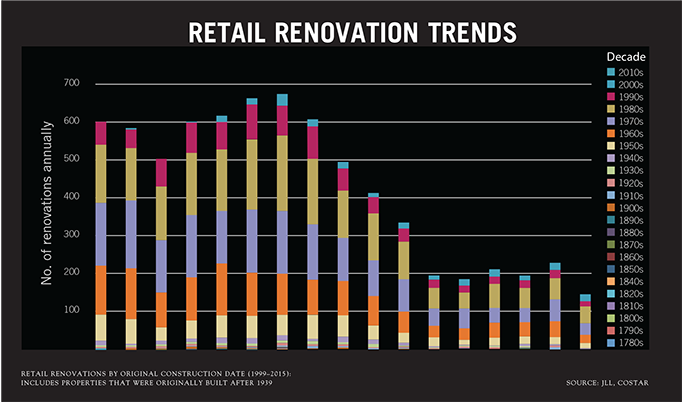

Shopping center redevelopment makes up the lion’s share of U.S. retail construction today, though the activity has fallen over the past half decade, especially when compared with the peak of 675 renovations in 2005. Retail self-improvement projects, intended to help form connections with consumers while maximizing property values and investment returns, averaged 198 per year from 2010 through 2015, according to a JLL research paper this year titled Remaking -Retail: A Tricky Proposition. Obviously, not every shopping center owner can engineer a major upgrade in this flight-to-quality environment. Among the challenges are fewer numbers of expanding retailers, a lack of funding for any but class-A properties, resistant anchor tenants, and cash-strapped municipalities with recession-gutted budgets, JLL says.

Shopping center redevelopment makes up the lion’s share of U.S. retail construction today, though the activity has fallen over the past half decade, especially when compared with the peak of 675 renovations in 2005. Retail self-improvement projects, intended to help form connections with consumers while maximizing property values and investment returns, averaged 198 per year from 2010 through 2015, according to a JLL research paper this year titled Remaking -Retail: A Tricky Proposition. Obviously, not every shopping center owner can engineer a major upgrade in this flight-to-quality environment. Among the challenges are fewer numbers of expanding retailers, a lack of funding for any but class-A properties, resistant anchor tenants, and cash-strapped municipalities with recession-gutted budgets, JLL says.

“Renovations have stabilized at a lower level, like the industry itself, since 2010,” said Nick Egelanian, president of Annapolis, Md.–based SiteWorks Retail. “This is indicative of a mature industry that’s creating less new product and is instead working to maintain and improve its current stock.”

Some of those redevelopments involve creative solutions, as in the case of older malls that may be filling space with medical, educational, residential and other nonretail uses or are switching to a big-box orientation. “Retailers have cut back in their open-to-buy for new stores,” said Bill -Moston, a JLL senior vice president of national retail development, using an industry term for future store plans. “And it’s harder to put together that core group of retailers needed to support retail -expansion.”

Some regional malls under renovation are in suburban centers that have seen the departure of a Dillard’s, Macy’s, Sears or other anchor, opening up sizable opportunities for new tenants, says Jerry Hoffman, president of Lincoln, Neb.–based Hoffman Strategy Group, who works with Equity One and other retail REITs on redevelopment strategies.

Others are sticking to creative retail solutions. Compass Retail’s 47-year-old Rosedale Center, in Roseville, Minn., is among these, Moston says. This JLL-managed center is to -receive a 140,000-square-foot addition that will be occupied by a Von Maur department store, plus an interior renovation and a 450-space parking deck. Most of the work is to begin next year.

Owners are embarking on mall remakes on a grand scale, notes the JLL report, which cites a $150 million renovation-addition at the mammoth King of Prussia Mall, in Upper Merion Township, just outside Philadelphia. The 2.9 million-square-foot mall, which opened in phases starting in 1963, was divided into two sections on opposite sides of a road, forcing patrons to trudge through the elements to get from one section to the other. In joining the two, owner Simon had to dismantle an entire parking deck as part of the two-year project. Making the effort even more worthwhile will be a 170,000-square-foot section featuring 50 retail and restaurant spaces that are expected to bring in some $100 million in additional sales to the mall’s estimated annual gross of $1 billion.

There are other challenges. “The length of approval timelines really depends on how progressive a city is,” Hoffman said. “You may have to get a center rezoned for specific uses, and there may be a TIF [tax increment financing] district involved, and that can all be drawn out.” Many cities are offering little in the way of development incentives, Hoffman says. “Some are just tapped out and have changed their tax policies,” he said. “Some might only provide streetscape and infrastructure where it will also benefit the community. There is more caution in the wind.”

The flip side of this is that cities realize they also need to help maintain their retail real estate’s taxable value, says Moston. “They certainly want to see a troubled asset redeveloped and can be aggressive in supporting that,” Moston said. In many cases, existing anchor tenants wield contractual power to approve incoming tenants, and they occasionally nix or delay a deal, especially if they believe a competitor is gaining an advantage within any reconfiguration. “Anchors might use these situations as renegotiating advantages,” Moston said. “But for the most part, they will eventually come around to be very supportive of projects that are value-enhancing.”

Shopping centers built during the 1980s have been the most popular targets for renovation since 1999, with the exception of 2003, according to the JLL study. “Malls are like clothing; a design that was positively of the moment in 1985 is now desperately in need of a refresh,” the report noted. Some 30 percent of all retail renovations since 1999 have been done in just three states: California, Florida and Texas — the first, second and fourth most populous states, respectively. In city terms, the Los Angeles market led, with 567 renovations during the period, followed by Philadelphia, with 285, and Houston, which saw 249, according to JLL. Though no data support it, Egelanian says renovation rates are higher now in cities than in suburbs, given ongoing consumer migrations, of the Millennials in particular, into -urban spaces.

Today’s redevelopments often include entertainment, residential, hotel, office and/or medical uses, or some combination of those, according to Hoffman. A prime example is Starwood Retail Partners’ renovation of the 15-year-old Shops at Willow Bend, in Plano, Texas, Hoffman says. Starwood, which bought the property from Taubman in 2014, will add an office tower, a hotel, an entertainment district that includes at least six new restaurants, a fashion anchor store and residences. Some of the new uses will replace a 125,000-square-foot Saks Fifth Avenue building that is being razed. The $100 -million project will be completed in phases, to end in 2019. The Shops at Willow Bend was originally pegged as a “superluxury” center, but that was an overshoot; mainstream tenants dominate now. Center renovations may also include new seating, new lighting, upgraded common areas, new restrooms, free Wi-Fi and other integration with technology, says the JLL report. King of Prussia’s expansion includes charging stations for mobile devices and sensor-enabled parking decks that display the number of available spaces.

Typically, owners pondering renovations must be able to realize the addition of at least 200 basis points to a shopping center’s cap rate if a project is to be worth the effort, JLL concludes. If a remodel makes no fiscal sense, an owner will often opt instead to develop one or more pads on the periphery of a shopping center.

As usual, there are far more commodity-based shopping centers being built and redeveloped than other types — 86 percent of the renovations performed since 1999 were done in grocery-anchored developments, according to JLL. “Grocery stores have always been a great staple for retail real estate holdings and will continue to be,” said Hoffman.

Redevelopment is the cornerstone of the retail environment, according to Moston, because that is critical to maintaining the vitality of the asset. “There is still value,” he said, “in creating a great sense of place.”

SIDEBAR: MORE LENDERS OPEN WALLETS

While large, well-funded retail REITs typically focus their redevelopment efforts on core ‘A’ centers and high-end tenants in major markets, most smaller owners of ‘B’ and ‘C’ properties have had limited options since the recession, because of capital constraints. Gradually, however, money is becoming available for investors aiming to stabilize and improve such secondary centers, says Bill Moston, senior vice president of national retail development for JLL. “We’re seeing some smaller developers buying mildly distressed centers lately with hopes to add value, especially for properties that still sit on relatively valuable real estate,” he said.

One such investor is evangelist Jerry Falwell Jr., whose Liberty University acquired a 75 percent stake in River Ridge Mall, next to the school’s Lynchburg, Va., campus, in March for $33 million. Falwell says the university will upgrade the property, which is the only regional mall within 50 miles, and then sell it in a few years. “We’ll be able to make a substantial profit,” he said.

That same month an affiliate of San Francisco–based Farallon Capital Management bought three small-market malls in the South from Pennsylvania Real Estate Investment Real Estate Trust (PREIT) for an aggregate 66 million, with the aim of repositioning them. At one property — New River Valley Mall, in Christiansburg, Va. — Farallon has brought in CBL & Associates to manage. “Over the long term, there is tremendous opportunity at New River Valley Mall to bring new growth and vitality to the center with new-to-market stores, restaurants and entertainment options,” said CBL spokeswoman Stacey Keating. Farallon paid $27 million for New River Valley Mall, and a combined $39 million for Wiregrass Commons Mall, in Dothan, Ala., and Gadsden (Ala.) Mall.

Having sold off 13 malls in three years, PREIT says it is disposing of many of its ‘B’ assets and using the

$600 million in proceeds to reinvest in other properties and to pay down debt. PREIT says it has boosted its sales value per square foot from $372 to $458 in the process. CEO Joseph F. Coradino says there is always a higher level of uncertainty in lower-quality assets. PREIT has “really de-risked our company,” according to Coradino.

The 26-year-old Bellevue Center Mall, in Nashville, Tennessee, which has lost its anchors in recent years, including Macy’s and Sears, is a redevelopment that is benefiting from a city undergoing a building boom. North Carolina–based developer Crosland Southeast bought the property with plans for a $200 million mixed-use redevelopment, to include apartments, offices and 350,000 square feet of additional retail. The city of Nashville, which has about 100 commercial projects under way, valued at a combined $2 billion, is kicking in $15 million to the redevelopment.

Research firm Green Street Advisors estimates that 44 percent of total U.S. shopping mall value, based on quality, sales, size and other measures, still resides in the industry’s top 100 properties (out of about 1,000). Nearly all of the 40 stores Macy’s closed last year, the firm says, were in ‘B’ or ‘C’ malls.