Retail Developers Are Still Playing It Safe

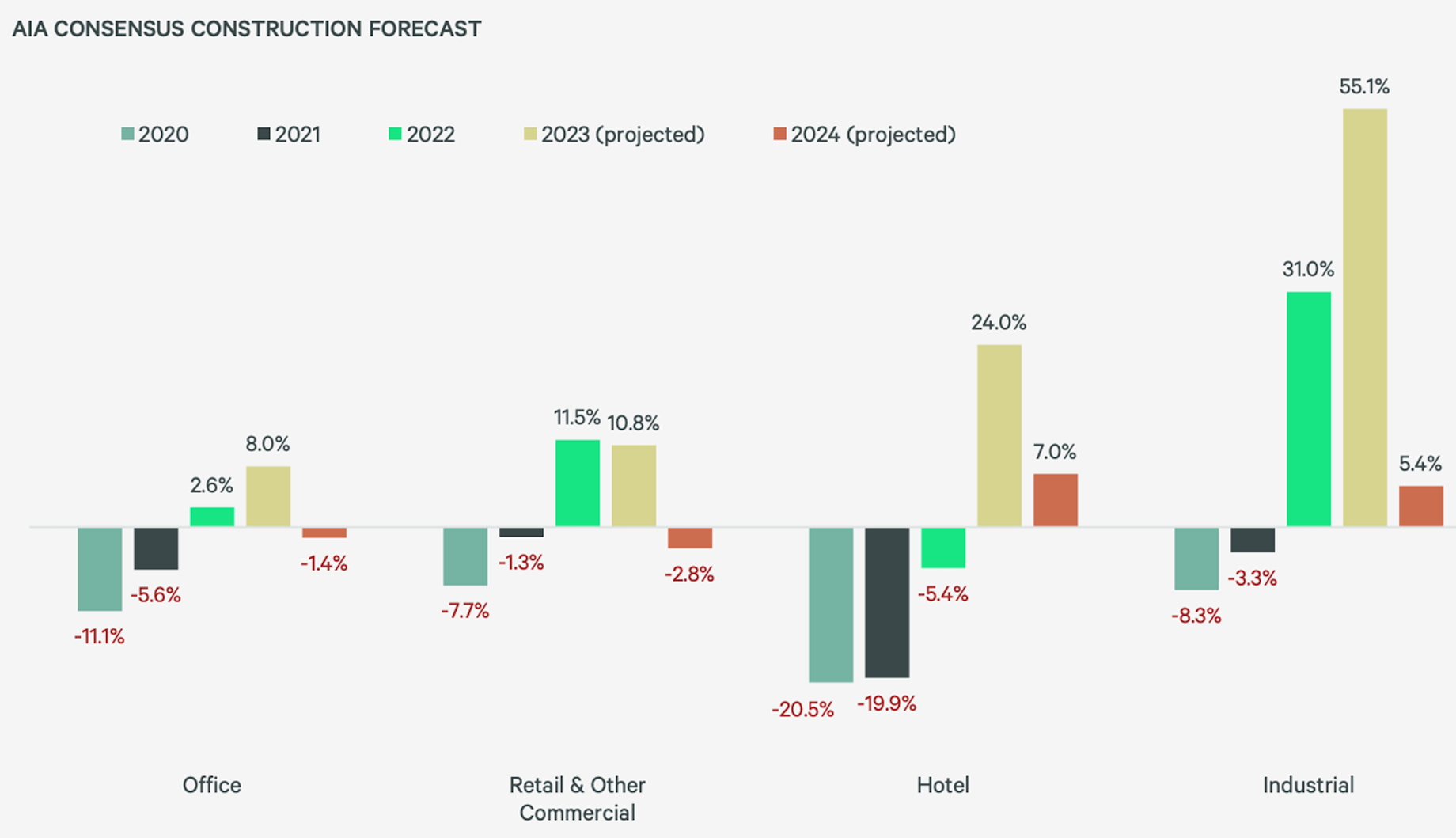

Investors and developers are showing remarkable restraint in chasing new retail development. “Even with retail CRE seeing perhaps the best fundamentals in history, the pipeline for new space remains remarkably low,” CBRE Americas retail research head Brandon Isner wrote on LinkedIn. Spending in the development category that encompasses retail, transportation and communications is expected to decline by 2.8% in 2024, according to CBRE’s Q3 2023 U.S. Construction Market Trends report. That’s after a 10.8% projected increase in 2023.

Source: AIA Consensus Construction Forecast, from the American Institute of Architects, and CBRE Cost Consultancy

Ground-up retail projects that have opened in 2023 include Phase I of Vestar Development’s 260,000-square-foot, Sprouts Farmers Market-anchored Vineyard Towne Center in Queen Creek, Arizona. A Target will open as part of Phase II in 2025. Vestar has four similar ground-up retail developments underway across Arizona. The $146 million, 291,000-square-foot Tanger Nashville, which opened 96.5% leased on Oct. 27, is another one of the few new retail properties to open this year.

Most are part of larger, mixed-use projects. These include the 600,000-square-foot retail component of Jasper Stone’s 200-acre Avenue One development in Omaha, Nebraska. JLL and Poag Development Group are working with the company to manage and develop the property, which broke ground three years ago on farmland and will include 785,000 square feet of office and 1,500 residences.

Supermarket chains also are fueling what sparse new retail development is underway. Sembler recently broke ground, for example, on a 75,000-square-foot center to be anchored by Publix that will open next summer in White House, Tennessee, north of Nashville.

Simon Will Raise More than $1 Billion in Debt in the U.S., Plus More in Europe

Simon plans to borrow more than $1.5 billion to pay down existing debt and fund corporate expenses. The REIT has agreed to sell $1 billion worth of new senior notes that will pay an average interest rate of 6.45% and mature in 20.2 years. In Europe, Simon’s private, Netherlands-based subsidiary will borrow another €750 million, or $793 million, by issuing bonds that can be exchanged for shares of stock in its French joint venture, Klepierre. The bonds will mature in 2026 and pay an interest rate of 3.5% per year. They’re being offered only to investors outside the U.S. Simon’s ability to raise a large amount of debt at attractive rates would be a positive sign for the overall retail real estate market.

Klarna’s U.S. Customer Count Grows by a Third

Swedish buy-now-pay-later network Klarna, which also offers shopping services to consumers and marketing services to brands, continues to build its presence in the U.S. The company’s U.S. users increased 32% year over year in the third quarter to 37 million. Its U.S. retail partners increased 38% to 26,000. The company boosted its reach in part by adding artificial intelligence-powered features to its smartphone app. These include a discovery feed that recommends products based on personal interests; a shopping lens that lets shoppers snap, search and shop anything around them; in-store barcode scanning for instant access to product information on more than 10 million items; gift cards; and product sustainability certification filters.

5 Retailers Crossing Borders to Find Growth

Brand management firm WHP Global recently signed long-term licensing deals with local partners to open Express stores throughout Latin America: one for stores in Central America and one for locations in Mexico, Paraguay and Indonesia. Express has 530 stores in the U.S. and Puerto Rico.

U.S. lifestyle brand Timberland is expanding in Asia, adding a streetfront store in Tokyo’s Daikanyama neighborhood last month. The VF Corp.-owned brand has about 350 stores worldwide.

Duck Donuts and Thailand franchise partner The Great Restaurant Group Co. launched the first Duck Donuts store in Bangkok, at Siam Discovery mall. Outside the U.S., Duck Donuts also has stores in Burlington, Ontario; Cairo; Saudi Arabia; and Doha, Qatar. It intends to open in Pakistan, Curacao and Edmonton, Alberta, in the next year.

Starbucks plans to expand to 35,000 locations outside North America by 2030. It had roughly 20,200 cafes outside North America as of Oct. 1, and aims to reach 55,000 globally by 2030, up from 38,000 now.

International chains are expanding in the U.S., as well. U.K.-based sandwich chain Pret is set to quintuple its U.S. store count, aiming for 300 locations by 2029.

Rite Aid and WeWork Bankruptcy Updates

Rite Aid is liquidating a second tranche of leases as it seeks to restructure to emerge from Chapter 11 bankruptcy protection. A&G Real Estate Partners is marketing another 92 leases for sale, ranging from 5,000 to 33,548 square feet. Fifty-three are freestanding locations, all but nine of which offer attached one- or two-lane drive-thrus; 36 are in strip or power centers; and three are in central business districts. They sit in eight states: 22 in Michigan, 17 in California, 17 in Pennsylvania, 11 in New York, 10 in Washington, seven in New Jersey, six in Maryland, and two in Ohio.

Investors have been clamoring to purchase the 78 Rite Aid and Bartell Drugs leases A&G started marketing for Rite Aid a few weeks ago, said A&G co-president Andy Graiser. “The lack of new build of this type of product is driving demand for these leases.” As part of its plan to restructure some $3 billion in debt under Chapter 11, for which Rite Aid filed last month, it has marked at least 347 leases for possible rejection of future obligation. As Rite Aid’s restructuring process moves forward, A&G will market additional leases, the total depending on ongoing negotiations between A&G and Rite Aid landlords, Graiser said.

And WeWork has marked 69 of its 659 leases for rejection as part of its restructuring and bankruptcy filing, many of them in New York City. The coworking company, faced with $4 billion in debt and only $164 million in cash on hand, is determined to cut costs by trimming rent from its balance sheet. If a judge approves the plan, landlords will have to find new tenants for those spaces, or the leases may be auctioned or sold to other tenants.

WeWork could reject additional leases later in its bankruptcy. It had renegotiated 590 leases before filing for bankruptcy, saving about $12.7 billion in future rent payments. The tenant is seeking to renegotiate other leases with 400 landlords.

By Brannon Boswell

Executive Editor, Commerce + Communities Today