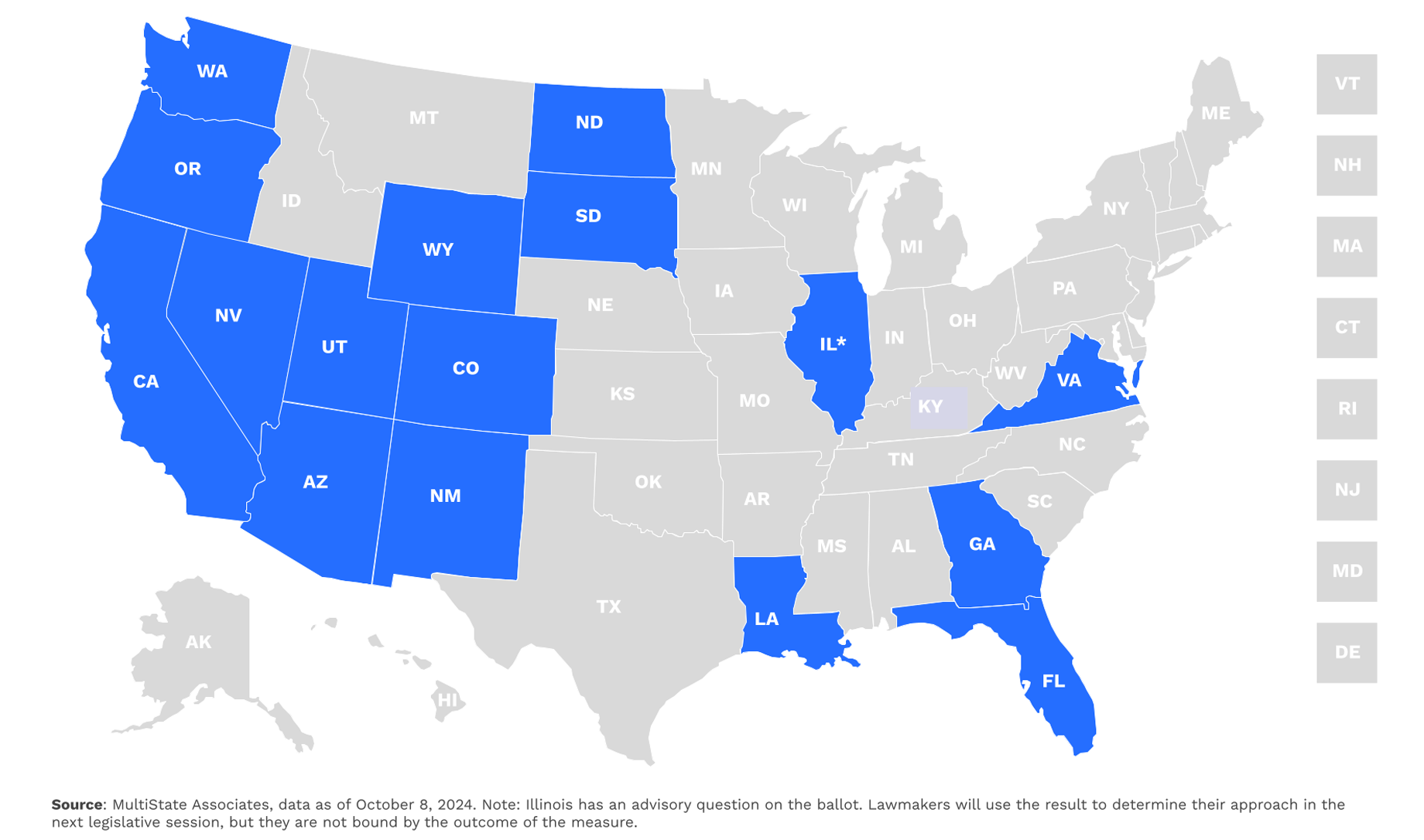

In addition to choosing elected officials on November 5, voters in 16 states weighed in on several ballot measures related to taxation, with proposals ranging from adding new taxes to repealing controversial ones and everything in between. For commercial property owners, tax ballot measures can be a critical policy vehicle in states and provide an important temperature check on the popularity of tax proposals. The following ballot measures were among the major tax questions appearing before voters:

California Proposition 5 (Rejected) - If approved by voters, this measure would have lowered the vote threshold from 66.67% to 55% for local special taxes and bond measures for funding housing projects and public infrastructure.

Oregon Measure 118 (Rejected) - Oregon voters rejected a measure that would have to add a 3% gross receipts tax on large corporations with the proceeds distributed to Oregon residents as a universal basic income-style program. Legislative leaders of both parties and Governor Tina Kotek (D) all opposed the measure, with even the left-leaning group Tax Fairness Oregon calling the measure “a hot mess.”

North Dakota Initiated Measure 4 (Rejected) - Voters rejected an attempt to repeal the property tax. If the measure had passed, the state would have needed to replace local government revenue, with a projected cost of $3.15 billion over the next two years.

Washington Initiatives 2109, 2117, and 2124 (Rejected) - Voters rejected three ballot measures that attempted to reverse controversial taxes passed by the state legislature. Initiative 2109 would have repealed the state's capital gains tax. Initiative 2117 would have repealed the state's Climate Commitment Act which institutes a cap-and-trade system that aims to reduce greenhouse gas emissions. And finally, Initiative 2124 aimed to allow employees and self-employed persons to opt out of paying the payroll tax for and collecting benefits from WA Cares, the state's long-term care program.

Georgia Amendment 2 (Approved) - This measure creates the Georgia Tax Court, which would have concurrent jurisdiction with the state business court and the superior courts.

Illinois Advisory Question (Approved) - This question asked voters whether they think the state constitution should be amended to include an additional 3% tax on income over $1,000,000. This additional tax collection would be allocated to property tax relief.

Wyoming Property Tax on Residential Property and Owner-Occupied Primary Residences Amendment (Approved) - This measure creates an additional category that would be proposed for the state's property tax, giving the legislature the ability to tax owner-occupied primary residences at a lower rate than other residential properties, important to the residents of a state where second homes and vacation rentals have increased in recent years.

States with Tax Policies on the Ballot in 2024