One perhaps unexpected disruptor that gained traction during the COVID-19 crisis was the rise of vending machines. Once seen as archaic dispensaries for 75-cent potato chip bags, they now may feature digital touchscreens and even biometric facial identification to make the buying experience faster. And during the pandemic, retailers began looking more seriously at vending machines as seamless, contactless ways to get their products to consumers quickly.

“All types of stores deployed vending machines during the pandemic when they had to close due to the lockdown and still wanted to make their merchandise available,” explained Elliot Maras, editor of Vending Times. “In every case I am aware of, the sales surpassed expectations and they are keeping the machines on-site post pandemic.”

Vending machines during the pandemic were selling not just prepackaged snacks and soda cans. Instead, retailers stocked products like CBD gummies, artisanal pizzas, prime cuts of meat, down jackets, swimsuits and iPad chargers. Thanks to advances in wireless technology, customers rarely find vending machines empty of the products they want, and operators adjust the products based on real-time sales. And forget paying with quarters; customers now can pay via mobile apps.

As the U.S. labor shortage continues and contactless transactions remain on the upswing — hello delta and lambda variants — some retailers consider vending machines rather than brick-and-mortar or kiosks as primary entry points into retail sales. Dude, Seriously Hot Sauce CEO Kai Schneider, for instance, had considered opening his own store but changed his mind once COVID-19 hit. “People — Dude, Seriously employees included — deserve a hassle free-experience with minimal risk to exposure, and the vending machine supplies that,” he explained.

Selling through vending machines also enables the company to differentiate itself. “No other company in the United States was selling hot sauces through vending machines,” he said. And it makes financial sense, too. Vending machines proved “a unique and eye-catching way of selling hot sauce that didn’t require a daily staff to manage sales or rental of retail space,” he said. He added that it’s hard for small to midsize hot sauce brands to get national distribution; vending machines get his product in front of consumers in a nontraditional way on his own terms.

Schneider unveiled his first vending machine at Cincinnati Oakley Kitchen Food Hall in June to what he called a great reception and plans to roll out more than 100 to major U.S. cities over the next two years, targeting high-traffic, indoor locations like truck stops and airports. Dude, Seriously also sells through retail locations and wholesalers, as well as online and at events.

One sign vending machines have entered a new age: Cincinnati Oakley Kitchen Food Hall visitors post photos on social media of “the world’s first hot sauce vending machine” from Dude, Seriously Hot Sauce.

Passive CBD Vending launched in February 2020 and sells THC-free CBD products like gummies, oils and gels. CEO Nick Jones said the change in consumer behavior during the pandemic reinforced his company’s decision to concentrate on vending machines as its main distribution channel. In 2020, analytics firm BDSA predicted the U.S. CBD market will reach $20 billion in sales by 2024. Yet over the past year, Jones watched some competitors that had opened brick-and-mortar stores and kiosks fold due to shopping center closures. Vending machines don’t carry that same overhead and as a result are less susceptible to market fluctuations, he said.

And Jones learned from vape stores. A few years ago, “brick-and-mortar vape stores were popping up overnight like mushrooms everywhere, but as soon as Philip Morris came out with the Juul cartridge, the [brick-and-mortar] owners couldn’t compete with the pricing. They put it in the big-box stores, and a lot of brick-and-mortar vape stores went out of business.” The same thing, Jones believes, will happen with CBD products. “A lot of people have invested heavily in these brick-and-mortar stores, but the FDA has been a little late on clarifying some things with CBD,” he said. By investing in prime vending machine locations before others have, Jones believes Passive CBD will become the Redbox of CBD vending: popular, recognizable and trusted. “Instead of pulling back and sitting on the sidelines during COVID, we pressed into it, and I think that’s the best reason for our success,” he said.

In June, Passive CBD brought on JLL and Spinoso Real Estate to place Passive CBD machines in malls and shopping centers. Jones thinks enclosed shopping centers make great partners because of their existing base of shopping-minded visitors, their prime locations and their security. “Our vending machines are solid,” Jones said. “They weigh just under 800 pounds. [Vandals] are not going to get into the machine, but they could destroy the machine trying to.” He hopes to have 400 machines deployed by the end of 2021.

The arguments against vending machine-shopping center partnerships

But not every vending machine owner and shopping center see each other as natural partners. Shopping centers always have had self-service machines and continue to add them, but most vending machine growth in the past year has been in high-traffic locations with little existing retail like airports, hotels casinos and universities, vending machine operators said.

Retail Automation Consultants implements contactless, automated retail systems for clients like Juul, P&G and L’Oreal. When president Rebecca Faulconer reaches out to property owners, “shopping centers are the only space where there’s been some pushback,” she said. This might be because shopping centers haven’t always had great experiences with vending machine operators. The machines might have broken down, might not have been restocked quickly or might have just looked ugly, she said.

Additionally, some mall owners believe vending machines won’t provide monetary value compared other ancillary retail formats. “When you look at the income around [vending machines], it’s not much,” said Colliers national director of retail Anjee Solanki. “If you have a vending machine versus a specialty leasing kiosk versus a pop up and you rank those three, I would say that the vending machine would be at the bottom.”

Vending machine owners similarly may not see the value of partnering with shopping centers. Location within the center matters deeply. “Sometimes, there will be a really great mall you want to be at, and they say, ‘I’m going to put you next to the women’s restroom,’” Faulconer said. Her clients then say: “I’m not going to go there. We need to have traffic, too.” Additionally, many vending machine operators don’t buy in to shopping centers’ requirements for a percentage of the sales.

The arguments for working together

There’s proof, though, that shopping centers and vending machine owners can be successful together. For many years, Linda Johansen-James and her husband, Max James, owned and operated vending machines for skincare line Proactiv through their company, American Kiosk Management. At the height, 1,000 Proactiv machines were running in places like military bases, airports and shopping centers. “We were doing $50 million a year selling zit creams,” Johansen-James said. Shopping centers were profitable locations. “We had some machines that were doing $30,000 to $40,000 a month in sales inside malls.”

Alejandro Rodriguez — owner of Pharmabox, the first over-the-counter medication and pharmaceutical vending machine operator — also has found success in malls. Since the first PharmaBox in 2016, he has deployed 101, 48 of which are in shopping centers. Many shopping centers don’t have pharmacies, so a customer who gets a headache might leave the property to get an Advil. “For malls, having a Pharmabox is a solution to keeping customers inside,” Rodriguez said.

For both shopping center and vending machine owners, profitability comes from scale, meaning locations in multiple properties. Rodriguez knows that the more leases he can do with a shopping center owner, the better the rent he can negotiate and the more purchasing power he has with pharmaceutical suppliers. “The recipe to be successful in a mall, we’ve found, is a fair rent based on a percentage of sales with a natural break point,” he said. Pharmabox offers between 8% and 15%.

Taubman has embraced Pharmabox and automated retail in general as part of its leasing strategy. “We look at it as a benefit to the customer,” said vice president of specialty leasing Lori McGhee-Curtis.

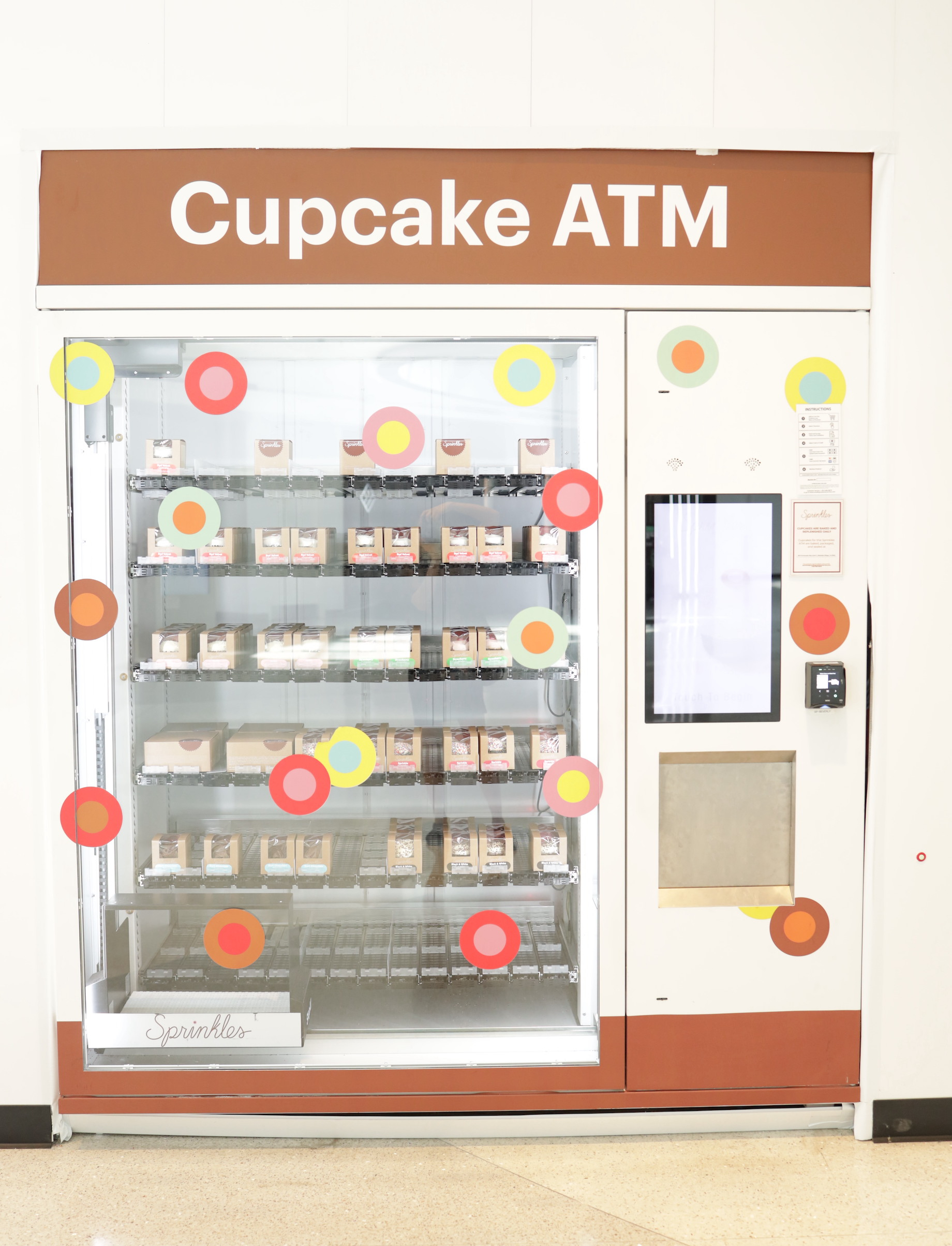

At Beverly Center in Los Angeles, for instance, shoppers who want a freshly baked sweets don’t have to stand in line at a bakery; they can head to the Sprinkles machine that’s stocked with cupcakes, cookies and brownies baked that day. “They’re something that [our guests] can grab and go while they’re still shopping,” McGhee-Curtis said.

A Sprinkles “Cupcake ATM” at Beverly Center in Los Angeles

Sprinkles stocks the machine with cupcakes baked that day.

Some Taubman centers also deploy eyelash extension vending machines. “It’s as simple as inserting a credit card and picking which one you want,” McGhee-Curtis said, referring to three options: bejeweled, plain and glamorous.

The Lash Tower in Sterling Heights, Michigan’s Lakeside

A Glamnetic vending machine selling magnetic eyelashes in Sunrise, Florida’s Sawgrass Mills

And when centers started opening up after COVID shutdowns, Taubman leased to personal protective equipment vending machines at some centers. The machines were helpful “for people who were coming to shop and forgot their masks,” McGhee-Curtis said.

She emphasized that vending machines are indeed profitable ancillary income for Taubman: “When you are opening more than one and you’ve got them operating at several properties and it’s a desired use, every penny counts and it does add to the bottom line.”

Picking and choosing

Taubman evaluates vending machine owners the same way it would any other retail operation. That means understanding how the product fits into a center’s needs and identity. Additionally, “I look at their business plan [and] evaluate how many [machines] they want and how they take care of them,” McGhee-Curtis said. Indeed, maintenance is an important factor in whether a vending machine will work in a center. Machines that break down or aren’t quickly refilled are headaches for everyone. McGhee-Curtis asks of vending machine owners whether they are capable of fixing any problems that arise within 24 hours.

Aesthetics also form an important consideration. Customers and landlords don’t want to see big metal boxes clustered in the middle of a shopping experience. “If you have too much visual cluster in a shopping center, people tend not to buy anything because they are overstimulated,” Solanki said.

McGhee-Curtis avoids this by “bumping a vending machine into a vacant storefront and placing graphics on either side so it’s not in the common area,” she said. That way, the vending machines start to look more like carefully designed stores.

Automated retail is not going away. “Consumers have become increasingly comfortable with self-service automation since they encounter it in more environments,” Vending Times’ Maras said. And advanced technology today allows vending machines to do things like produce fresh, customized pizza in under three minutes, making guests in some scenarios less likely to wait for service at a traditional restaurant.

To ensure traffic at centers, it might behoove property owners to add more automated retail machines, perhaps even a wall of them outside. “For an indoor shopping center, having an outdoor wall of automated retail machines where people could purchase whatever they needed even when the mall wasn’t open or if they didn’t want to go in — it would help drive consumers to shop with you,” said Johansen-James. It also would mean retailers could net sales 24/7, allowing them to compete with the speed of many e-commerce channels.

However, for vending machines to be successful, shopping center owners need to be willing to reevaluate assumptions about vending machines. “Malls have been having a hard time,” Faulconer said. Shopping centers reinventing themselves may think they’ve already tried vending machines, she said. “What they tried is not this.”

By Rebecca Meiser

Contributor, Commerce + Communities Today