The Short Version

- DealGround, a new proptech platform, uses AI to extract and organize property data buried in piles of offering memorandums.

- Co-founders Chris Rodriguez and Dan Mosher created the tool to help brokers turn scattered PDFs into searchable, actionable insights.

- DealGround launched at ICSC@WESTERN and counts users from major brokerage firms among its early adopters.

- Starting with retail real estate, the company plans to expand its AI-driven database to additional commercial real estate sectors.

Digitizing Offering Memorandums: The Proptech Streamlining Broker Workflows

Offering memorandums are standard-issue for marketing properties. They’re also chock-full of vital data like current lease terms and rent rolls, financial performance details, debt and internal rate of return. Brokers tend to be so inundated with these data-rich PDF email attachments that they get buried in email folders over years. Even if a broker did remember that an email had some information that might be helpful, they’d spend valuable time digging it up when needed.

In late September, property technology start-up DealGround introduced artificial intelligence to read those OMs, extract pertinent data and then place it in a personalized database for the owner of all those emails. It includes a searchable map interface that the user can query for quick results. The service reads emailed offerings that are forwarded by brokers. It can also read a broker’s past offering documents and those received privately, all of which remain the sole domain of the DealGround subscriber.

Chris Rodriguez and Dan Mosher formed the company in November 2024 after Rodriguez — who had until then been president of a boutique retail brokerage in Newport Beach, California — saw an opportunity for large language models to read and digitize such documents at scale. The concept, Rodriguez believed, would solve a challenge he’d been wrestling for years: organizing disparate pieces of data scattered throughout PDFs.

Rodriguez pitched the idea to Mosher, a Silicon Valley tech veteran he knew from their UC Berkeley days in the 1990s. “Chris was always telling me that data in commercial real estate was super fragmented and in a bunch of different silos,” said Mosher. “We put our heads together and built what we hope is going to be a command center for commercial real estate brokers. It will be a main hub where all their information on a deal can be assimilated and aggregated so that they can see a deal completely.”

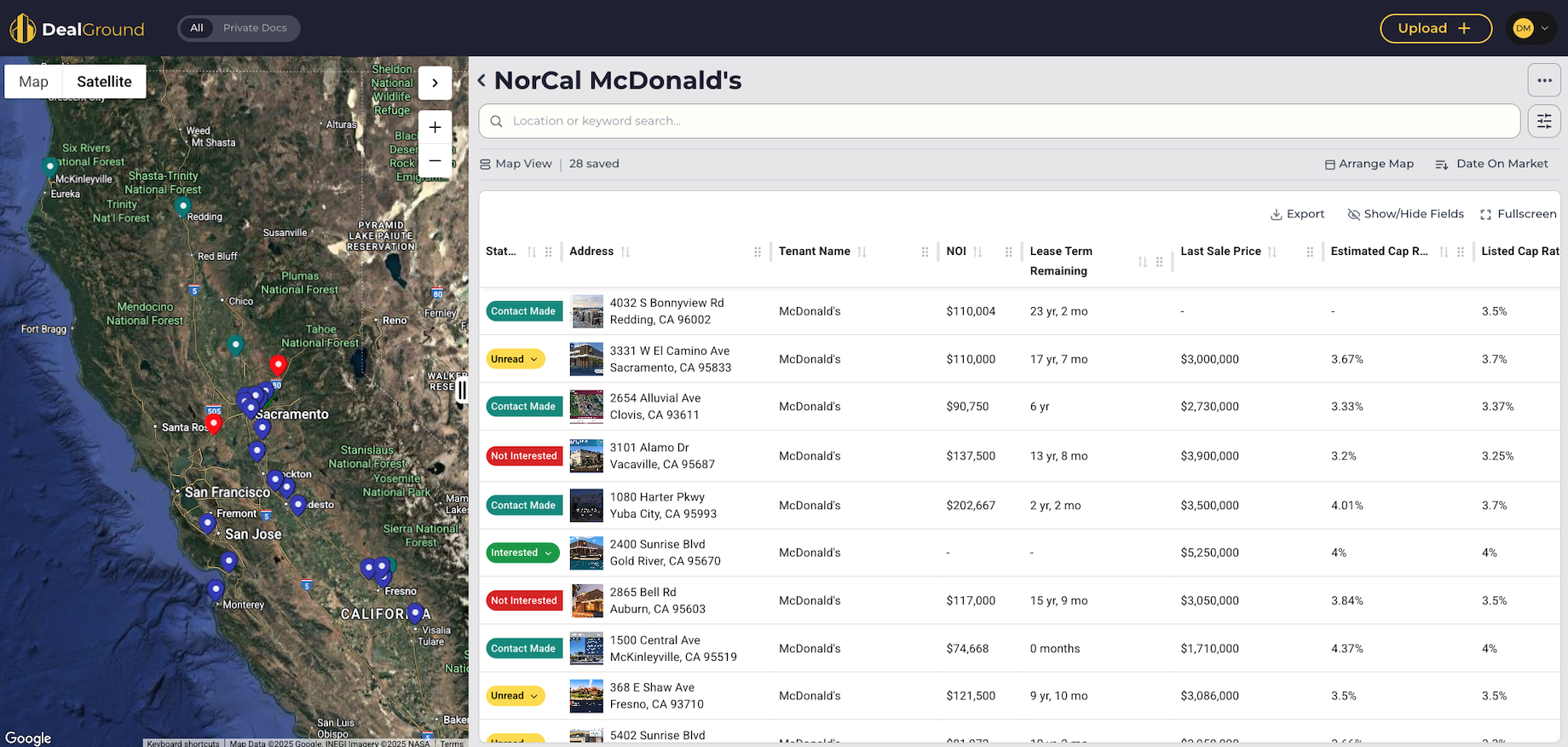

DealGround clients can search properties in various ways. This search for McDonald’s locations in Northern California filtered results by annual rents between $70,000 and $125,000. Image courtesy of DealGround

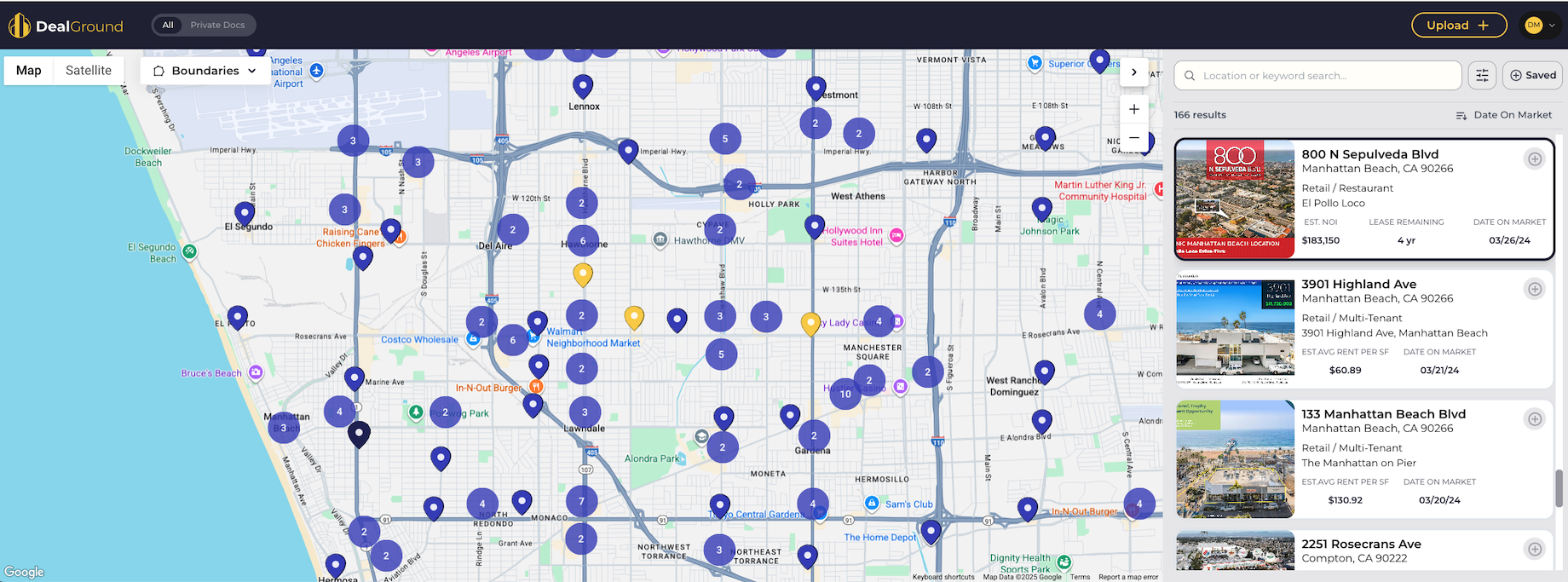

And this query for Manhattan Beach, California, looked at properties that had been on the market for some time in the past 10 years. Image courtesy of DealGround

From Beta to Breakthrough: Brokers Test-Drive DealGround’s AI Platform

DealGround introduced a beta version to customers in June and launched officially at ICSC@WESTERN in September. Ultimately, Mosher sees the AI-driven platform as the only database that brokers will need, replacing other services and systems used to collect and cobble together rent roll, capitalization rates, comparable sales and other financial and fundamental information.

For Colliers’ Ann Natunewicz — a senior vice president specializing in retail, restaurant, service and tech leasing in San Francisco —the platform represents a welcome advancement in real estate. Coming from a research background, she’s painfully aware of how much energy brokerage teams can spend finding and assembling data to drive transactions. “It’s easy to use, and the information is accurate; everything is in one place, and the interface is clean,” said Natunewicz. “It also helps you to prospect very efficiently, which is needed because you can spend a lot of time researching deals and going after clients that don’t go anywhere. With DealGround, you can screen and evaluate opportunities and then move forward or move on.”

Daniel Herrold, a Northmarq senior vice president who specializes in net lease sales in Newport Beach and is a member of DealGround’s advisory committee, said it’s not unusual to receive 400 to 500 offering emails each day. Despite best intentions to store the most relevant deals for later perusal, he added, they typically wind up as clutter. “DealGround allows you to retrieve meaningful property data from packages that you might have seen a month ago or five years ago, and you can slice and dice the properties in many different ways,” he said. “It makes information actionable and is certainly a big time saver.”

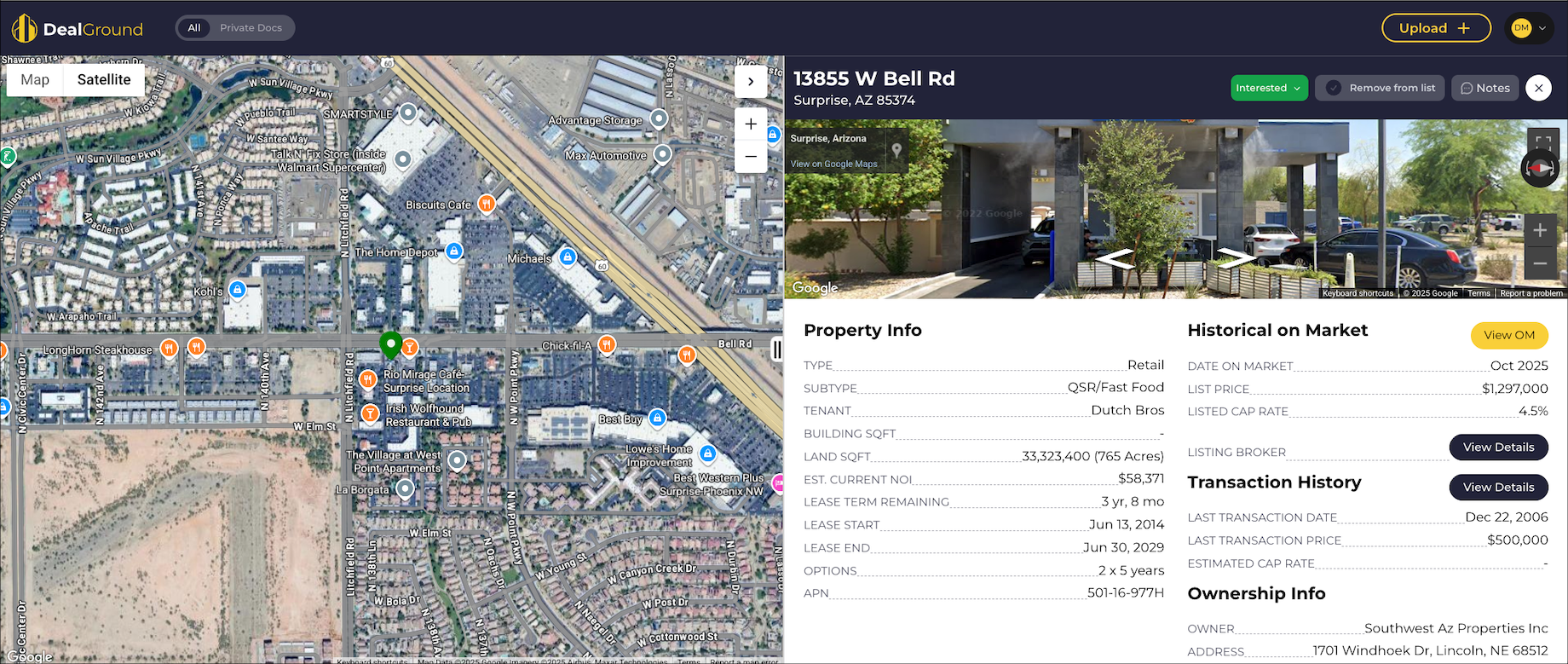

DealGround allows users to drill into a property’s details and offers context via a broader submarket view. Image courtesy of DealGround

Building a Smarter Database: DealGround Expands Its AI-Driven Capabilities

DealGround already is supplementing OM data with property trade history, tenant information and ownership information from First American Title. It plans to add more data, including tenant-sales volume, and will automatically update as properties change — rent increases, new tenants and new loans, for example — to create a “living, breathing” database, Mosher said.

Early DealGround adopters include teams within Marcus & Millichap Institutional Property Advisors, Franklin Street, Lee & Associates and True Equity Group, as well as independent brokers.

Brokers are using DealGround in numerous ways, including:

- retailer representation: A tenant rep for a client that plans to add locations could identify buildings with lease terms that are coming to an end.

- agency leasing: A landlord rep could identify retailers whose leases are expiring so as to offer an alternative property.

- due diligence: If preparing to sell a net lease property, a seller could discover the number of others that are on the market. The seller also could analyze cap rates, cash flows, building sizes and other characteristics of that operator’s sales over the past 10 years.

- speculative dealmaking: An investor could find off-market acquisition or disposition opportunities by identifying properties that haven’t sold in a number of years.

Why DealGround Started with Retail Real Estate

DealGround is focusing on retail real estate initially because of Rodriguez’s familiarity with the sector and its diversity of ownership, its liquidity and its size and breadth, with users as different as car washes, restaurants, grocery stores, clothing stores and medical providers in settings from single-tenant properties to lifestyle, mall and mixed-use assets, Mosher said. “The idea is to add the industrial, multifamily and office sectors in a similar execution path, and we’ve already looked at what it will take to go into those spaces. There are some different data elements to extract for each one,” he explained, “but we figured that if we could get retail right, then the next few would be easier because we’ll have perfected the model for a relatively complex property segment.”

By Joe Gose

Contributor, Commerce + Communities Today