The One Big Beautiful Bill Act (H.R. 1), signed into law by President Trump in July, contains hundreds of provisions related to healthcare, tax and spending priorities that could have major impacts on state finances. For businesses, the OBBBA primarily extends and modifies the 2017 TCJA provisions, making permanent key business deductions and individual tax rates. In response to the spending changes, fifteen states published reports containing estimated costs of the impact that OBBBA will have, particularly in regards to funding available to support programs like the Supplemental Nutrition Assistance Program (SNAP) and Medicaid.

While most states will likely wait until next session to address the funding shortfalls and tax conformity changes related to OBBBA, some have already taken action. For example, governors in Illinois and New York have directed executive agencies to plan cuts to their departments to partially offset losses. Every state also differs in how it approaches federal tax conformity. Some states automatically adopt new federal changes without the legislature but others have a static conformity date and must proactively pass legislation to update the version of the Internal Revenue Code (IRC) they conform to.

Colorado, due to the calculations in its conformity to the IRC, had an especially large and immediate budget deficit. The legislature held a special session in August, altering the taxation of foreign income, removing preferential insurance premium tax rates, offering $125 million in tax credits for sale, and eliminating the sales tax vendor fee. Governor Jared Polis (D) signed an executive order mandating temporary cuts through the end of the year and will address $300 million in further cuts later this year.

In Oregon, lawmakers are also considering calling for an additional special session to decouple from the federal tax code. This follows a report from the state’s Legislative Revenue Office that estimated that the state will lose $888 million (i.e. 2.5% of the revised Net General Fund estimate) for the next two years if the state allows federal changes to take effect. If the legislature waits until the regular session to convene, it will be too late to avoid revenue losses from the 2025 tax year, because most of the tax cuts in HR 1 are effective immediately. Between federal tax conformity and changes to federal spending allocations to states for health programs, state lawmakers will be taking a closer look at how to make changes to their revenue sources to offset changes made by OBBBA.

For more information contact gpp@icsc.com.

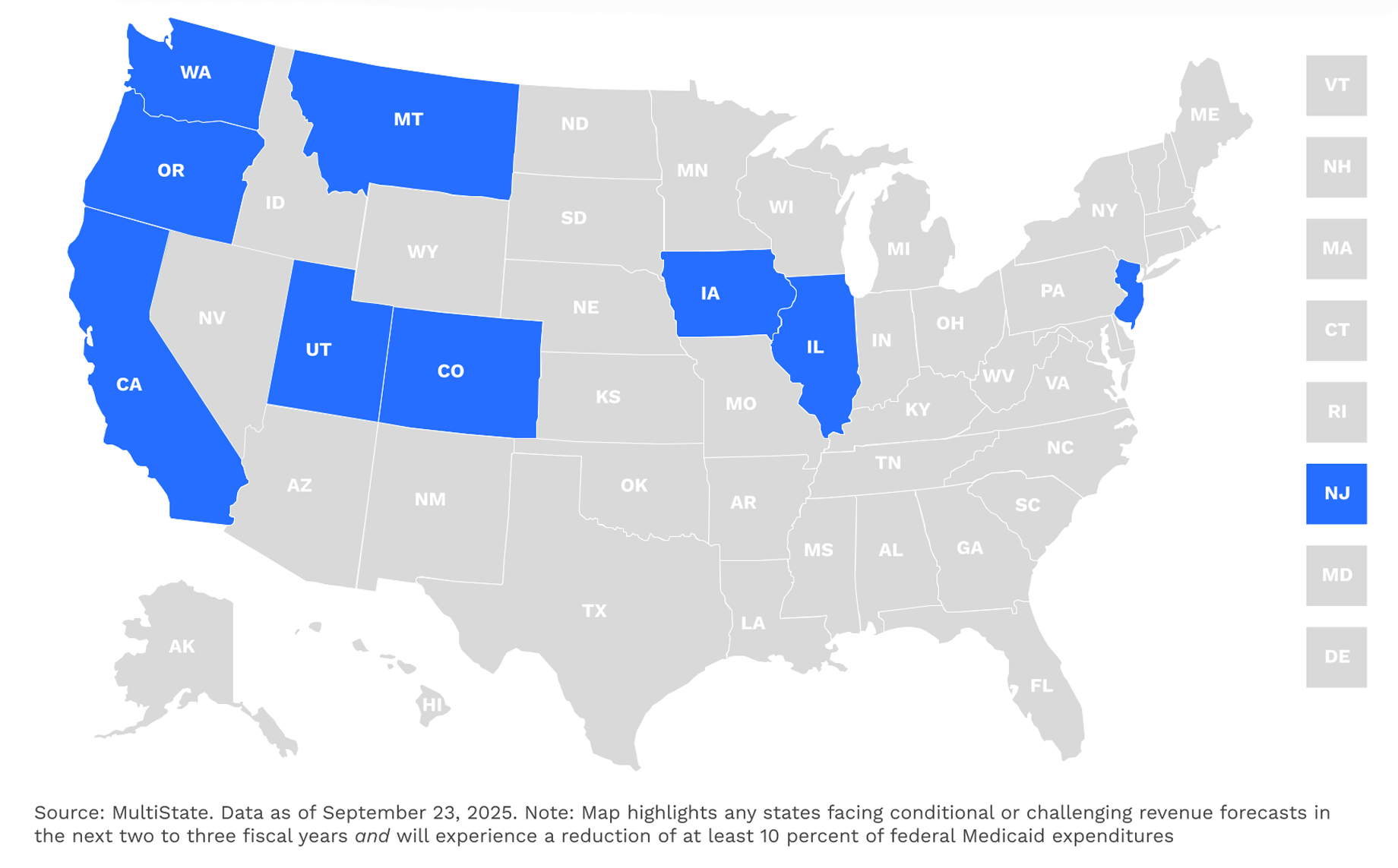

States facing conditional or challenging revenue forecasts in the short term that will be most impacted by federal Medicaid cuts