What Makes a Mall Anchor These Days?

Historically, mall anchors have been department stores like Sears and Nordstrom. But as malls are evolving, so too is the notion of what constitutes a mall anchor. Placer.ai makes the case for viewing retailers like Aldi, Barnes & Noble, Chick-fil-A, In-N-Out Burger and Scheels as today’s “new” anchor retailers.

Barnes & Noble at Texas’ Woodlands Mall in 2022 Photo credit: Nigar - stock.adobe.com

“While traditional mainstays like Macy’s and JCPenney still play an important role, specialized offerings — from popular eateries to fitness centers and immersive retailtainment destinations — are increasingly taking center stage,” said a new Placer report, Rethinking the Mall Anchor in 2025: A Visit-Focused Approach. “These attractions maximize the experiential value that brick-and-mortar venues can deliver, driving visits and sales for the center as a whole.”

Dollar General Is Attracting Higher-Income Shoppers

Photo courtesy of Dollar General

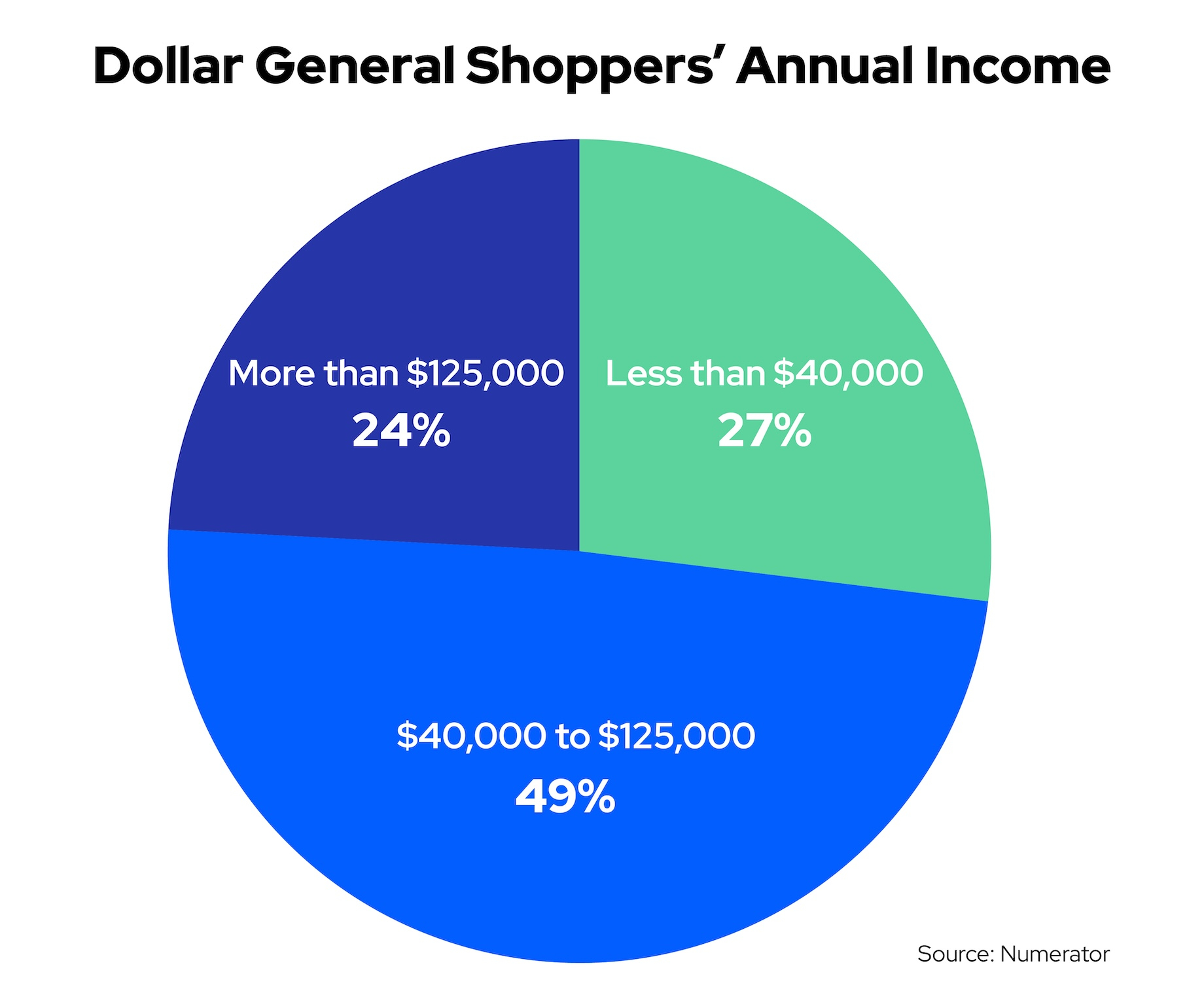

Dollar General is becoming more of a magnet for higher-income shoppers. During the discount retailer’s June 3 earnings call for the first quarter of the 2025 fiscal year, CEO Tom Vasos said that while the company’s core customer “remains financially constrained,” Dollar General stores have seen a recent uptick in middle- and high-income shoppers. These wealthier customers “are looking to maximize value while still shopping for items they want and need,” said Vasos. Placer.ai reported: “Discount and dollar stores are seeing renewed growth in 2025 as economic uncertainty drives consumers to prioritize value, outperforming other nondiscretionary retail sectors.”

In recent surveys, 25% of Dollar General customers reported receiving less income than they had a year earlier, according to Vasos, and nearly 60% of “core customers” felt the need to sacrifice on necessities in the coming year. “Our data shows that new customers this year are making more trips and spending more with us compared to new customers from last year while also allocating more of their spend to discretionary categories,” he said.

Dollar General now predicts same-store sales growth of about 1.5% to 2.5% this year, up from an earlier forecast of 1.2% to 2.2%. In the first quarter, same-store sales jumped 2.4%. Seeking to capitalize on robust sales, the retailer plans to open 575 new U.S. stores this year. How many others it will close during that time is not clear. In the first quarter, Dollar General opened 156 new stores, primarily going with 8,500-square-foot formats, and closed 168 stores. As of May 2, the retailer operated 20,582 stores.

A Quarter of Office-Conversion Square Feet Will Become Mixed-Use

Mixed-use makes up 12 of the 68 office conversions planned or underway in 2025 in 58 major U.S. markets that CBRE monitors. That’s 18% of the projects but 27% based on square footage, according to CBRE’s Conversions & Demolitions Reducing U.S. Office Supply. A chunk of projects presumably include retail. Among the 23.3 million square feet of office space on track to change to other uses, 12.8 million square feet will be adapted, and 10.5 million square feet will be demolished and replaced with ground-up construction.

In 2024, developers completed a record-setting 94 office-conversion projects totaling 13.1 million square feet in the U.S, according to CBRE.

Markets With the Most Space Being Converted in 2025

- Manhattan: 10.3 million square feet

- Washington, D.C.: 9.2 million square feet

- Houston: 6.7 million square feet

- Chicago: 4.8 million square feet

- Dallas-Fort Worth: 4.4 million square feet

Source: CBRE

FROM THE C+CT ARCHIVE: Time To Replace Suburban Office With Mixed-Use and Residential?

NYC Suburb Gets Proactive About Retail Revitalization

Casaroma Cafe is using its funding to optimize space so it can host more evening programs, arts events and social gatherings. Photo courtesy of City of New Rochelle, New York

Eight retailers in New Rochelle, New York, have gotten a financial boost via the New York City suburb’s Vanguard New Rochelle downtown retail strategy. Altogether, this first batch of retailers are sharing $1.12 million from the city’s $2.25 million Retail Tenant Improvement Fund to undertake upgrades, renovations and buildouts. The first awards range from $40,000 to $250,000 apiece. Recipients are:

- Casaroma Cafe coffeehouse

- Hour To Exit escape room

- Touchd Medical Spa

- Lincoln Park Conservancy History & Culture Center, which celebrates Black history and heritage

- Monarch Reserve cannabis dispensary

- Mona Indian restaurant

- Roc-N-Ramen Caribbean-Japanese ramen restaurant

- Teriyaki Madness restaurant

FROM THE C+CT ARCHIVE: Landlord Becomes Teriyaki Madness Franchisee and Backfills Space

New Rochelle — home to more than 85,500 residents as of July 2024, according to census data — has attracted $2.5 billion in private investment, more than 10,000 new housing units and 50 new businesses over the past five years. “With the Retail Tenant Improvement Fund, we’re not just transforming storefronts; we’re creating vibrant, welcoming destinations where people can gather for a meal, enjoy outdoor seating, attend events and truly experience the heart of our city,” said New Rochelle Mayor Yadira Ramos-Herbert. “These enhancements are helping shape a more dynamic, welcoming city center that invites discovery and connection.”

Add More Retail — or More Trees?

Westfield UTC in San Diego Photo credit: Unibail-Rodamco-Westfield

From David McCullough’s professional perch, some retail real estate developers can’t see the trees for the forest. In other words, they’re focusing on the entirety of a retail project, yet giving little thought to trees and other landscaping. The principal of McCullough Landscape Architecture believes that at retail centers, trees aren’t solely about beautification but also “about business strategy, creating environments where people want to stay longer and come back more often,” he told C+CT. “When I walk through a shopping center that’s struggling to hold attention or energy, my first thought is rarely: ‘Add more retail.’ It’s usually: ‘Add more trees.’”

He said trees are the most effective yet most underused element of retail design. “They cool the environment, create visual interest and offer the kind of comfort that draws people in on a hot day. For the price, trees deliver greater impact than almost any other design feature,” McCullough said.

MORE FROM C+CT: Check Out All the Green Among the ICSC Global Design & Development Awards Gold Winners

McCullough’s firm helped reinvigorate San Diego’s Westfield UTC open-air center as a lively retail destination by weaving landscaping into every level, he said. “Ultimately, landscape is not a cosmetic layer; it’s a business strategy,” said McCullough. “The most vibrant, successful retail streets in the world all share one thing in common: big, beautiful trees.”

Here’s a throwback to the center’s 1977 grand opening, including a reference to making sure tree planers were in place in time.

By John Egan

Contributor, Commerce + Communities Today