The U.S. CMBS delinquency rate hit another post-crisis low of 2.06 percent in June, down by 9 basis points from May and by 113 basis points from a year ago, according to Morningstar Credit Ratings.

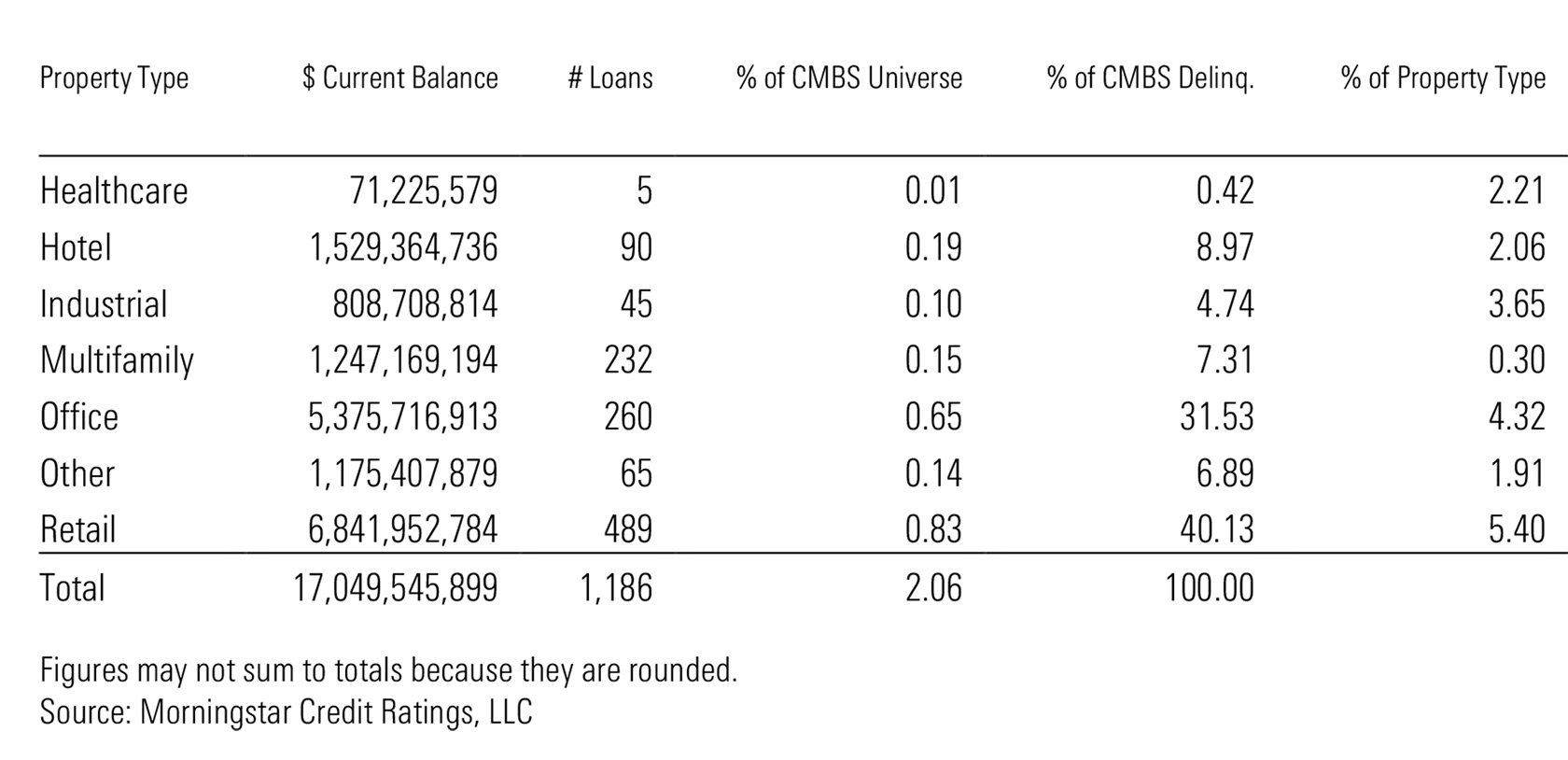

June CMBS delinquency by property type

Delinquent loans are those whose payments are at least 30 days late. In June 5.4 percent of the outstanding retail commercial-mortgage-backed-securities loans were delinquent, according to Morningstar, making retail the property type with the most delinquent loans for the month. That compares with only 0.3 percent of multifamily, 2.06 percent of hotel and 4.32 percent of office CMBS loans.

The total value of retail CMBS loans in delinquency status dropped by $1.65 billion in June (19.4 percent), to $6.84 billion, from $8.49 billion one year ago, because more loans were either liquidated or resolved than were replaced with newly delinquent loans.

Morningstar says it believes the overall delinquency rate will hold below 2.5 percent for the rest of the year, thanks to the continued disposal of distressed legacy debt and the swift pace of new loan origination, which will continue to raise the outstanding balance of CMBS loans.

By Brannon Boswell

Executive Editor, Commerce + Communities Today