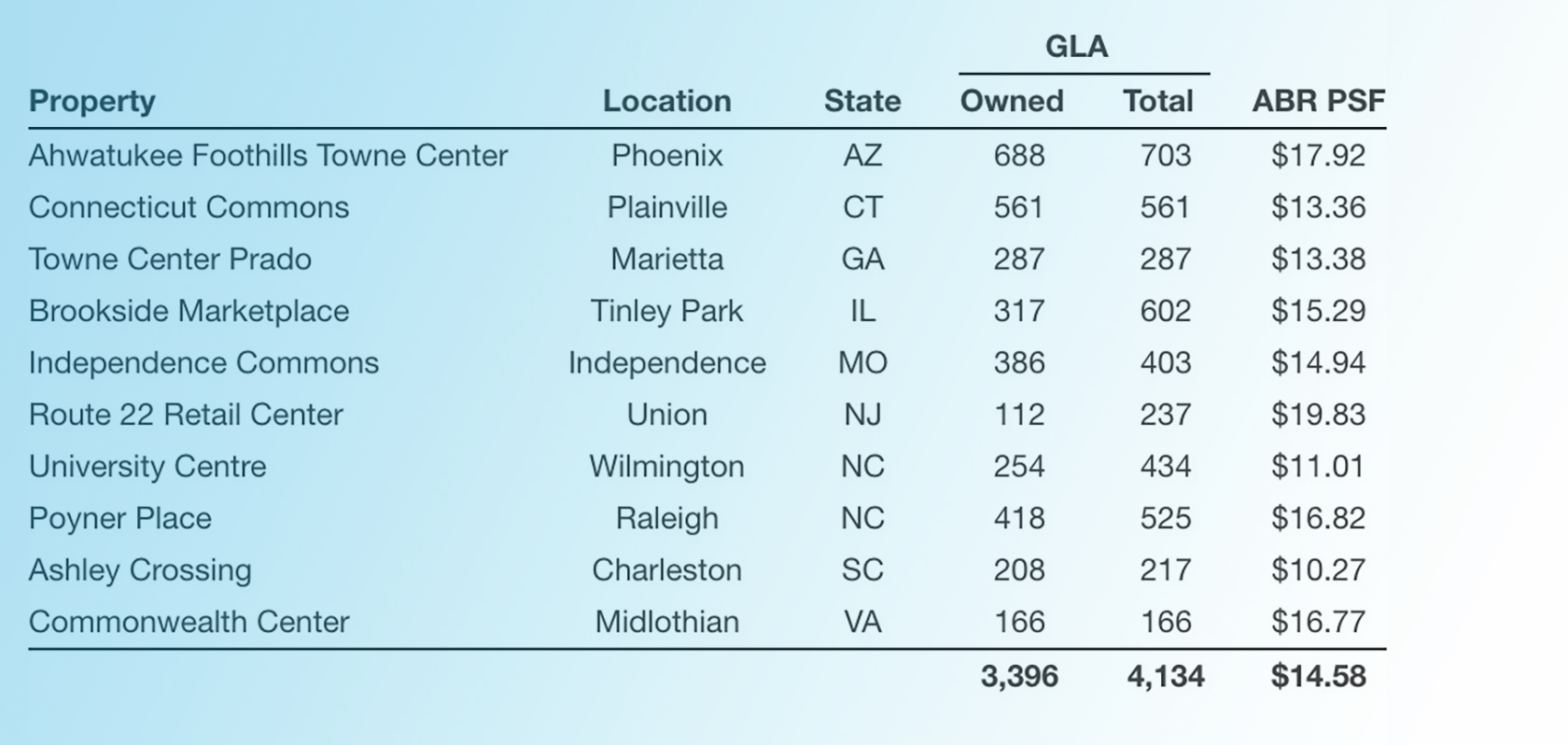

Site Centers Corp. sold an 80 percent stake in a 10-property, 4 million-square-foot portfolio to two Chinese institutional investors. The deal’s pricing values the portfolio at some $607 million, according to the company.

Site Centers will retain 20 percent and also manage the properties. The companies are forming a joint venture called Dividend Trust Portfolio to co-own the properties, which will take on a $364 million mortgage.

“This exciting joint venture is the culmination of a multiyear relationship-building process that has resulted in a new strategic partnership that we expect to ultimately extend beyond this initial investment,” said David Lukes, president and CEO of Site Centers, in a press release.

The Dividend Trust portfolio

The deal leaves Site Centers with 68 properties in its wholly owned portfolio, and the firm says it will use proceeds from the deal to redevelop some of these. Site Centers also plans to repay some $95 million of mortgage debt maturing in the first quarter of 2019 and also as much as $400 million in unsecured debt. The Beachwood, Ohio–based REIT recently changed its name from DDR.

By Brannon Boswell

Executive Editor, Commerce + Communities Today