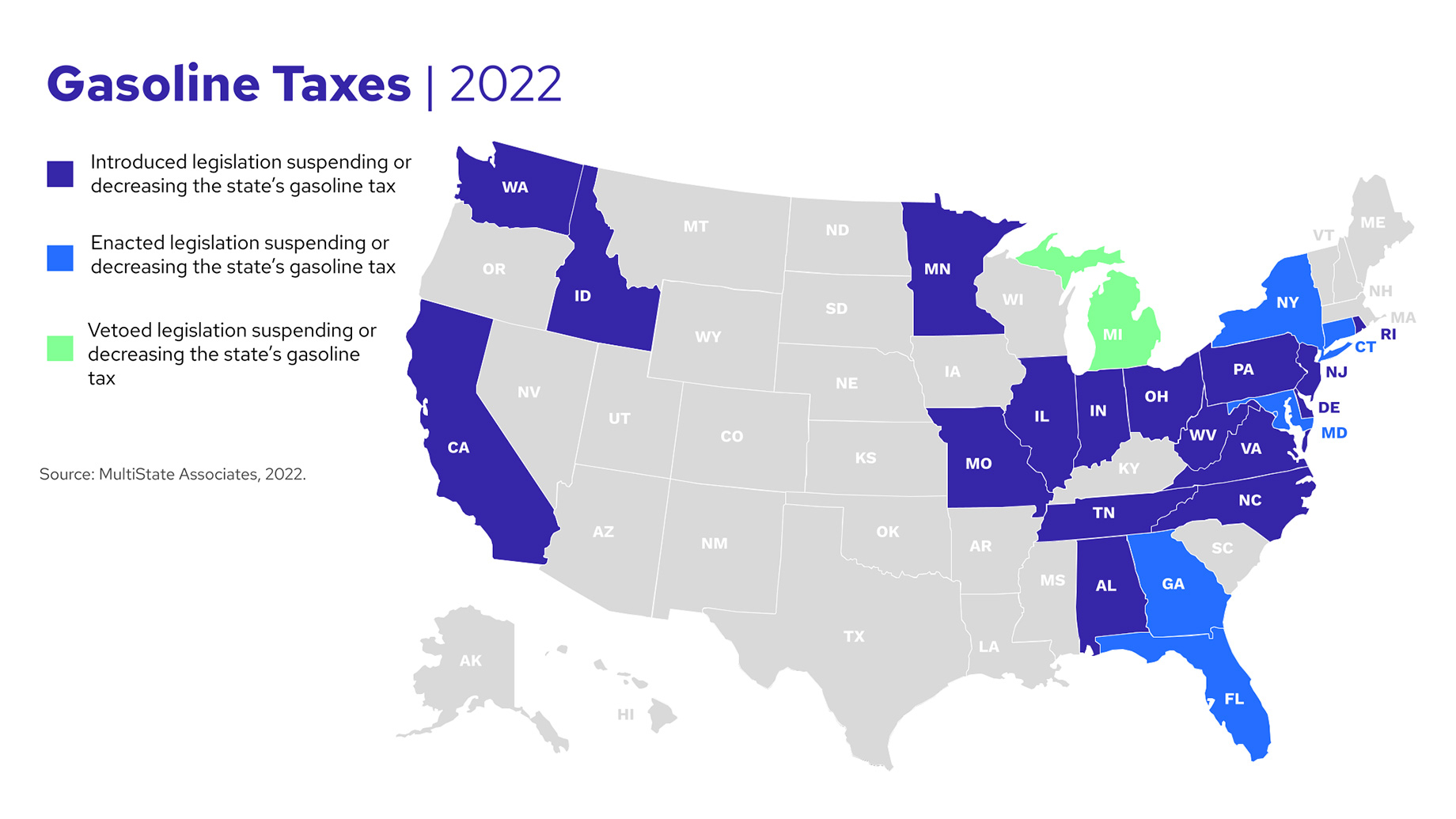

Several states have begun offering “gas tax holidays” this summer, where gas purchased during a certain period of time will be exempt from state gas taxes or taxed at a lower rate. So far, five states — Connecticut, Florida, Georgia, Maryland, and New York — have enacted measures to suspend or lower the state gas tax this summer, and lawmakers in 23 states have introduced legislation to do the same.

In Connecticut, CT HB 5501 suspends the 25 cents-per-gallon state gas tax until June 30, 2022. Maryland’s law (MD SB 1010) suspended the state gas tax for just one month. The 36 cents-per-gallon tax was reinstated on April 18, 2022 after Maryland lawmakers ended their session without extending the tax break.

In April, Michigan Governor Gretchen Whitmer (D) vetoed legislation (MI HB 5570) that would have suspended the state’s 27 cents-per-gallon tax for six months, calling it a “misguided proposal” that “does nothing for Michiganders facing pain at the pump right now.” Gov. Whitmer has instead proposed exempting gasoline from the 6% sales tax, a measure that would save drivers 24 cents on a $4 gallon of gas.

California lawmakers have advocated a different approach: direct payments to taxpayers. With the highest gas prices in the country, Governor Gavin Newsom (D) has called for a $400 gas tax refund to be given away in debit cards.

Suspending the gas tax is not without costs, though. Gas tax revenues are used to support transportation funding, and a suspension in taxes could blow a hole through state infrastructure budgets. For example, the one-month Maryland gas tax holiday will cost the state an estimated $100 million, with money from the Transportation Trust Fund used to make up the shortfall.

The rise of EVs on roadways is also complicating revenue matters now and in the long-term. Gasoline taxes make up 29% of state and 84% of federal highway funding. While states like Oregon and Utah have experimented with vehicle miles traveled (VMT) tax programs, others states are looking at taxing drivers at charging stations either through a purchase, flat usage fee, or kilowatt-per hour (kWh) tax. As policymakers push the transition to fully electric cars in the coming decades, motorists charging their EVs at their local shopping center will likely be faced with some new form of tax in order to maintain transportation infrastructure.