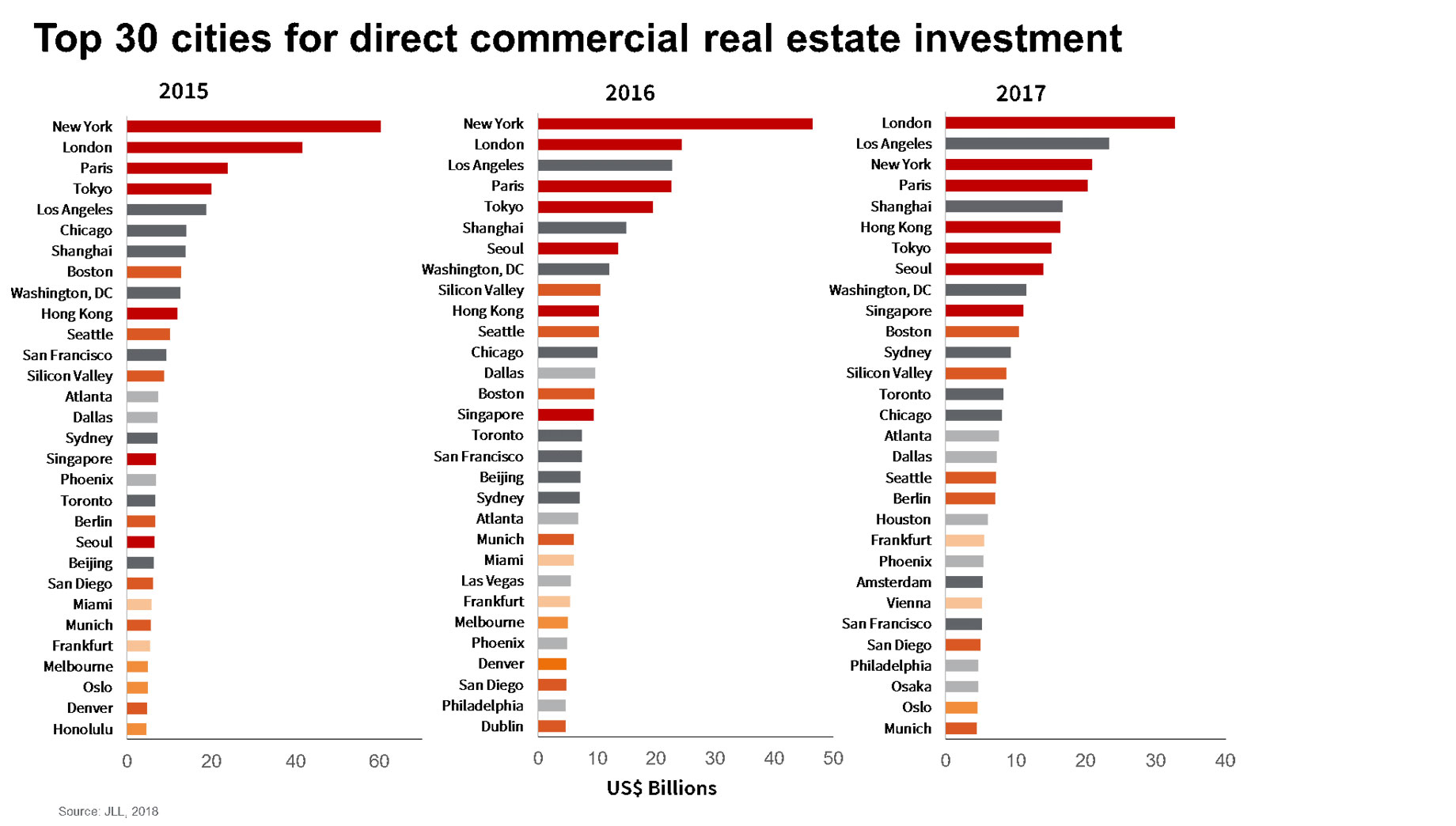

London was the top city for global real estate investment in 2017, according to JLL. Brexit-related uncertainty did not hamstring real estate investment, as had been feared.

The figures highlight that investment in London increased by 35 percent from what it was in 2016, to $33 billion in 2017. Los Angeles climbed to second place among the top 30, with $23 billion invested, while New York City dropped into third place, with $21 billion.

JLL says the latest data show resilience in the global real estate market, despite geopolitical uncertainty. Transaction volumes reached close to $700 billion for full-year 2017, exceeding the robust levels of 2016.

Investment activity is poised to stay strong, with the weight of capital that seeks access to the sector remaining significant and investors looking for new ways to deploy funds, according to Richard Bloxam, JLL's global head of capital markets. "It may come as a surprise that the London commercial real estate market has stood firm in the first full year after the U.K.'s decision to leave the European Union," Bloxam said. "2018 will see a number of key decisions during the negotiations and will give us a much clearer picture of what the post-Brexit future will look like."

“JLL is projecting that real estate investment volumes will be 5 to 10 percent lower in 2018 as the challenges of finding available assets, combined with continuing investor discipline, are likely to constrain growth in volumes”

Even with an expanding amount of capital targeting real estate, JLL is projecting that real estate investment volumes will be 5 to 10 percent lower in 2018 as the challenges of finding available assets, combined with continuing investor discipline, are likely to constrain growth in volumes. This evolution in the capital markets will push investors to consider new strategies and greater focus on entity-level deals, recapitalizations, refinancing and broader debt, as well as a wider universe of real estate sectors and cities, Bloxam says.

JLL bases its ranking on the relative performance of cities — including finance and business activity, investment profile, demographic diversity, innovation, infrastructure, global reach, quality of life, culture, governance and institutional framework. Among other factors: analysis of city size, GDP per capita, growth rates, industrial structure and level of in-depth experience working with hundreds of city governments and leadership teams.

JLL's World Cities: Mapping the Pathways to Success report is available here.

By Brannon Boswell

Executive Editor, Commerce + Communities Today