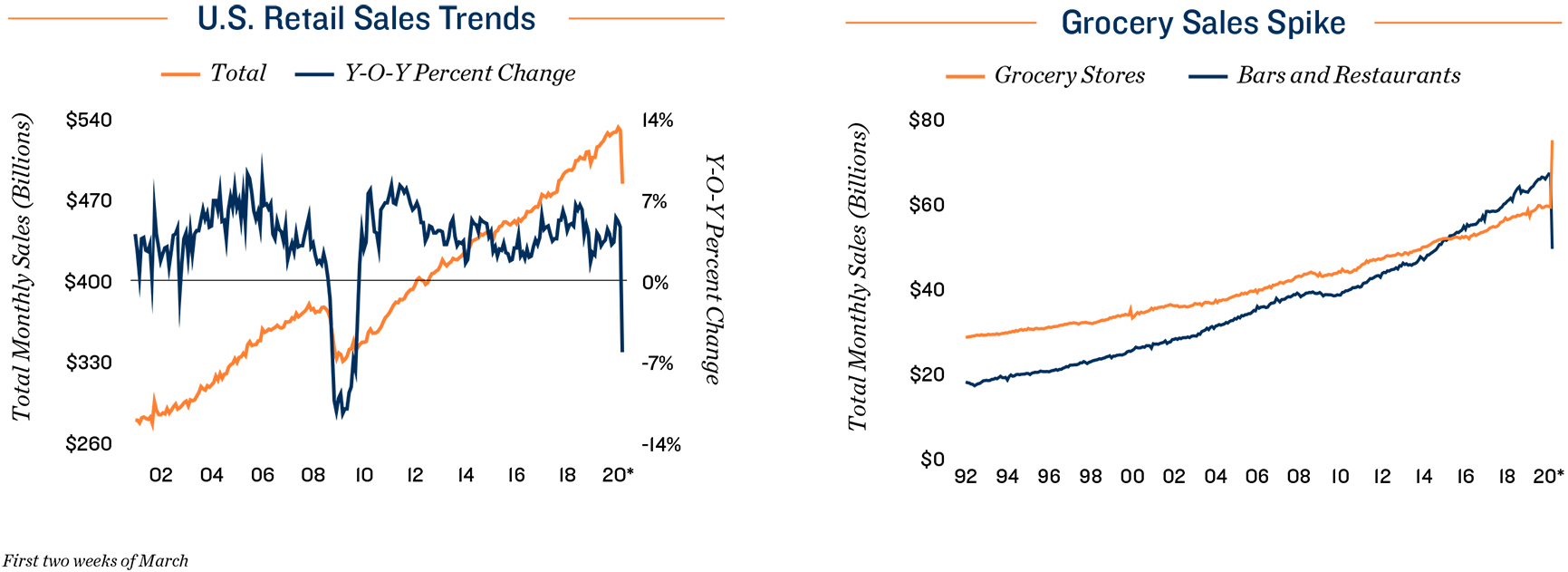

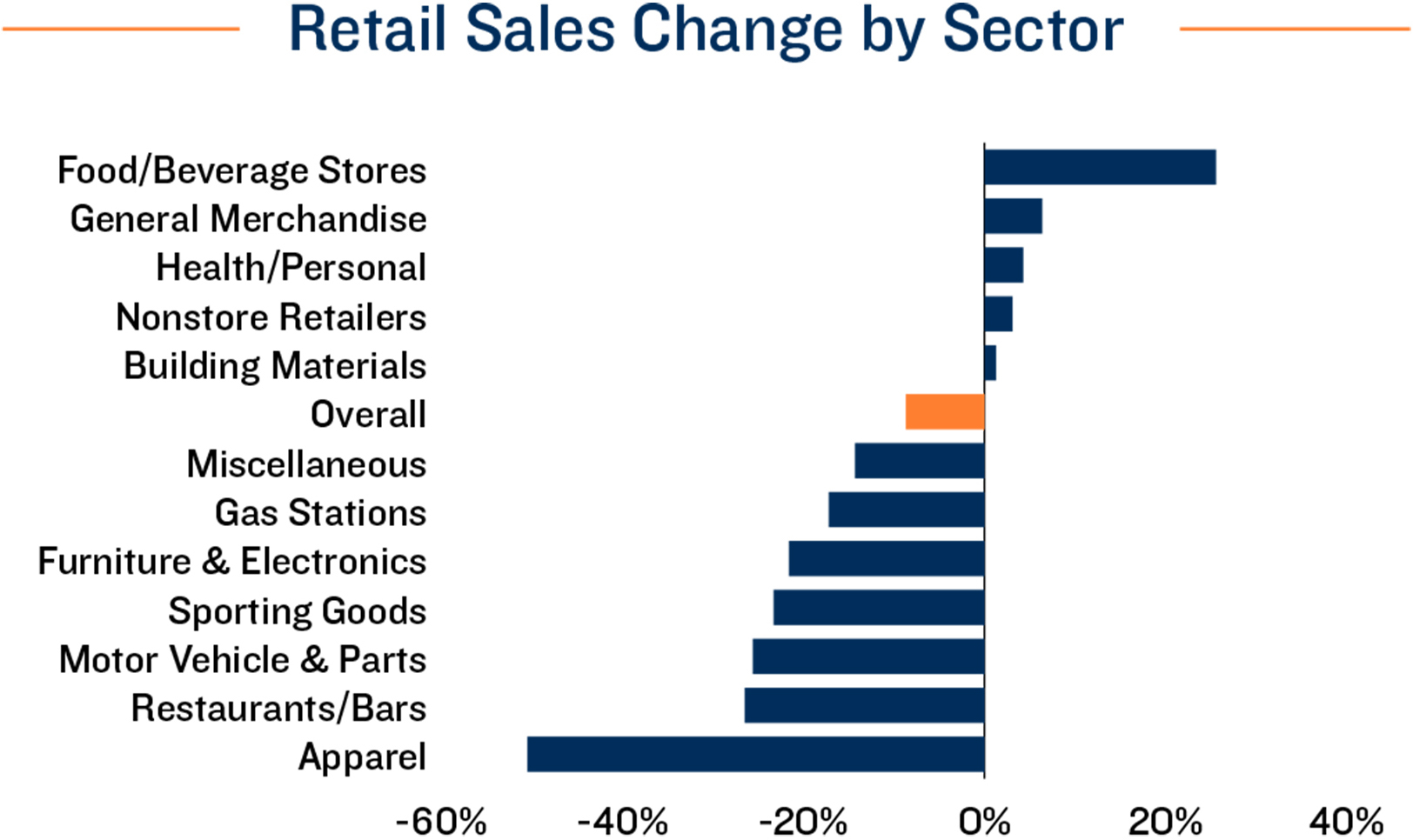

Retailers were not affected equally when U.S. retail sales plunged by 8.7 percent from February to March thanks to COVID-19. Marcus & Millichap dug into the numbers.

Grocery store sales jumped by 26.9 percent after years of stagnating sales and loss of business to restaurants. Supermarket traffic is likely to keep climbing in coming months as social distancing further inhibits a restaurant recovery.

By contrast, sales for the once surging food services and drinking places category declined by 26.5 percent from February to March. Restaurants and bars accounted for $17.5 billion of the $46.2 billion decrease in retail sales.

Source: Marcus & Millichap

Sales of building materials and garden equipment and supplies soared by $550 million from February to March as furloughed workers took the opportunity to complete home projects, according to Marcus & Millichap. Sales at health and personal care stores, a category that includes pharmacies and drug stores, increased by $1.3 billion, largely due to overlapping product lines with grocers, which performed exceptionally well.

“Most stay-at-home orders are expected to remain through the end of April before some potential openings targeted by state and federal authorities begin in May,” wrote Scott M. Holmes, senior vice president and national director of Marcus & Millichap’s National Retail Group. “As a result, these stores should continue to perform well, and some of the pantry stocking reported at the end of last month will bleed over into the early weeks of April.”

Source: Marcus & Millichap

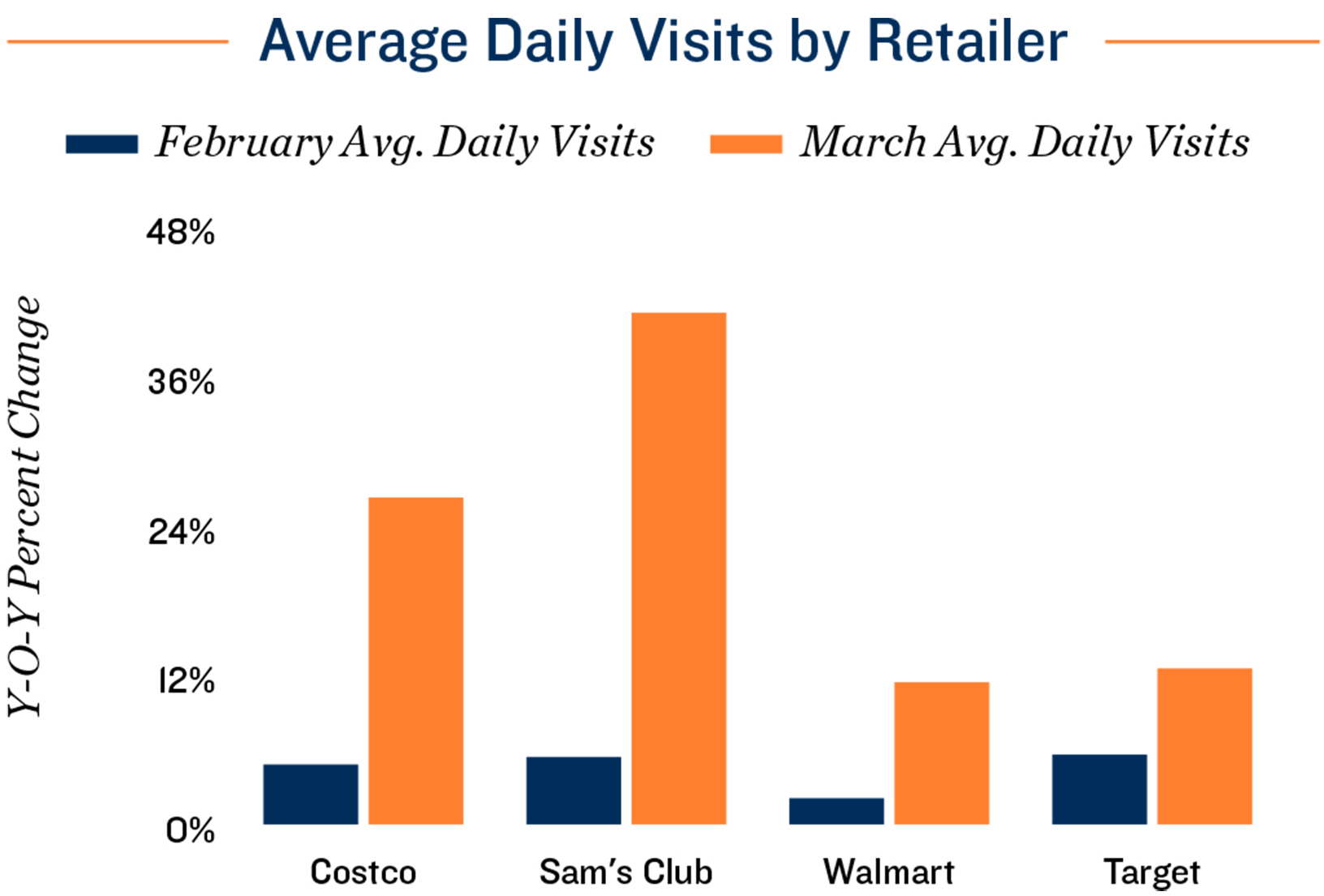

As the reality of the pandemic and impending stay-at-home orders sank in, buyers also flocked to wholesalers and big-box retailers to grab supplies, Holmes wrote.

Source: Marcus & Millichap

April promises to bring more red ink for U.S. retailers. But sales growth should return as soon as consumers receive their stimulus checks in May, Holmes wrote. The average start date for statewide stay-at-home orders was March 27, and 18 states enacted the order after April 1 or not at all.

By Brannon Boswell

Executive Editor, Commerce + Communities Today