The housing crunch is accelerating the trend toward ambitious remakes of enclosed malls, up to and including master-planned projects that are bringing thousands of residential units to individual sites first developed decades ago, experts say. These outsize projects typically are in major cities where real estate values and residential rents continue to mushroom, justifying bold moves like buying out anchor stores or replacing “sea-of-asphalt” parking with structured decks that can cost as much as $100,000 per stall.

While master-planned mall reinventions come with high costs and intense community interest, the developers, brokers, architects and redevelopment consultants who work on these projects say they can be big wins for those with the wherewithal to pull them off.

Finding a place to live is getting harder by the day. According to Freddie Mac, the U.S. needs to build 3.8 million new housing units just to stay on pace with the formation of households. In places where the crisis is most acute, governments are desperate to encourage the rapid construction of high-density housing. Passed in 2019 and extended last year, a California housing law, for example, speeds up residential project approvals, limits fees and makes it harder for local governments to use zoning downgrades to curtail density. Last year, Gov. Gavin Newsom announced plans to create 84,000 housing units across the state.

ALSO CHECK OUT: When Anchors Block Mall Redos

The acute demand for residential units is shaping many of architecture firm MG2’s reinvention plans for owners of enclosed mall sites, said architect and principal Mark Taylor. “We see it in just about every conversation that we are in around mall spaces,” he said.

The push is translating into truly large-scale mall-densification projects. Taylor cited two such efforts in British Columbia, Canada: The Amazing Brentwood and The City of Lougheed. His firm did retail planning and design work on both.

Nearly a decade in the making, The Amazing Brentwood is a joint venture among Shape, Healthcare of Ontario Pension and L Catterton Real Estate. Located in Burnaby, the master-planned, mixed-use development is growing up around the former Brentwood Town Centre, an enclosed mall from the ’60s. When all phases are complete, it will feature “world-class shops, restaurants, public plazas, entertainment and 6,000-plus new homes,” according to Shape. Phased openings are happening now.

The City of Lougheed will be even bigger. Built on 37 acres around the former Lougheed Town Centre enclosed mall, it will include 20 residential towers and more than 10,000 homes. Shape bills it as “Canada’s largest shopping, dining, residential and social destination … with parks, plazas, entertainment and culture at an unprecedented scale.” The first phase is set for delivery in 2023.

This past spring, Shape and Cadillac Fairview announced plans to ramp up the downtown Toronto site of CF Fairview Mall, which has served as a shopping hub in Toronto’s North York district for more than 50 years. The first phase, now under entitlement review, will bring 1.1 million square feet of mixed uses to the site, including condos, apartments, retail and a “village green” urban plaza. Cadillac Fairview also has teamed with residential and mixed-use specialist DiamondCorp to replace acres of parking lots at West Toronto’s CF Sherway Gardens with residential, office and retail buildings.

Just as in the U.S., the demand for housing in Canada far exceeds the supply and is accelerating mall-site densification and reinvention, said Molly Westbrook, executive managing director for Cushman & Wakefield Asset Services’ 30-mall Canadian portfolio. She moved from Utah to Toronto three years ago to take the job. “I thought the housing-supply situation would be better than in the States, but it is critical here, as well,” Westbrook said. “There’s an inherent need to build affordable housing across all major Canadian markets.”

Creative Destruction

It is no accident that none of those Canadian projects flattens the mall, noted John Crombie, Cushman & Wakefield executive managing director of retail services in Canada. “We have 35% less retail space per capita here than in the United States, so most of our malls are still quite productive,” he explained. “So tearing down a mall — you rarely see that in Canada. All of that said, retail is still probably the best asset to redevelop. Malls sit on a ton of land, and they generally have very few environmental issues like those that you could face with converting an industrial property.”

By contrast, over-malled markets in the States offer plenty of opportunities for ambitious developers to reinvent huge sites, partially or completely demolishing the underperforming regional mall, added Mark Gilbert, Cushman & Wakefield vice chair and Americas retail capital markets practice leader. Gilbert said Michigan, Georgia and Ohio are among the states with the highest gross leasable area of mall space per capita. “It’s natural that you’d see more malls being redeveloped in these states,” he said, “and they’re where we’re seeing a lot of the closures taking place.”

Lower-tier malls can represent a tremendous opportunity for companies with the capital resources and expertise to rethink them in ambitious ways, Gilbert said. He pointed to Edens’ 2021 acquisition of the nearly 60-year-old North DeKalb Mall in suburban Atlanta. “North DeKalb used to be one of the major malls in Atlanta, but the area became over-malled, and Edens is going to do a large, mixed-use redevelopment of that site,” Gilbert said. “The mall is ready for its next phase.”

Edens has not yet released full details for its planned transformation of North DeKalb Mall but has produced initial renderings, including the images above and at top. The company confirmed that plans include 1,700 multifamily units, 100 townhomes, 300,000 square feet of retail and 180,000 square feet of office.

Seritage Factor

Acquiring 100-acre sites for eye-popping sums isn’t the only way to take advantage of well-located mall real estate. As noted by Gilbert, the typical mall site was carved up into multiple parcels long ago, especially because major department stores always have preferred to own their own real estate. Throw in the parking lots around some of these anchor stores, and the acreage can be enough to support a substantial mixed-use project for any developer able to gain control of the parcel.

That’s precisely what Shopoff Realty Investments accomplished this past July when it acquired a 14-acre chunk of Westminster Mall in the heart of Orange County, California, for $46.3 million. The seller was Sears spinoff Seritage Growth Properties, which is selling dozens of retail, mixed-use and residential assets and has sought SEC permission to liquidate more than 160 properties, distribute the proceeds to shareholders and dissolve the company. With its parking lots and vacant Sears, the Westminster Mall parcel represented a rare opportunity in densely populated and affluent Orange County, said Shopoff Realty president and CEO William Shopoff, who is pursuing other parts of the 80-acre mall site, as well. Founded in 1992, his firm repositions properties and land, typically in partnership with banks, developers, builders and investors. The Westminster Mall site is “an incredible palette,” Shopoff said. “If I go to Dallas, I can find 80 acres of developable land. In Orange County, that just does not exist.”

The intense demand for housing in the Southern California county, even more acute than in other housing-deficient parts of the state, also favored the deal, added Shopoff executive vice president of development Brian Rupp. “The cities see properties like Westminster Mall as an opportunity to provide more housing,” he explained. “We have found that the planning directors and city managers are all getting more creative, more open and receptive to rezoning these properties. The timing for Westminster Mall could not be better.”

According to Rupp, municipal officials plan for as many as 2,550 housing units on the site of the 48-year-old, 1.3 million-square-foot mall. Westminster’s Target and Best Buy continue to perform well and could be integrated into the mixed-use redevelopment, along with office, hospitality, residential and new retail components, said CEO Shopoff. Kaiser Permanente also has preliminary plans for a portion of the site. “The city is preparing site-specific zoning for the property, and that will be the framework for how the site evolves,” he said. “It will likely have far less retail, but there will be more value to the overall community.”

ALSO CHECK OUT: House Passes Pilot Program for Adaptive Reuse of Malls

The scale of the project means it will take shape over years rather than months. “Touch base with us in three to five years, and you’ll know whether we made the right decision with this acquisition,” Shopoff said. “These types of projects are not quick, nor are they for the faint of heart.” The company is already engaging with the community, the municipality and placemaking experts to get started on a big-picture vision. “In reimagining this space, it is important to figure out a holistic approach,” the executive said. “Fortunately, we’ve got a forward-thinking municipality, which makes it easier.”

Nor does William Shopoff anticipate a quick sale of his firm’s stake once the project is underway. “We’re likely to be involved in the development and ownership of the residential component over the long term,” he said. “We see this as a generational-type asset.”

In the Works: A Few Examples of Master-Planned Mall Makeovers

Collin Creek, Plano, Texas: Centurion American Development Group’s $1 billion redevelopment of the 41-year-old mall is bringing 2,300 multifamily units, 500 single-family homes and 300 independent-living residences to Dallas-Fort Worth. The mixed-use transformation, now under construction, is set to offer 540,000-square-feet of retail, restaurant and service uses; 1.3 million square feet of office; and 200 hotel rooms. It will boast eight acres of parks and 1.6 miles of walking trails, according to a Centurion project page.

Eastern Hills Mall, Williamsville, New York: Uniland Development Co. and Mountain Development Corp. have unveiled their preliminary vision for transforming the 100-acre site of Eastern Hills Mall, which opened in 1971, into a mixed-use district with “about 1,500 residential units, 1 million square feet of office space, a brewery, several restaurants and a park for outdoor events,” according to Uniland’s website. The project “has the potential to become a new regional destination for both residents and tourists, as nothing on this scale currently exists in western New York.” The mall would keep running during phased construction.

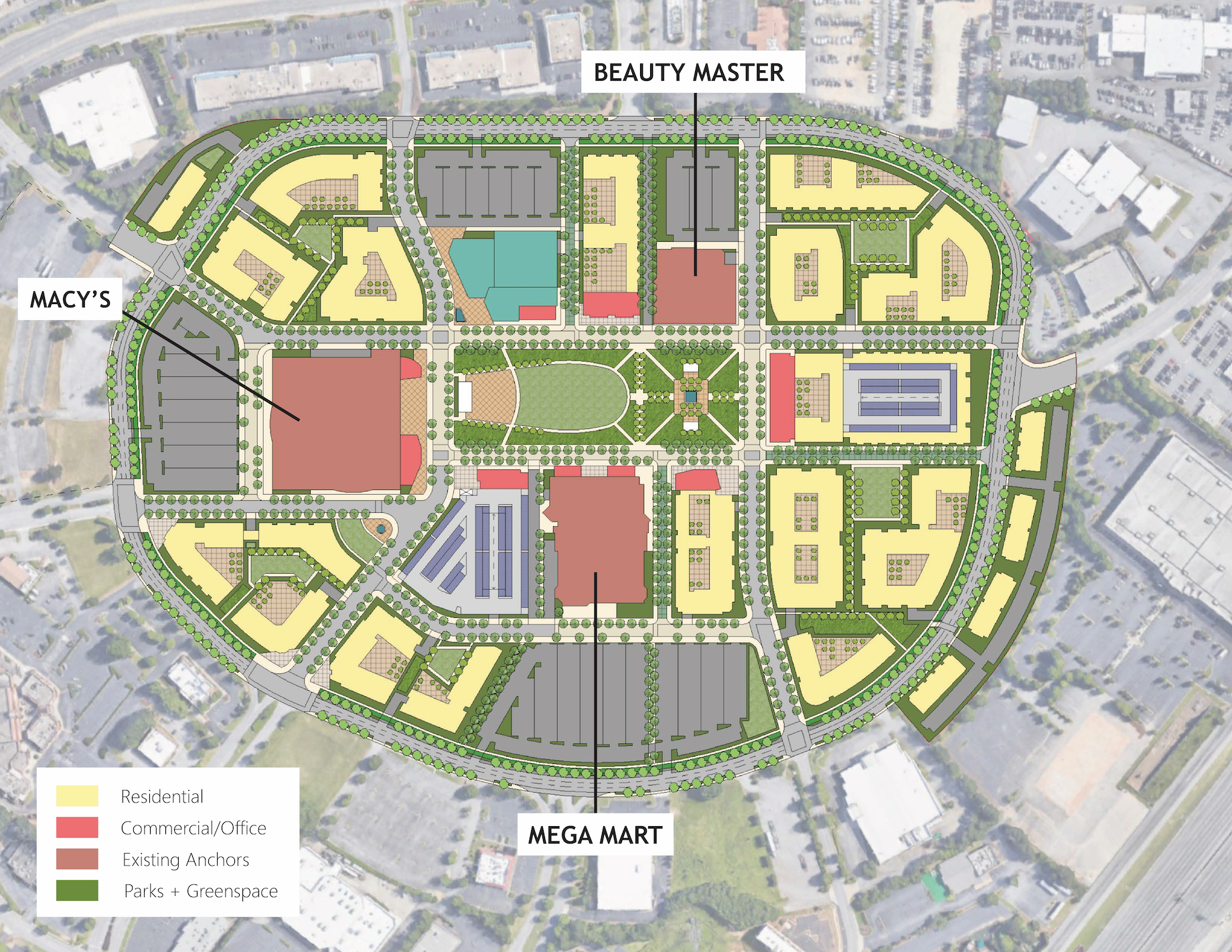

Gwinnett Place Mall, suburban Atlanta: This past July, a planning committee released more details about the “Global Villages” that could replace the county-owned mall, which opened in 1984 and made a cameo in the ’80s-themed Netflix show Stranger Things. Under the proposed master plan, seven individually designed areas would bring as many as 3,500 residential units to the 90-acre site. Macy’s, Mega Mart and BeautyMaster, which own their own real estate, would stay, according to the proposal.

Gwinnett Place. Image credit: VHB and Van Meter Williams Pollack

Metrocenter, Phoenix: Billed as the largest mall redevelopment project in Arizona history, the project is an alliance of Concord Wilshire Capital, TLG Investment Partners and Hines. The companies aim to redevelop the 68-acre site into a community with more than 2,600 multifamily units and 100,000 square feet of retail. The self-contained site will include a $150 million light-rail station, set to come online in 2024.

Metrocenter

Stonestown Galleria, San Francisco: Brookfield aims to densify the 40-acre site with 2,930 residential units, a 200,000-square-foot merchant corridor and as much as 200,000 square feet of office. It would boast six acres for parks, plazas, a town square and open space, with smaller cafes and shops sprinkled throughout. Expanded and redeveloped in the 1980s by John Field, the mall owes its origins to a smaller center built in the ’50s. A Brookfield fact sheet points to momentum at the existing retail center: “An 11-screen Regal Stonestown Galleria theater, Sports Basement and several smaller retail spaces opened in mid-2021, and Whole Foods opened in January 2022, all at the former site of Macy’s. Target expanded into the main floor of a former Nordstrom.”

Tri-County-Mall, Springdale, Ohio: The city plans to convert the 72-acre, Cincinnati-area mall into a $1 billion development with 2,400 apartments, 230,000 square feet of retail and restaurants, a hotel, recreation and education facilities, parks, and biking and walking trails. Garages with more than 3,000 parking spaces are all that would be left standing. Construction on the site of the largely vacant mall — Macy’s closed last year — could take as long as a decade.

Vallco Mall (aka Cupertino Square, Vallco Fashion Park), Cupertino, California: Sand Hill Property Co. this past March announced plans for The Rise, a 7 million-square-foot, redevelopment of the mall. It will boast “40 acres of open space and the largest green roof in the world,” with more than 2,400 homes; 429,000 square feet of retail, dining and entertainment space; and nearly 2 million square feet of office/lab space, the company said.

The Rise

Sand Hill Property Co. said The Rise will have the largest green roof in the world.

By Joel Groover

Contributor, Commerce + Communities Today