Banks may not be battling the likes of Amazon as hard goods sellers are, but the rise of digital banking has taken its toll on physical branch locations. Banks have been steadily closing locations over the past decade, and that trend could very well accelerate in 2021.

After peaking at nearly 100,000 in 2009, the number of bank branches in the U.S. has dropped by more than 13,000 over the past decade, including 1,683 net closures in fiscal year 2019, according to JLL. The banking industry has been scaling back on physical locations at a steady rate of about 2 percent per year for the past several years, notes JLL Central U.S. research and strategy director Christian Beaudoin. “Our assumption is that the pandemic will accelerate that trend considerably.” The volume of branch closures is expected to be subdued in 2020 due to disruption caused by the pandemic. However, looking ahead to 2021 and beyond, JLL anticipates that the pace of closures could very well double over the next few years.

A variety of factors are fueling the closures. At the top of the list are the shift to digital banking, oversaturation and M&A. Much like the e-commerce challenges facing brick-and-mortar retailers, banks are scrambling to adapt to a rise in online and mobile transactions that has reduced customer visits to physical branches.

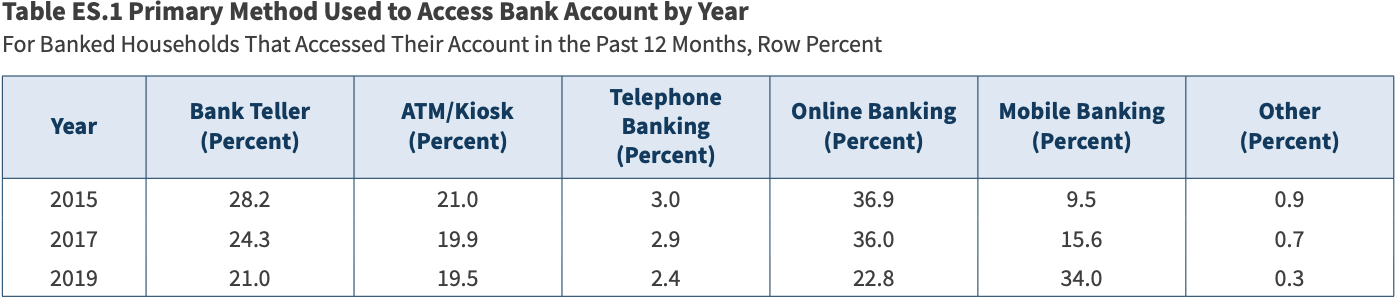

Though banks are essential businesses that were allowed to operate during stay-at-home orders, many of them chose to close lobbies or limit hours of operation, which pushed more customers to online and mobile channels. Those customer-behavior changes are expected to accelerate the move to digital banking. According to a 2019 FDIC study called How America Banks: Household Use of Banking and Financial Services, 56.8 percent of households primarily used online or mobile channels to access bank accounts, compared with 21 percent that primarily use bank tellers and 19.5 percent that primarily use ATMs. Notably, those who primarily use mobile banking to access their accounts has jumped from 9.5 percent in 2015 to 34 percent in 2019.

Source: FDIC’s How America Banks: Household Use of Banking and Financial Services

The industry also had become overstored in many markets. Large banks, in particular, had embraced a Starbucks-like strategy prior to the last recession, a proliferation of convenient branches to attract and retain customers, notes Colliers International Retail Services U.S. director Anjee Solanki. Now, those banks are rightsizing their portfolios to the digital age, all while M&A also has prompted consolidation in physical locations.

The top 25 banks were responsible for 86 percent of the net closures in 2019, according to Beaudoin. “The top five banks have the greatest presence, so they also represent the greatest number of closures, but it is proportional. In reality, there are a lot of banks all across the spectrum that are closing.”

Demand for space persists

Despite the downsizing, physical branch locations still play a critical role for the banking industry. “A major component of community banking is developing personal relationships. Therefore, branches are an essential component to the business model that will never fully go away,” said Independent Community Bankers of America assistant vice president of economic policy and research Noah Yosif. Though the number of community banks has declined 36 percent over the past 10 years, the number of total branch locations has dropped only 17 percent, he adds.

He adds that the number of newly chartered banks ground to a halt following the Great Recession but has ticked up in the past three years. The FDIC has approved more than 30 de novo bank charters since 2018. “This is another indicator of local-level opportunities to provide financial services, which are currently unmet by the rest of the banking industry, especially large banks,” said Yosif.

Banks continue to represent a solid tenant category for landlords. Most have excellent credit and reliability and tend to favor long-term leases. “Although there are closures and consolidation in the banking space, those are still somewhat low risk relative to the turnover you see in restaurants or the closures we are seeing in retail,” said Beaudoin. “So even though banks are closing, they are in a much better position than some other sectors right now.”

In addition, banks continue to open locations for a variety of reasons, including expansion into new markets, following population growth and replacing outdated locations. According to JLL, banks opened 1,481 locations in fiscal year 2019 and closed 3,164. According to an October 2020 DepositAccounts report, the more active banks for new openings in recent years are Chase, which added 371 branches between 2017 and 2020; Bank of America, which added 89; and Woodforest National Bank, which added 66.

Rethinking branch designs

Revamped branch designs offer a more modern, efficient and engaging customer experience. The traditional line of teller windows is shrinking or being replaced with an open format. Many banks are leveraging “universal bankers,” or customer service representatives, who can assist clients with multiple services, such as loan servicing, opening new accounts, transactional services and wealth management and financial advisory.

Hilltop Bank’s new, 2,500-square-foot prototype, designed by NewGround, features a flexible conference room and lobby area that the bank plans to use to welcome customers, as well as to host community events

Hilltop Bank debuted a new prototype in Casper, Wyoming, in October, and OneWest Bank, CIT's Southern California retail bank division, debuted a design for its West Los Angeles location last year with more tech, including digital displays, automation, ATMs that streamline the branch experience, and a “digital bar” where customers can charge their phones and laptops. The design also incorporates energy-efficient lighting and a water-filtration system to reduce the use of plastic bottles.

Another common theme is a smaller, more efficient footprint. “For new locations, we’re definitely seeing some rightsizing,” said Solanki. Several years ago, the typical footprint was 3,500 to 4,000 square feet, and now that is sliding down to 2,000 to 2,500 square feet.

Going forward, landlords will have opportunities to attract new bank tenants and to repurpose space as some banks vacate or downsize. “If it is a strong location with good visibility, the landlord will be happy to take back that bank site because there is a queue of retailers who are willing to backfill it,” said Solanki. Well-located pad sites are still in demand from quick-service restaurants like Chick-fil-A and Raising Cane’s, as well as medical tenants that are looking for highly visible, convenient locations. “There is a good, healthy list of tenants who will backfill — and backfill at a pretty comparable rent.”

By Beth Mattson-Teig

Contributor, Commerce + Communities Today