General retailers are getting into the primary health care business, paving an avenue of growth for commercial property developers and investors. CVS Health will buy Oak Street Health, the owner of more than 170 senior-focused medical facilities. Walgreens will buy urgent care chain CityMD’s parent. Dollar General is testing mobile health care clinics services at three Tennessee stores to offer basic, preventative and urgent care services, as well as lab testing. Best Buy is partnering with hospital system Advocate Health, one of the country’s largest nonprofit hospital systems, to offer a high-tech hospital-at-home service. Publix is making inroads in health care, too. In January, the supermarket chain opened its fourth physical site facilitating telehealth visits. This latest location connects with South Carolina’s Beaufort Memorial Hospital.

Walmart Health

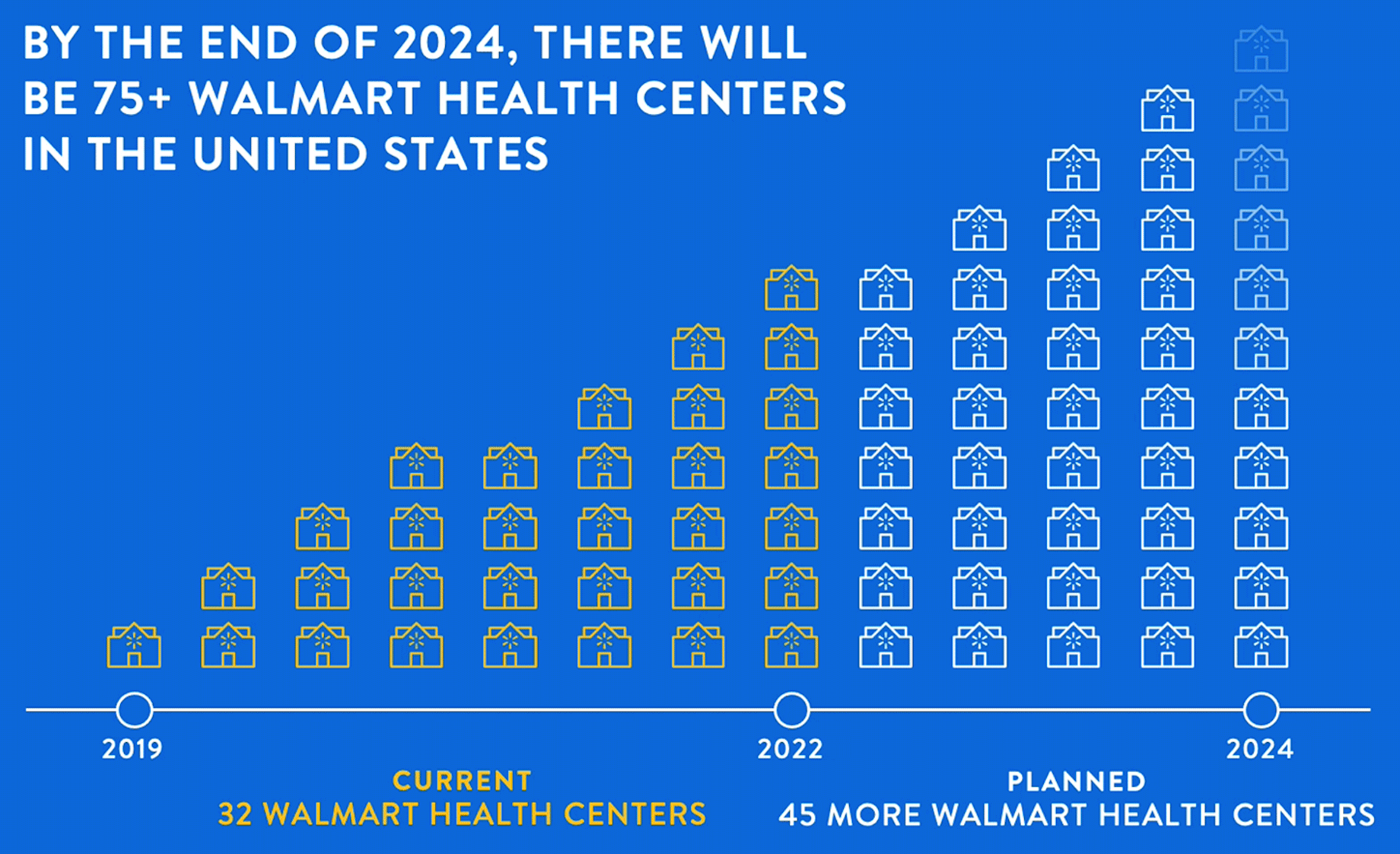

Now Walmart, too, is prepping for a clinic growth spurt. The retailer announced this week it plans to open 28 new health care centers in Texas, Arizona and Missouri, bringing the national total to more than 75. Walmart Health clinics offer a services like primary care, laboratories, X-rays, dental treatments, behavioral health care, hearing care, select specialist care and community health services. They’re situated near or adjacent to Walmart stores.

Walmart Health is on a growth trajectory. Source: Walmart

Retailers will seek clinics near their existing stores and will build freestanding clinics in existing store parking lots, creating a pool of assets for retail and healthcare net lease property investors to fund, according to Northmarq vice president Tom Georges. “There is growing interest from commercial real estate investors who have traditionally been narrowly focused on either retail or medical assets,” Georges said. “As established, strong-credit retailers expand further into the rapidly growing healthcare sector, investors will see increased opportunities to acquire newly built, well located healthcare assets in desirable markets.”

Some Apparel Chains Are Going Off-Mall, and Others Are Pursuing Malls

Even as some established apparel retailers depart mall locations for open-air centers, newer competitors are clamoring for the brand exposure and sales per square foot that top malls provide.

Abercrombie & Fitch Co. closed a flagship at Chicago’s Water Tower Place in 2020 and the next year opened a boutique-style shop five miles north in Lakeview. The retailer’s chief digital and technology officer, Samir Desai, said the company’s expansion strategy favors neighborhood mall streets with a fitness experience. Abercrombie will replicate the Chicago test in other cities in the coming years.

Similarly, Macy’s closed a department store in St. Louis’ Chesterfield Mall and opened a smaller Market by Macy’s in an Aldi- and Walmart-anchored center three miles away. Macy’s wants to open off-mall, small formats to replace some existing stores and to expand into new markets.

But not all apparel chains are throwing so much focus on open-air and streetfront corridors. Relatively new brands trying to make their marks are still seeking prime enclosed mall space in top urban markets. Irish fast-fashion chain Primark, for example, recently announced plans to open at Queens Center mall in New York City’s Elmhurst. The store will mark the company’s 17th location in the U.S. Primark plans to reach 60 U.S. stores by 2026.

Spanish fashion chain Mango, too, is growing in malls. The company will open its first Houston location at The Galleria this year, one of the 30 North America units it plans to open in the next two years. Mango also inked a deal with mall owner Brookfield Properties to open seven shops at its properties. And digitally native activewear brand Vuori is placing its new U.S. stores in malls, including Bloomington, Minnesota’s Mall of America.

Off-Mall, Mall and Apparel: More from Commerce + Communities Today

The Real Story When a Retailer Goes Off-Mall

Is the Term “Mall” Making a Comeback?

Tenant Outlook: Sports Apparel Brands Race to Capture Global Growth

Green Buildings’ Value to Tenants and Investors

Higher energy prices and government requirements have caused the global commercial property sector to focus on environmental, social and governance, according to a new CBRE survey of 500 commercial property executives. Nearly 70% focused more on ESG strategies in 2022. For most commercial property companies, the E in ESG remains the top priority, as they see reducing energy consumption as having the most immediate and meaningful impact.

Why? It directly affects a property’s value. For this reason, 84% of global commercial property executives are more likely to buy or occupy properties that have on-site renewable energy generation and/or smart technology to monitor and adjust energy use, according to the survey. More than half are willing to pay a premium for such features, and if a property lacked these features, almost half would seek a discount or walk away from a deal.

Marketplaces Industry Best Practices from the ICSC ESG Center

Edens Cuts Energy Use

How Macerich Is Cutting Waste

Federal Realty’s On-Site Solar Program

Collaboration Is Key to Burlington’s Solar Strategy

Visit the ICSC ESG Center

5 Retailers Making News

Consumer electronics giant Best Buy expects sales to decline this year as shoppers buy fewer computers, home theater merchandise, appliances and mobile phones. “We are preparing for another down year for the consumer electronics industry,” CFO Matt Bilunas said on an earnings call. Best Buy expects sales at stores that have been open at least one year to decline by between 3% and 6% year over year for its fiscal year 2024, which began Jan. 29, 2023. That’s after same-store sales plunged 9.3% in the fourth quarter of Best Buy’s fiscal year 2023, which ended Jan. 28, 2023. The company has 1,040 U.S. stores. Bilunas said it expects the sales slide to reverse in the company’s fiscal year 2025 as new technologies emerge, as customers replace and upgrade the products they purchased during the pandemic, as consumers embrace augmented reality and as more consumers gain access to broadband internet.

Sustainable footwear and accessories brand Nisolo has ramped up in brick-and-mortar. Adding to its flagship in Nashville’s Buchanan Arts District, the brand opened a store in Washington, D.C.’s Georgetown in January and this week opened a streetfront unit on Newbury Street in Boston’s Back Bay.

Department store chain Nordstrom is pulling out of Canada after eight years. Nordstrom Canada operates six Nordstroms and seven Nordstrom Racks. “We regularly review every aspect of our business to make sure that we are set up for success,” said CEO Erik Nordstrom. “We entered Canada in 2014 with a plan to build and sustain a long-term business there. Despite our best efforts, we do not see a realistic path to profitability for the Canadian business.”

Pet Supplies Plus snapped up 20 Loyal Companion stores from Independent Pet Partners. The stores are in Massachusetts, Maryland, Maine, New Hampshire and Virginia. Half will convert to the Pet Supplies Plus banner and half to the Wag N’ Wash banner. Pet Supplies Plus operates 660 eponymous stores and 14 Wag N Wash grooming units.

Beginning this spring, Target will allow guests to process returns from their cars for unopened items purchased within the previous 90 days via their Target.com accounts. Each guest will initiate the return through the Target app, drive to the store and wait in the car for a Target employee to pick up and complete the return.

Birmingham Shopping District Appoints Executive Director

Cristina Sheppard-Decius has joined Michigan’s Birmingham Shopping District as executive director. Previously, she worked as manager of the east and west Dearborn Downtown Development Authorities. She has experience in economic and infrastructure development, in public relations and downtown marketing, and in business attraction and retention.

Cristina Sheppard-Decius

By Brannon Boswell

Executive Editor, Commerce + Communities Today