Resquared will announce today that it’s been chosen for the winter 2021 batch of startups in which Y Combinator will invest and which it will help accelerate. Fewer than 2 percent of applicants get the investor's green light. Resquared, a tech company that helps retail leasing agents identify and reach out to local business prospects, will announce the news today.

Y Combinator invests in early-stage-startups. Past recipients of Y Combinator’s capital and seed funding include Airbnb, DoorDash, Coinbase, Instacart, Dropbox, Twitch and Reddit. Twice a year, it chooses a batch of entrepreneurs/companies to which it provides mentorship, advice and $125,000 in exchange for 7 percent of each company.

Griffin Morris, who founded Resquared alongside Tyler Carlson, says the company will use the funding to grow its team. Plus, the Y Combinator stamp of approval will help it compete for talent. “There’s a lot of really talented people who want to work for Y Combinator startups,” Morris said. “We are excited to bring in the very best minds that we can find and get them focused on challenges in the retail real estate industry.”

RELATED: Griffin Morris was among the voices offering up lease-up advice in this September 2020 SCT story

Resquared aggregates data on thousands of local businesses, making it easy for landlords and agents to assess them and get in touch. “Our goal is to make it absolutely seamless to connect with businesses in your local ecosystem,” Morris said. Since launching last March, Resquared has signed on clients like Colliers International and Weingarten Realty.

Morris spoke with SCT contributing editor Rebecca Meiser about trends the tech company sees in its data and in its conversations with clients.

You started Resquared last March, right before lockdowns began. So much has changed within the shopping center space. Anchors like JCPenney and Neiman Marcus have filed for bankruptcy. Is there an overarching theme in the types of tenants shopping centers are looking for today?

Pre-COVID, grocery-anchored shopping center [landlords] would tell us that maybe 50 percent of the leases they’d signed were with local businesses and 50 percent were with national chains. Now we’re hearing frequently that as high as 70 or even 80 percent of leases are getting signed with local retailers or local businesses.

That seems counterintuitive to what we’re reading in the news about local businesses being the ones most affected by COVID-19. Analysts have predicted that national chains, those with strong capital and e-commerce capabilities, are the retailers that would most likely survive.

Local businesses definitely got hit the hardest, but if you were a local operator that was able to survive, then right now is a good opportunity to get better [rental] rates. Now might be the perfect time for you to start your expansions. In fact, a lot of the tenant categories that are in demand right now are businesses that are traditionally local like dentists and chiropractors.

Story continues below

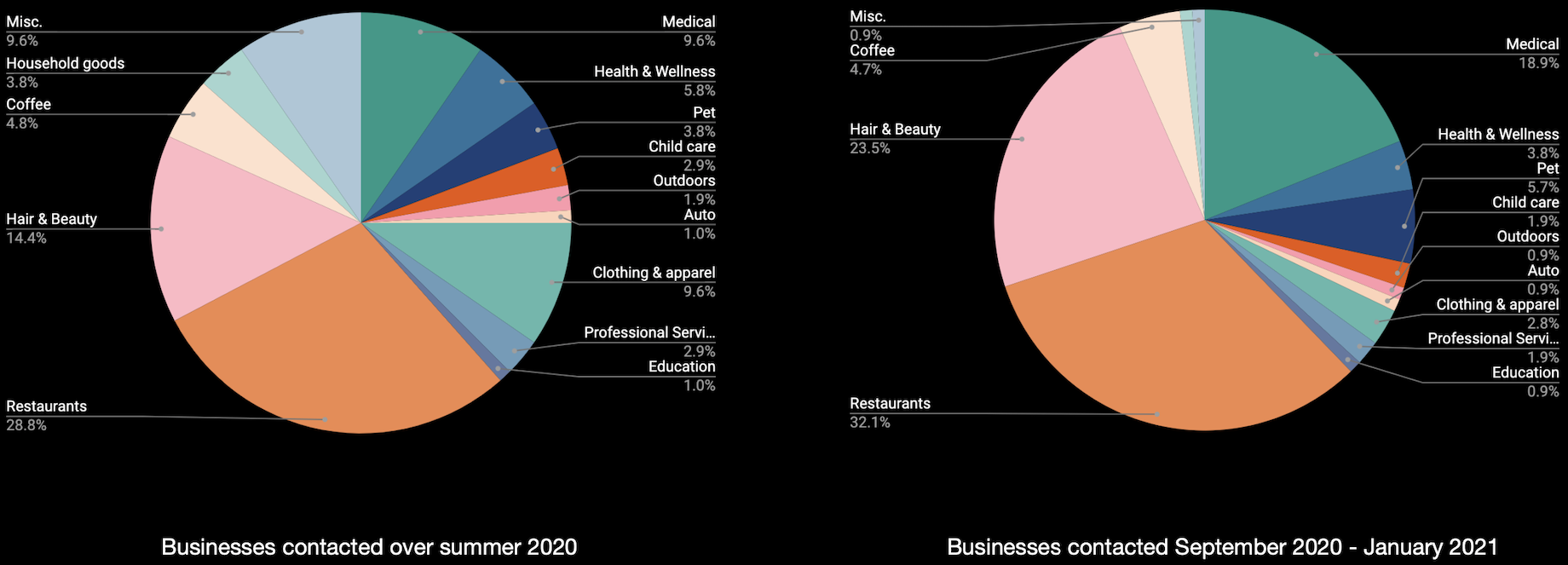

The potential tenants that Resquared users reached out to, based on a sample of more than 70,000

Thirty-two percent of all inquiries Resquared users put out to local businesses between September and January went to restaurants. Is that pretty typical? Are specific restaurants in demand?

If there were no such thing as COVID, restaurants would probably be 40 or 50 percent of this chart. Depending on the restaurant, timing has been tough. But certain type of restaurants – ones that do a lot of delivery or pickup or drive-thru like pizza restaurants, for example, are very much in demand right now and a lot of times are the ones looking for new space.

Will the quick-service-restaurant trend stay, then? Are landlords not as interested in the traditional sit-down-restaurant model?

It's as simple as: The businesses doing well right now are more open to discussing expanding locations or moving to more premium spaces. I don't think there is widespread belief that sit-down restaurants won't bounce back.

In the summer, medical tenants made up 9.6 percent of Resquared inquiries. From September through January, they made up 18.9 percent. What do you make of that growth?

Medical usage, in general, is seen as a good, long-term, stable tenant. Obviously, it’s an essential business. Dentists, actually, were probably one of the most in-demand tenants during the fall and early winter.

Story continues below

Resquared co-founder Tyler Carlson

Why do you think dentists are moving into shopping centers? Is it COVID related?

COVID is accelerating the trend toward medtail, and vacancies caused by COVID are part of the reason more retail space is now available for medical offices like dentists. It’s an opportunity for those types of businesses, who are very stable, to move into space where they get a lot better visibility.

One category for which inquiries declined, from 9.6 percent in the summer to 2.8 percent from September through January, was apparel. Any bright spots in this category?

Outdoors-oriented apparel — think bike or camping stores — are likely the one sub-segment that has been in high demand.

The most queried categories in the summer — restaurants, medical, and hair and beauty — are also the most in-demand now. What do you take from that?

That speaks to the mindset of [retail leasing professionals]. There were so many sharp changes through May with lockdowns. As soon as stuff started opening back up again, there was so much built-up energy and eagerness to get back into trying to lease up these spaces. And this mindset hasn't changed, even though lockdowns and the pandemic have persisted. Most people are looking to the future and not sitting around waiting for things to get better.

“A lot of the tenant categories that are in demand right now are businesses that are traditionally local like dentists and chiropractors”