Despite widespread speculation that the pandemic would cause a major contraction of the U.S. commercial real estate market, reports show that it has bounced back to pre-pandemic levels. Fueled by record-low interest rates and a surge of investor demand in the second quarter of 2021, investors spent $144.7 billion on U.S. commercial property, nearly three times what they spent in the second quarter of 2020, according to Real Capital Analytics, as reported by The Wall Street Journal at the end of July. That’s 13.4% greater than the average of $127.2 billion from 2015 and 2019.

Brokers saw a switch in retail activity early in 2021, as vaccinations ramped up across the country. “We’ve seen investor capital flows back to the retail sector in a pretty meaningful way over the past six to nine months,” said JLL Capital Markets U.S. retail co-leader Danny Finkle. “We’re now at a point where investor capital flows into the retail sector are more substantial than we were seeing prior to the start of the pandemic.” What’s driving that institutional confidence, he said, is a conviction about the retail sector more broadly. Consumers’ pent-up demand, an increased availability of disposable income and the reopening of most of the economy, caused second-quarter spending to increase by 20% to 30% year over year and by 4% to 7% from pre-COVID-19 levels, according to an August McKinsey & Co. report. “Retailer balance sheets are quite strong, and it has validated the immediate and long-term need and viability of the retail sector,” Finkle said.

A record number of retiring Baby Boomers form a new segment of investors creating additional demand for retail assets. In the first quarter, for instance, 30.3 million Boomers left the labor force for retirement, according to Pew Research Center. That’s 2.7 million more than had retired in the first quarter of 2020. “In the history of mankind, we’ve never had so many people who are either being retired or retiring,” said CBRE Capital Markets U.S. retail managing director Christopher Decoufle. “If you think about the global health of the industrialized nations and you think about how many people are retired or retiring, that volume of people all need fixed income of some kind. When you think about fixed income, that goes into everything from interest rates to how real estate is priced to how stocks and bonds are priced.”

And this larger pool of investors is chasing a limited number of assets. “The reality is that there’s more capital flying around than ever, and it has to be invested,” said Decoufle. For retail real estate, he said, the question is: “What is the appropriate risk-adjusted return? Because there’s more demand, the pricing level is going up and the returns are going down.”

Despite dire forecasts for the retail real estate sector, the pandemic has not imposed lasting structural issues on either the capital markets or asset demand, so the upswing in April and May, Decoufle argued, shows that the rebound, unlike other recession cycles, “wasn’t a recovery but rather a resumption of all activity.”

What investors seek

While the general U.S. retail market is receiving increased interest from investors, brokers see especially high demand for community centers, grocery-anchored centers and net lease properties. These assets were also the most sought out pre-COVID.

Green Street’s comp database, which tracks sales properties of $5 million or more, shows that institutional-quality strip center transaction volumes rose 70 percent year over year in the second quarter. “Based on what we hear in the market, it’s clear that bids have become increasingly more competitive in the sector,” said Green Street retail analyst Paulina Rojas Schmidt, who focuses on strip centers. “We also see that institutional interest in the strip center sector is back, possibly even stronger than it was pre-COVID.”

While Green Street’s data includes only transactions that have closed, Rojas Schmidt said anecdotal information from clients indicates more transactions are coming to the market. It’s likely, she said, that “we will see another increase in transaction volume in the coming months.”

Today, 18 months after the pandemic began, low interest rates are driving investors to look harder at different types of retail, Rojas Schmidt said. “Initially, we saw in the sector that investors were almost exclusively concentrated on grocery-anchored or community centers.” But as demand and access to financing have increased, “now we’re increasingly seeing transactions that are traditionally perceived as a little more risky like power centers and lifestyle centers,” she said. Grocery-anchored centers, though, continue to claim the most demand. “Investor demand far exceeds the supply of grocery-anchored offerings,” said Finkle, and that leads to continued compression in cap rates in that segment.

The upward trend in sales mirrors what brokers are seeing on the leasing side, Rojas Schmidt said. “Companies are leasing space at a faster speed than we were anticipating. We compared the leasing volume versus the three-year average [of 2017 through 2019]. At the worst point in second quarter 2020, new leases were about half versus the historical average,” she explained. From that trough, activity skyrocketed. “Now we are positive about 10 percent above the historical level,” she says.

Net lease is seeing a similar increase. Unlike other retail assets, net lease fared well during COVID because such properties were perceived as providing safe and stable returns. Even so, “at the height of COVID and mid-2020, [demand] was kind of broken into essential businesses and non-essential businesses, and all the demand was chasing essential business,” said Boulder Group senior vice president John Feeney. “During the midst of the pandemic, you couldn’t sell a fitness center. You couldn’t sell a move theater. You couldn’t sell a Dave & Buster’s. But you could sell a McDonald’s or a quick-service restaurant. You could sell a CVS pharmacy or a Kroger grocery store because they were essential. They were paying rent. They were strong credit tenants, and people were targeting them.”

Today, people are reconsidering their investment criteria. “You see people dipping back into what wasn’t looked at in May of 2020 as favorable,” Feeney said of the retail sector. “People are starting to look back into casual dining, they’re looking at Texas Roadhouse. They’re looking at Brinker,” which owns brands like Chili’s and Maggiano’s. CBRE’s United States Cap Rate Survey for the first half of 2021 confirmed this trend:

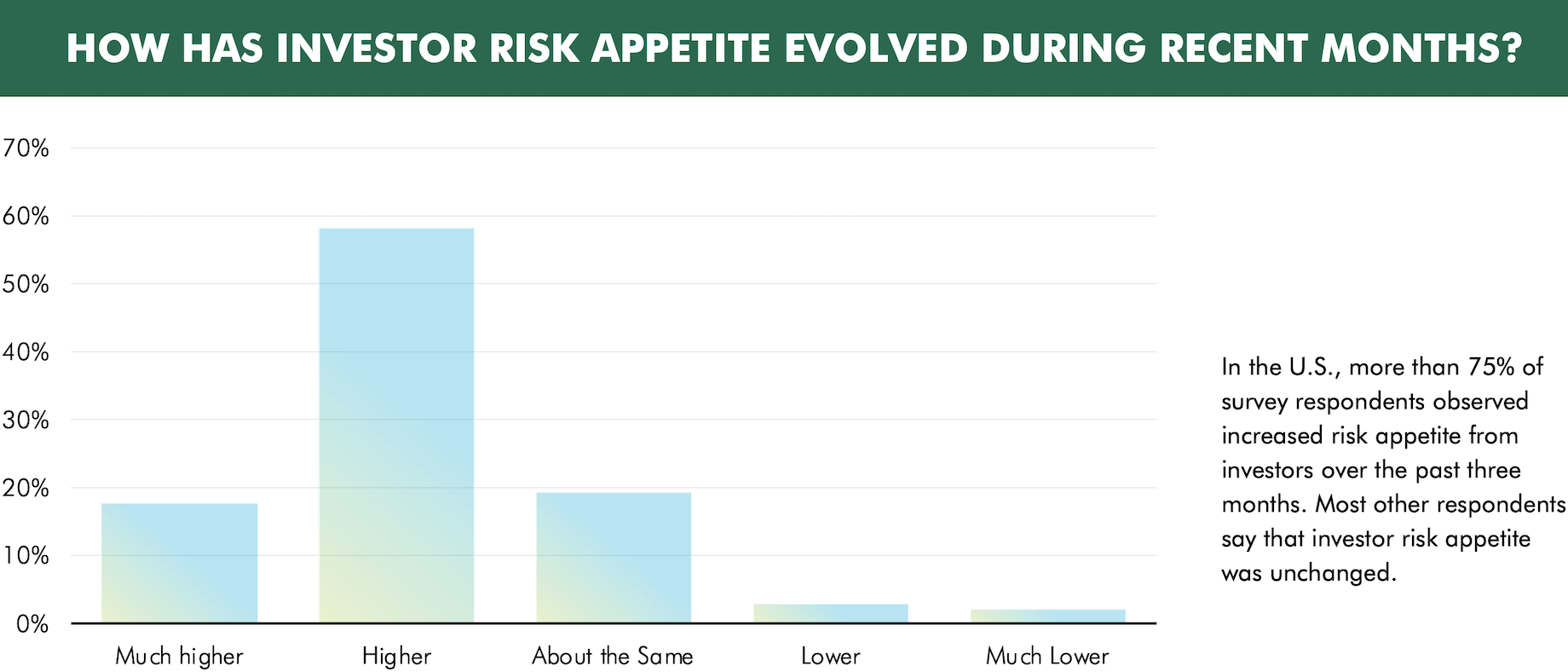

More than three-quarters of the 244 CBRE capital markets and valuations professionals CBRE surveyed at the end of the first half of 2021 indicated an increase in risk appetite from investors during the second quarter.

As spending at these establishments has returned, investors are going back, as well. Because of this, in the short- to near-term future, Feeney predicted cap rates will remain stable in the net lease sector. For stronger classes like properties with long-term leases and properties in the top 25 metropolitan statistical areas with investment-grade tenants, cap rates could even compress, he said.

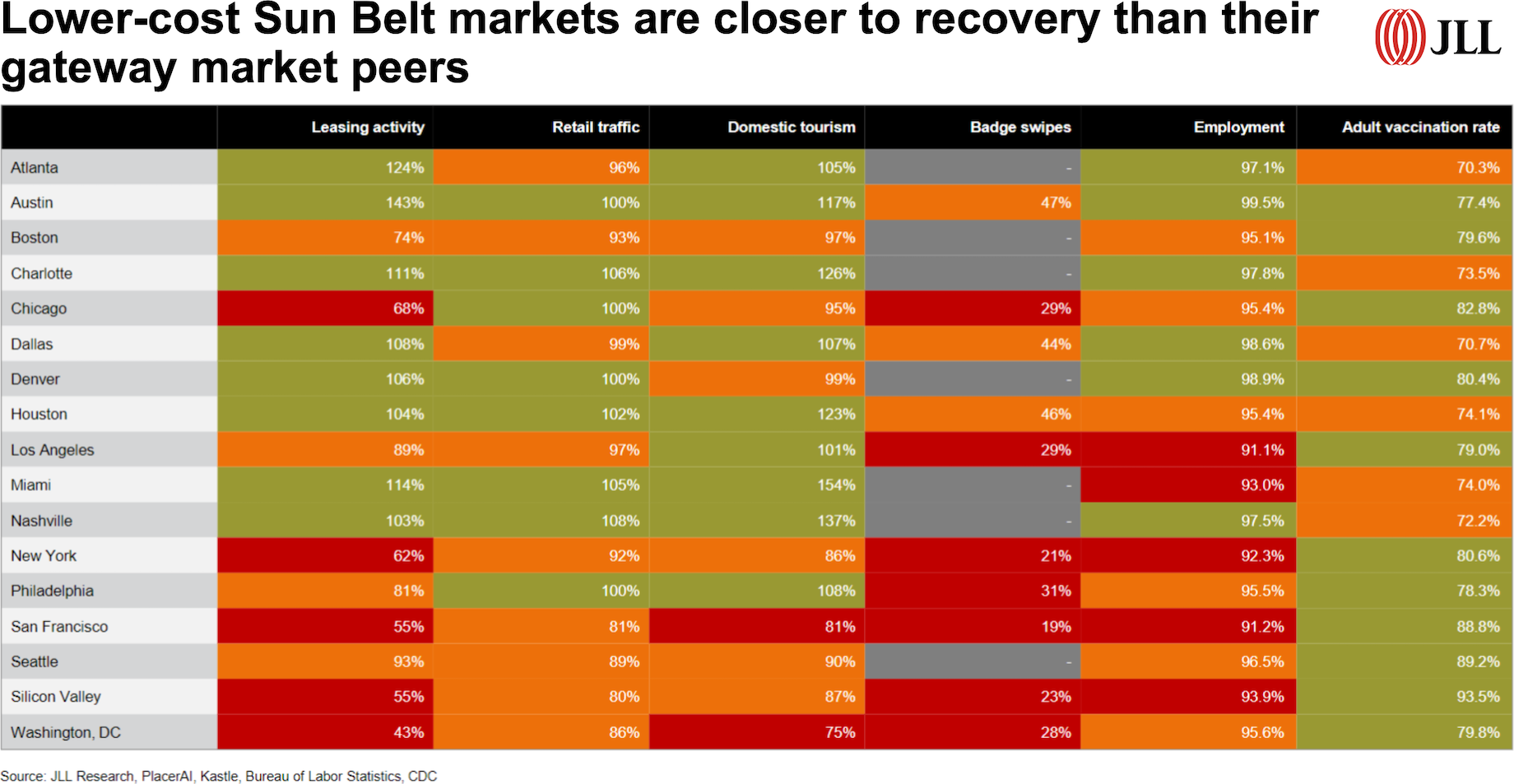

Sun Belt markets, particularly, saw record investor interest in commercial real estate, according to an August CBRE Deal Flow report. Dallas, Atlanta, Phoenix, Tampa and Nashville all boasted

record volumes of commercial property sales during the first half of 2021, according to Real Capital Analytics. As people migrated south, capital followed. But brokers say interest is increasing in the Midwest and Northeast. “The fundamental recovery in the retail market was led in the Sun Belt markets,” said Finkle, but “as the balance of the country continues to reopen, investors are seeking the best risk-adjusted returns that extend beyond the Sun Belt market.”

Canada demand

Investment interest in Canadian shopping centers similarly is returning to pre-pandemic levels. According to CBRE’s Canada Investment MarketView Q2 2021, published in September, Canada broke its all-time record for commercial real estate activity in the second quarter. The $14 billion in commercial property investment represented a 29.3% increase over the first quarter. Industrial, which clocked in $4.1 billion, and multifamily, which recorded $3.7 billion, drew the most demand, but retail accounted for $2 billion, almost 15% of all activity.

As the Canadian economy has reopened, retail sales have surged, as well. According to Statistics Canada, they rose 25.4% year over year in the second quarter, driven by pent-up demand. “A lot of us haven’t been going to work or driving to work or buying clothes. In Canada, there’s upwards of $200 billion of money sitting in our jeans, fueling this rapid spend back,” said Cushman & Wakefield executive managing director of Canada retail services John Crombie.

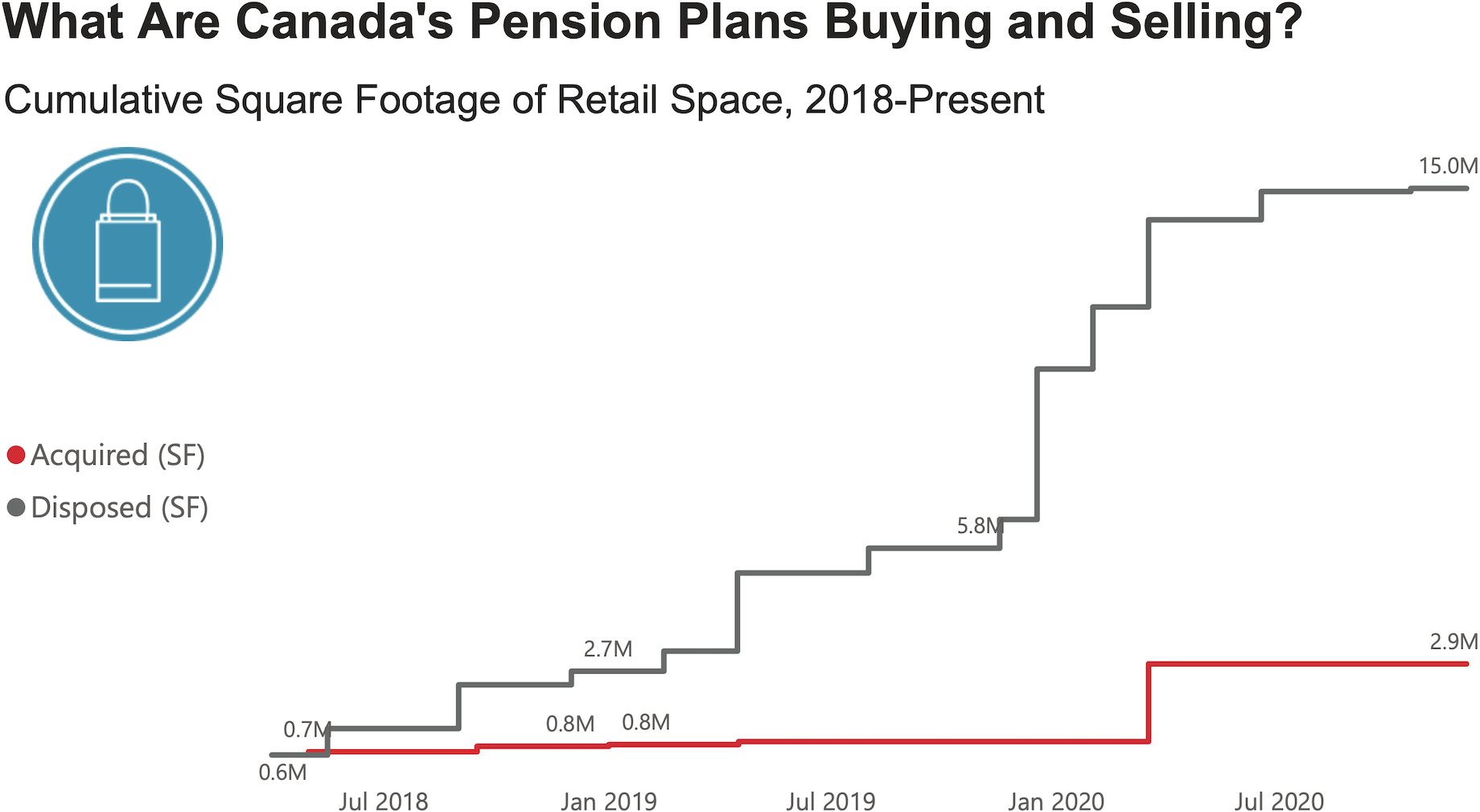

An increase of private investors also has driven retail property investment growth over the past year. Nearly half of the buyer pool in 2021 was made up of high-net-worth individuals, as well as smaller development companies and private investment firms. “We’re not seeing as much activity from the big pension funds and REITs,” said Cushman & Wakefield Canada investment sales vice president Nicholas Kendrew. “A lot of those groups are net sellers.”

This does not necessarily represent a negative view of retail. “It’s more of a recycling of capital — for instance, selling a regional mall in suburban Montreal and then buying an industrial building in Europe. That’s really what many of these bigger pension funds are looking at.”

Source: Cushman & Wakefield

Some of the interest from private investors interestingly has come from residential developers taking a long view toward redevelopment of well-located Canadian retail centers. The key is location and ease of access. Buyers believe that “if the demographics and fundamentals are good in the immediate area, then perhaps why not redevelop: demolish an anchor and de-mall slightly and build some high-density residential,” Kendrew said.

Recently, for instance, Cushman & Wakefield worked on a $3.2 million deal to sell a 9,100-square-foot plaza in the Toronto suburb of Scarborough. It sits on 0.65 acres and has a lot of residential around it. “The private investor behind that deal isn’t really a developer, and they aren’t looking to do anything immediately,” Kendrew said. Rather, the developer had a long-term perspective, thinking, according to Kendrew: “‘The tenants in there are brands that I recognize. They’re household names. And if I can get an income off this for 10 years, then maybe sometime in the long term, I can look at … redevelopment,’ especially in a situation like Toronto where there’s been such significant urbanization over the past decade or two.”

Confidence moving forward

Looking back, the pandemic, provided the retail real estate sector with what Decoufle called the ultimate pressure test. If a retail asset survived the pandemic, it’s still seen as a good asset. “If it’s made it, I think you can feel very strong about the asset,” Decoufle said. “That’s one of the things investors are focused on now.”

By Rebecca Meiser

Contributor, Commerce + Communities Today