Could landlords take financial stakes in their restaurant tenants to help ensure their long-term success? “We want landlords to be capital partners,” Vine Hospitality CEO Obadiah Ostergard said on a recent episode of JLL’s Where We Buy podcast. “That helps get things over the finish line.”

Ostergard’s company operates four Left Bank Brasserie locations in California, and he said intense capital investment is needed for the first one or two years of operations before a restaurant can start its road to profitability. If a landlord helps foot the bill during this period, it can reap the benefits once the eatery is in the black. “Opening restaurants is so hard,” he said. What’s needed is a landlord that’s willing to separate its thinking on the first year or two and then the next eight years. Full-service restaurants need help with cash flow for launch, and for that, the landlord could own a 5% to 10% stake.

Restaurants often act as traffic drivers and anchors, and leases are beginning to reflect that status. Landlords more frequently ask restaurants to pay a percentage of sales above a certain threshold on top of base rent. “Percentage rent was usually for full-service, fine dining, high-grossing restaurants,” JLL senior vice president of food-and-beverage advisory Emily Durham said on the podcast. “Now we’re seeing landlords ask for it on fast-casual deals on a regular basis.”

Upscale Canadian dining chain Moxies is expanding across the U.S., and 40% of its leases include percentage rent. The company has U.S. restaurants in high-profile retail centers and mixed-use properties in Fort Lauderdale, Florida; Miami; Columbus, Ohio; Houston; and Dallas. Units will open in Scottsdale, Arizona, in July and in Boston’s Seaport District in August. Moxies and its U.S. franchisor prefer the percentage rent formula, said Moxies vice president of U.S. development Glenn Moon. “It gives us a lot more leverage and reduces our risk up front,” he said.

One sticking point in percentage rent leases is how revenue from third-party delivery services like UberEats is handled in the formula, said Trent Patterson, director of operations for Five 12 Restaurant Concepts, which operates Houston upscale dining concepts Daily Gather and Dish Society. “We need to discuss percent rent and what should be factored in and not and what was never our money to begin with,” he said.

Retailers Moving to the Burbs

Department stores, apparel brands, restaurants and other specialty retailers want to be closer to supermarkets and other essential tenants that generate regular visits from work-from-home consumers. Thus, many are closing low-traffic locations in malls and downtown areas in favor of suburban neighborhood centers.

After COVID lockdown, Abercrombie & Fitch famously closed a large store in Water Tower Place along Chicago’s Magnificent Mile and opened a boutique-style shop farther north in the Lakeview neighborhood.

Foot Locker, too, is looking outside enclosed malls for growth. The retailer has marked 400 underperforming mall stores for closure by 2026 and will open approximately 300 locations in settings like streetfronts and open-air centers. The company operates 802 Foot Locker stores.

Fast-casual eatery Dig recently swapped an expansion strategy that focused on office workers for one aimed at suburban neighborhoods. “There is a permanent part of the work base that’s never going to return to the office five days a week,” Dig CEO Tracy Kim told The Wall Street Journal. “We just want to be where the mouths are, whether they’re at home or in the office.”

And Nordstrom has grabbed headlines with its plans to shutter its downtown San Francisco stores, including one in an enclosed mall.

ALSO IN C+CT: The Case for Rezoning San Francisco’s Union Square and Other Spots Like It

Meanwhile, Macy’s Inc. will open five more off-mall locations. Sales at its 10 existing off-mall stores, called Market by Macy’s and Bloomie’s, have outpaced those of traditional units. Macy’s will determine how many more mall stores to close and how many off-mall stores to open by year’s end, CEO Jeff Gennette told analysts.

The news is good for owners of the top supermarket-anchored shopping centers and mixed-use properties where these retailers are moving. Vacancy at malls was 8.8% in the first quarter, compared with 6.2% for neighborhood centers and 4.2% for all retail, according to JLL. And rents at neighborhood centers climbed 4.7% year over year in the first quarter while they grew 3.6% at malls and 3.8% for all retail.

InvenTrust Properties, for one, maintained 96.1% occupancy in the first quarter while growing net operating income by 3.2% year over year. It was the second quarter in a row of that record-high occupancy. President and CEO Daniel Busch said suburbanization, accelerated by hybrid work, seems to be the new normal. “Clearly, the structural shift places consumers closer to our centers for longer periods during traditional working hours, bringing additional activity and interim demand to our properties.”

Retail Property Investments Paid Off in Q1

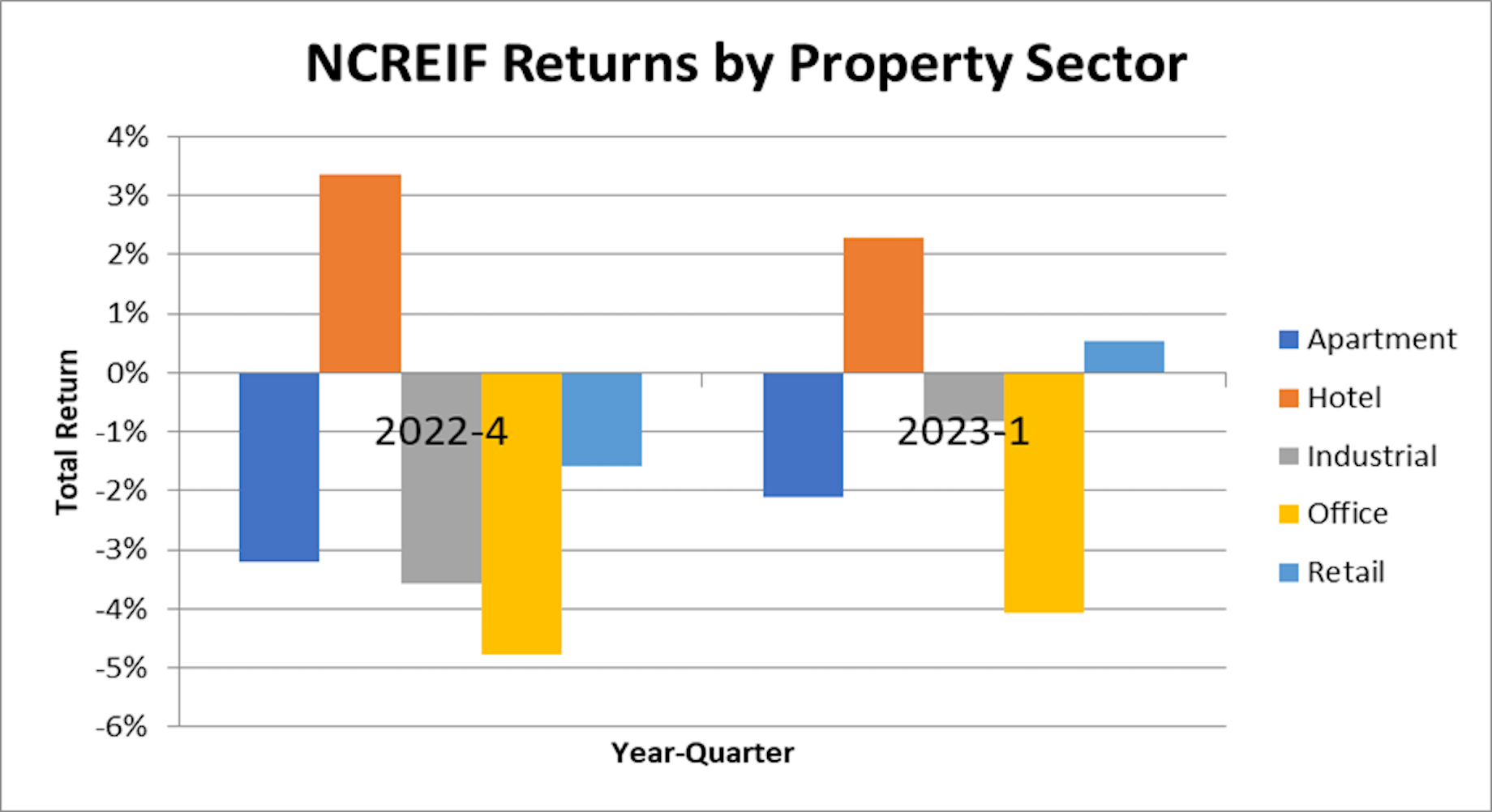

Investors averaged a 0.52% return on their investments in retail properties during the first quarter, according to the NCREIF Property Index. That’s a strong showing after years of underperformance against other commercial property sectors. Hotel produced a positive return of 2.3%, while office lost 4.06%, multifamily lost 2.1% and industrial lost 0.82%.

6 Retailers Making Headlines

The Athlete’s Foot is joining the neighborhood store trend to generate a small-community feel for customers. The athletic apparel chain has launched its “neighborhood” concept store at Atlantic Station in Midtown Atlanta. It wants to boost consumer experience with hyperlocalized product assortments and community engagement events. “We are thrilled to open our first neighborhood store in our hometown of Atlanta, the heart of the South’s streetwear and sneaker culture,” said Athlete’s Foot president Matt Lafone. “Our new store concept will pay tribute to the city’s character and our deep southern roots while showcasing local brands and designers and will serve as a hub for community-based events and philanthropic initiatives.”

ALSO IN C+CT: Localization Versus Cookie Cutter Stores: Is There a Payoff?

Carter’s has 50 store openings scheduled for this year, and the children’s apparel retailer plans to add at least 1,000 by 2027. Stores are the best use of capital, according to CEO Michael Casey. ”Our stores provide the very best presentation of our brands and are our highest source of new customer acquisition,” Carter’s Inc. chairman and CEO Michael Casey said on a first-quarter earnings call. “And when we open stores, we also see a lift in our high-margin e-commerce sales.”

Jenny Craig is shutting the doors of most of its 500 North American weight loss centers. The chain failed to secure financing to keep operating after missing a debt payment last month.

Christmas Tree Shops filed for Chapter 11 bankruptcy protection and plans to close 10 of its 82 stores in time to exit the restructuring process by August. The owners of the discount home goods retailer called the move “strictly a financial restructuring,” adding: “Our operations are sound.”

Bedding manufacturer Tempur Sealy International will buy retailer Mattress Firm from Steinhoff International Holdings for $4 billion. The deal gives the mattress maker control of one of the largest bedding retailer in the U.S., at 2,300 stores.

Xponential Fitness CEO Anthony Geisler told host Jim Cramer on the May 9 episode of Mad Money that his firm is gearing up to find locations while attending ICSC LAS VEGAS. Geisler said his firm’s footprint grew by 35% during the pandemic while the overall fitness club market shrunk by 30%.

New CEO at Cushman & Wakefield

Cushman & Wakefield’s board of directors appointed Michelle MacKay CEO, effective July 1. She will succeed John Forrester, who is retiring following 35 years at the company. MacKay joined Cushman & Wakefield in 2018 as a member of its board. The firm named her COO in 2020 and promoted her to president and COO in January 2022, giving her direct operational and management oversight of many of the firm’s service lines and regions, including the Europe, the Middle East and Africa region; Global Occupier Services and C&W Services. Previously, she served as executive vice president of investments and head of capital markets at REIT iStar. She also worked for UBS, JPMorgan Chase & Co. and Hartford Investment Management Co.

By Brannon Boswell

Executive Editor, Commerce + Communities Today