: Michael Hsu Office of Architecture

First-phase construction is scheduled for completion in 2028. When fully developed, the 37-acre development is on track to include 238,000 square feet of retail, about 880,000 square feet of office, 1,785 apartments and a 175-room hotel. The developer is FW Westside RE Investors, a partnership between Larkspur and billionaire Robert Bass’ Keystone Group.

SeaFlower Village Center in Bradenton, Florida, Will Begin Construction Next Week

Casto and Redstone’s third partnership — SeaFlower Village Center in Bradenton, Florida — will break ground next week and deliver in the fourth quarter of 2026. SeaFlower Village Center — the 47-acre first phase, anchored by Publix — will feature 362 apartments, 120 hotel rooms and 140,000 square feet of retail, dining and office. The broader SeaFlower community is approved for as many as 4,000 homes.

SeaFlower Village Center Image credit: D3 Creative Studio

Publix Joins $2B Pearl Square Mixed-Use Development in Jacksonville

Publix also has signed on as an anchor at the over-$2 billion Pearl Square in Jacksonville, Florida. Construction on the mixed-use development kicked off last year. Once finished, Pearl Square will include about 200,000 square feet of retail, 1,250 apartments and a revitalized Ambassador Hotel. Buildout is expected to take 10 years. The developer is Gateway Jax, a partnership between DLP Capital and JWB Real Estate Capital.

The more than $2 billion Pearl Square mixed-use project has added Publix as grocery anchor. Photo credit: Gateway Jax

Leadership Moves: Cullinan Properties and NAI Robert Lynn Appoint New Executives

Cullinan Properties — which specializes in mixed-use, office, multifamily and healthcare — has hired Maria Pope Toliopoulos as chief strategy officer. She most recently was president of her own real estate consulting firm, Hyperion Group. Before that, she was senior vice president of real estate at Ashley Global Retail, and vice president of real estate portfolio strategy at Ulta Beauty. She previously spent a decade at RPAI, including a stint as senior vice president of leasing.

And NAI Robert Lynn hired GC Carriero as president of the Dallas retail division. During his two-decade career, he has handled transactions valued at more than $300 million and totaling nearly 2 million square feet. His previous employers include DuWest Realty, JLL and Tricom Real Estate Group. Carriero has volunteered for ICSC as Texas co-chair, a member of the Next Generation Leadership Network and a committee member for the ICSC Red River event.

GC Carriero Photo courtesy of NAI Robert Lynn

In Memoriam: 3 Longtime ICSC Members

Three longtime ICSC members have died recently: Norman Kranzdorf, a founding member of the organization; John Hart, a past trustee; and Mike Polachek, a past Arizona and New Mexico state director.

Founding ICSC Member and REIT Pioneer Norman Kranzdorf

Norman Kranzdorf died on Wednesday, two weeks shy of his 95th birthday. He was part of many firsts in the industry.

Norman Kranzdorf

Kranzdorf founded Kranzco Realty in 1979 and in 1992 took it public, creating one of the country’s first shopping center REITs. It merged with CV REIT in 2000, forming Kramont Realty Trust. Centro, a predecessor company of Brixmor, acquired Kramont in 2005. Kranzdorf then worked for Urdang Capital Management, now CenterSquare, until his retirement 12 years ago.

He joined ICSC in 1957, its first year; served four terms as a trustee for ICSC; chaired the ICSC Bankruptcy Task Force; and authored books like Retail Tenant Bankruptcy: A Retailer Bankruptcy Primer for Shopping Center Landlords, which ICSC published in 1977. C+CT featured Kranzdorf among the sage voices of the industry in 2022.

He also was a founding member of University of Pennsylvania Wharton School’s Samuel Zell & Robert Lurie Real Estate Center and sat on its board.

He and his son, Michael, formed a shopping center development and management company, Amterre Property Group LLC, which specializes in shopping centers in Colorado.

Past ICSC Trustee John Hart

Former three-term ICSC Trustee John Hart of Simsbury, Connecticut, died in late August at age 88. Hart launched his real estate career at Connecticut General Life Insurance Co. In 1981, he started John M. Hart Associates to provided advisory services and capital for commercial real estate companies. That firm evolved into Hart Realty Advisers, a real estate investment management firm for public pension and endowment funds.

Former ICSC State Director for Arizona and New Mexico Mike Polachek

Commercial real estate executive Mike Polachek, former ICSC state director for Arizona and New Mexico, recently died in Scottsdale, Arizona, after a bout with pancreatic cancer. He was 78.

Mike Polachek Photo courtesy of SRS Real Estate Partners

Polachek launched his real estate career in 1974 at Grubb & Ellis. He later became a development partner at Trammell Crow and a brokerage partner at Red Development. His most recent role was executive vice president and co-market leader in Phoenix for SRS Real Estate Partners, which he joined in 2009.

“He was the consummate retail real estate professional and worked with passion up until his final days,” said SRS executive vice president and managing principal Ed Beeh. “When ICSC came out with the 25-year lapel pin, he joked that they should have sent him two, as he was a member for over 50 years. He always conducted himself with honesty and integrity and was a great mentor to many.”

Polachek was one of the first people in retail real estate to specialize in tenant representation, according to his obituary.

—Additional reporting by Commerce + Communities Today editor-in-chief Amanda Metcalf

By John Egan

Contributor, Commerce + Communities Today