U.S. retail property fundamentals strengthened in the second quarter, thanks in part to improved consumer sentiment and to retailers’ robust expansion plans, according to a report from CBRE.

Average retail net asking rents increased on both an annual and quarterly basis, to $18.01 per square foot, reflecting increased demand for retail space.

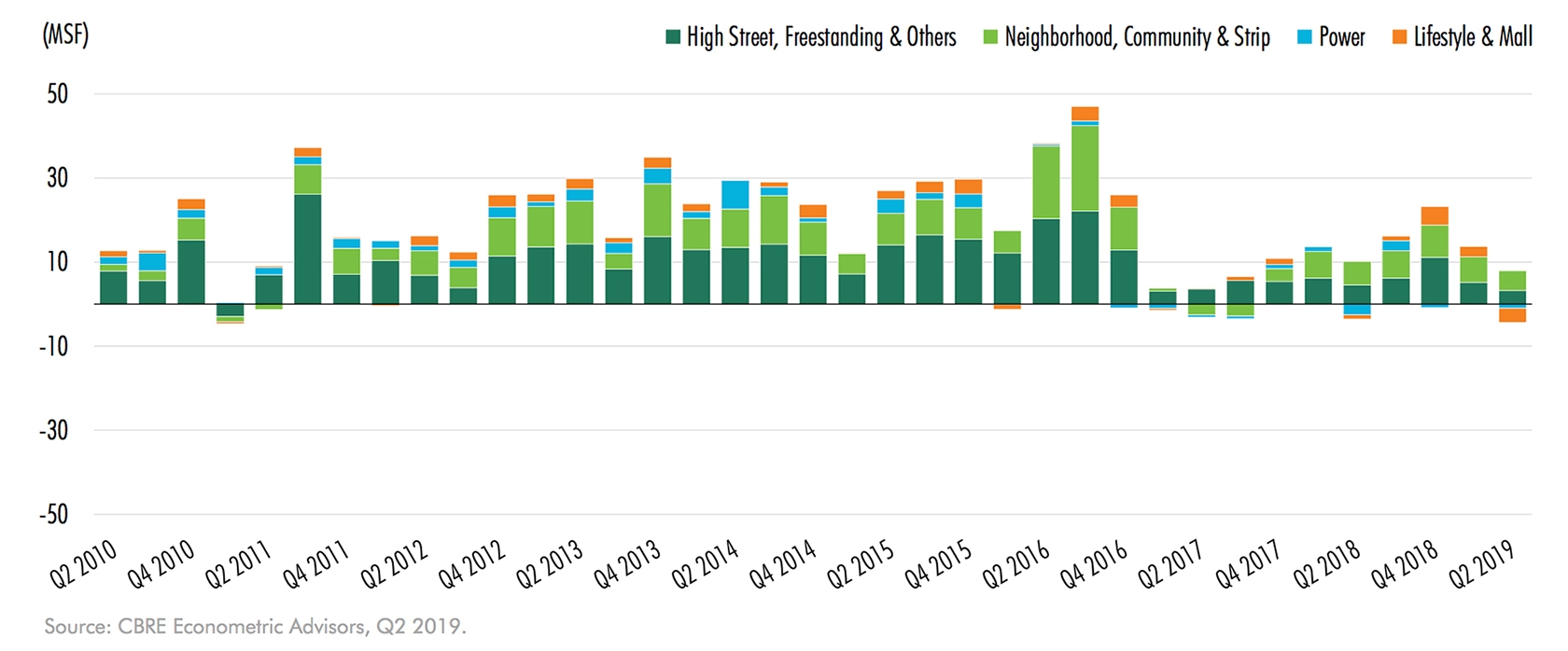

Total retail net absorption remains positive

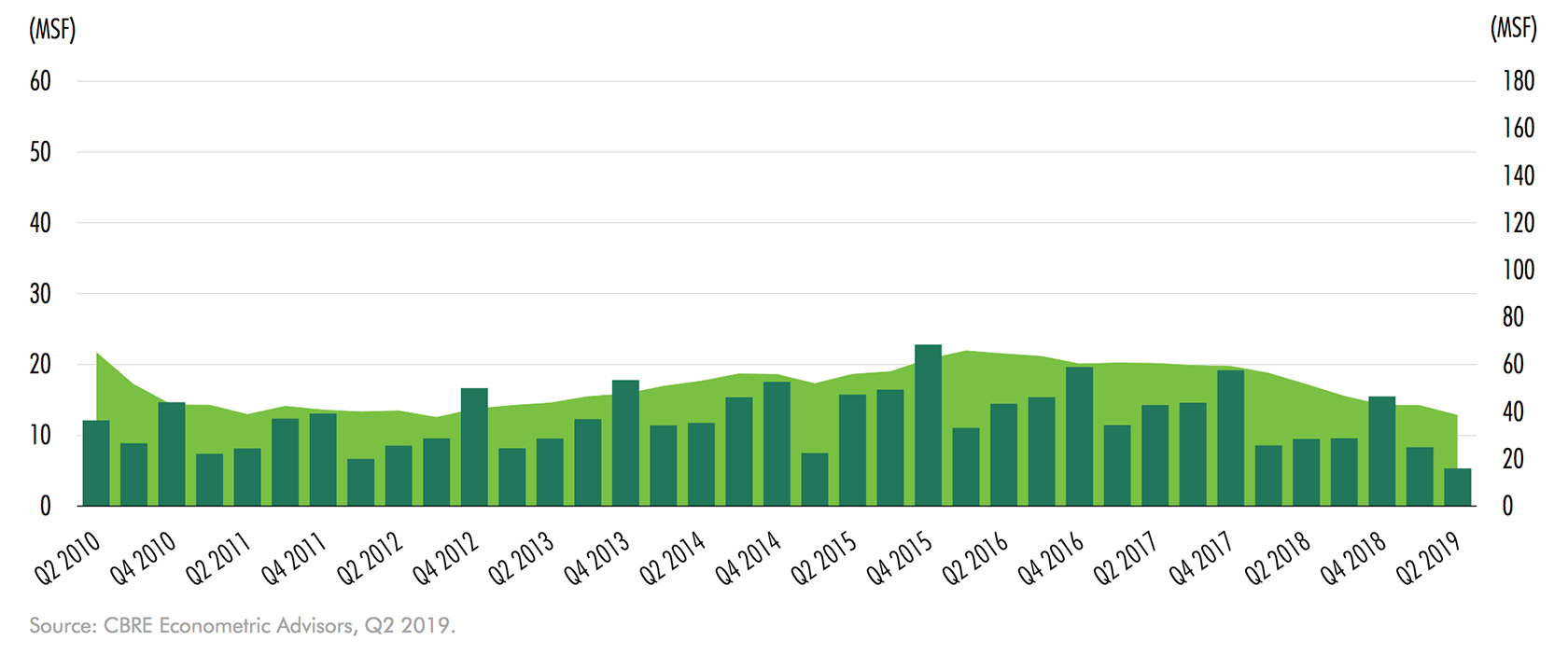

Retailers absorbed some 3.6 million square feet of retail space during the quarter, the firm reports. The supply of new retail space opening up has remained constrained, creating opportunities for redevelopment of existing properties, CBRE says. Total retail completions declined by 3.6 percent in the quarter, to about 5 million square feet.

Total retail completions

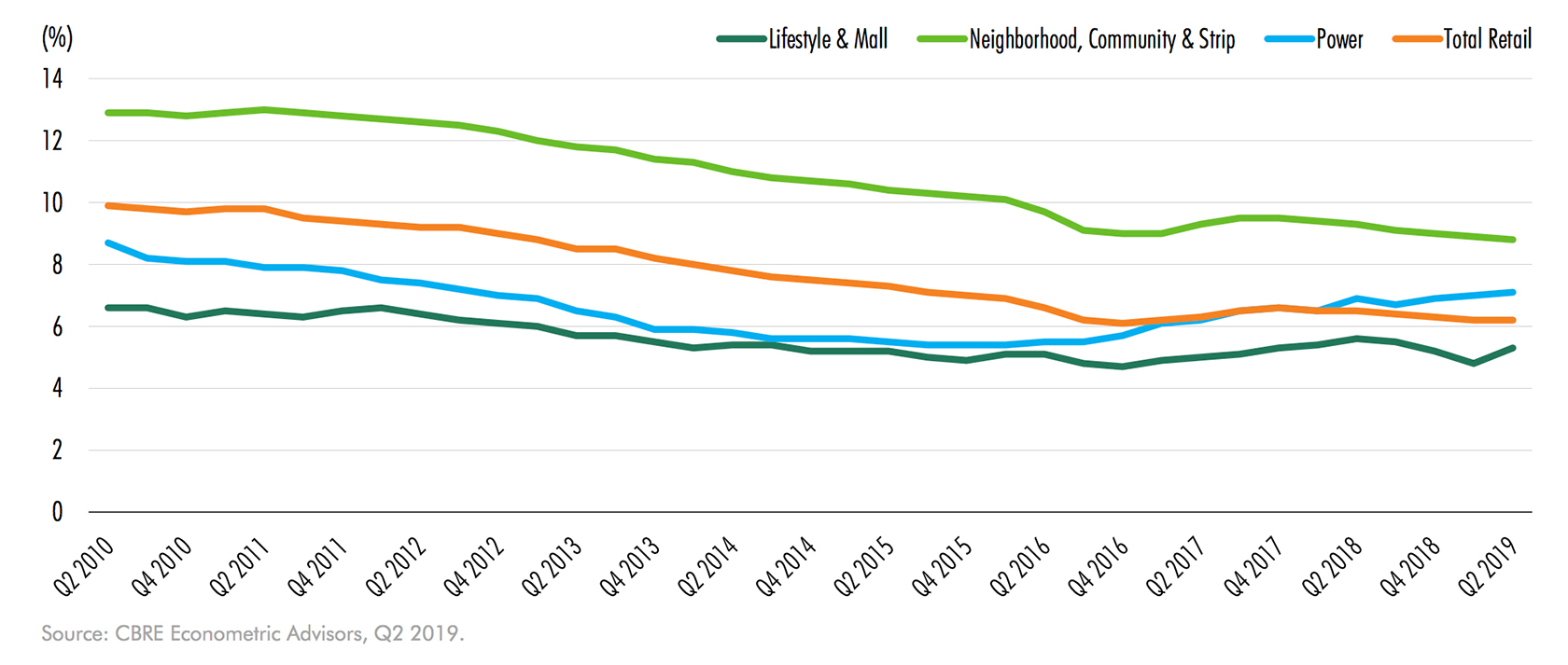

Total retail availability held steady quarter on quarter, at 6.2 percent, with grocery-anchored neighborhood, community and strip centers experiencing the highest demand among property types. The availability rate for the neighborhood, community and strip-center segment fell by 10 basis points in the second quarter, to 8.8 percent, continuing a downward trend that began in the first quarter of 2018.

Availability rates by property segment

CBRE says it anticipates that these healthy fundamentals will hold steady. Low unemployment, rising wages and increased consumer spending, the firm says, all indicate a healthy second half ahead.

By Brannon Boswell

Executive Editor, Commerce + Communities Today