Grocers have a lot on their plates these days, but they’re still hungry for growth in both brick-and-mortar and online channels.

Many grocers captured bigger shares of consumers’ food dollars during the pandemic. Now these essential retailers are scrambling to find ways to hold on to that business. At the same time, the sector is getting bombarded with challenges that include stiff competition, growth in online sales and pressures to improve technologies, not to mention supply chain disruption, inflation and labor issues.

“There are challenges and opportunities,” said JLL Americas director of research James Cook. The pandemic forced everyone to focus more on supermarket shopping, allowing grocers to woo customers and grow sales. It also accelerated digital grocery sales fairly significantly, which is adding new pressures to a category that operates on very thin margins, he adds.

Momentum also is shifting in favor of dining out. February seasonally adjusted retail sales for grocery stores grew by 7.9% year over year, according to the U.S. Census Bureau. However, when adjusting for the 7.9% inflation, that growth is flat. Over the same period, sales at restaurants and drinking establishments jumped 33%. “We’re having a bounce back in going out to eat,” said Cook. “Although that hasn’t taken further share away from grocery, I think there is a chance that it will.”

Grocers responded quickly to pandemic challenges, and they will need to continue to innovate and retool to withstand market pressures. However, solutions run the gamut from revamping stores to expanding mobile order and delivery platforms. In order to retain and grow business, grocers can’t offer the same traditional footprint, noted Colliers retail research analyst Nicole Larson. “We should see grocers start decreasing their footprint, adding more technology into their stores and adding more omnichannel offerings.”

Colliers Retail Services national director Anjee Solanki noted: “It’s all about convenience, and from there, the next piece is price and how do you start to create a pricing strategy in a competitive marketplace with all of the other factors like inflation and labor issues.” It’ll be interesting to see how these issues impact store strategies over the next six months, she added.

Fighting for Market Share

Grocers are bracing for slower growth. According to IBISWorld, U.S. supermarkets and grocery stores generate $756.6 billion in annual revenue. The research firm projects that growth will slow to an annual average of 1.5% through 2026, nearly half the 2.9% annual growth rate that occurred from 2016 to 2021. Grocers looking to outperform the market are rallying around two key strategies: value and experience. “Every grocer is going to have to differentiate themselves in one or the other,” said Cook.

Although price wars are nothing new to grocers, a number of brands are increasing their focus on the in-store experience, from expanding specialty food sections that cater to keto, vegan and gluten-free diets to adding in-store baristas, juice bars and sushi chefs. H-E-B, Schnucks, ShopRite, Hy-Vee and Whole Foods are among those that have rolled out food halls at select locations where people can stop for a bite to eat or to grab a beer and watch a game on the big screen. Uncle Giuseppe’s Marketplace opened its 10th location last fall, at Urban Edge Properties’ Briarcliff Commons in Morris Plains, N.J. The Italian grocer features a number of specialties, including a room where customers can watch their pasta being made from scratch and a selection of cheeses from around the world that includes the grocer’s own daily-made mozzarella. “We love their concept,” said Urban Edge executive vice president and COO Chris Weilminster. Urban Edge also has inked recent deals with Aldi and ShopRite.

Grocers also are differentiating themselves by bringing in new brand partners. Hy-Vee has announced a number of store-within-a-store concepts at select locations, including DSW footwear, Joe Fresh apparel and The W Nail Bar among others. Last November, Kroger announced a collaboration that will bring Bed Bath & Beyond products to its stores.

Steady Store Growth

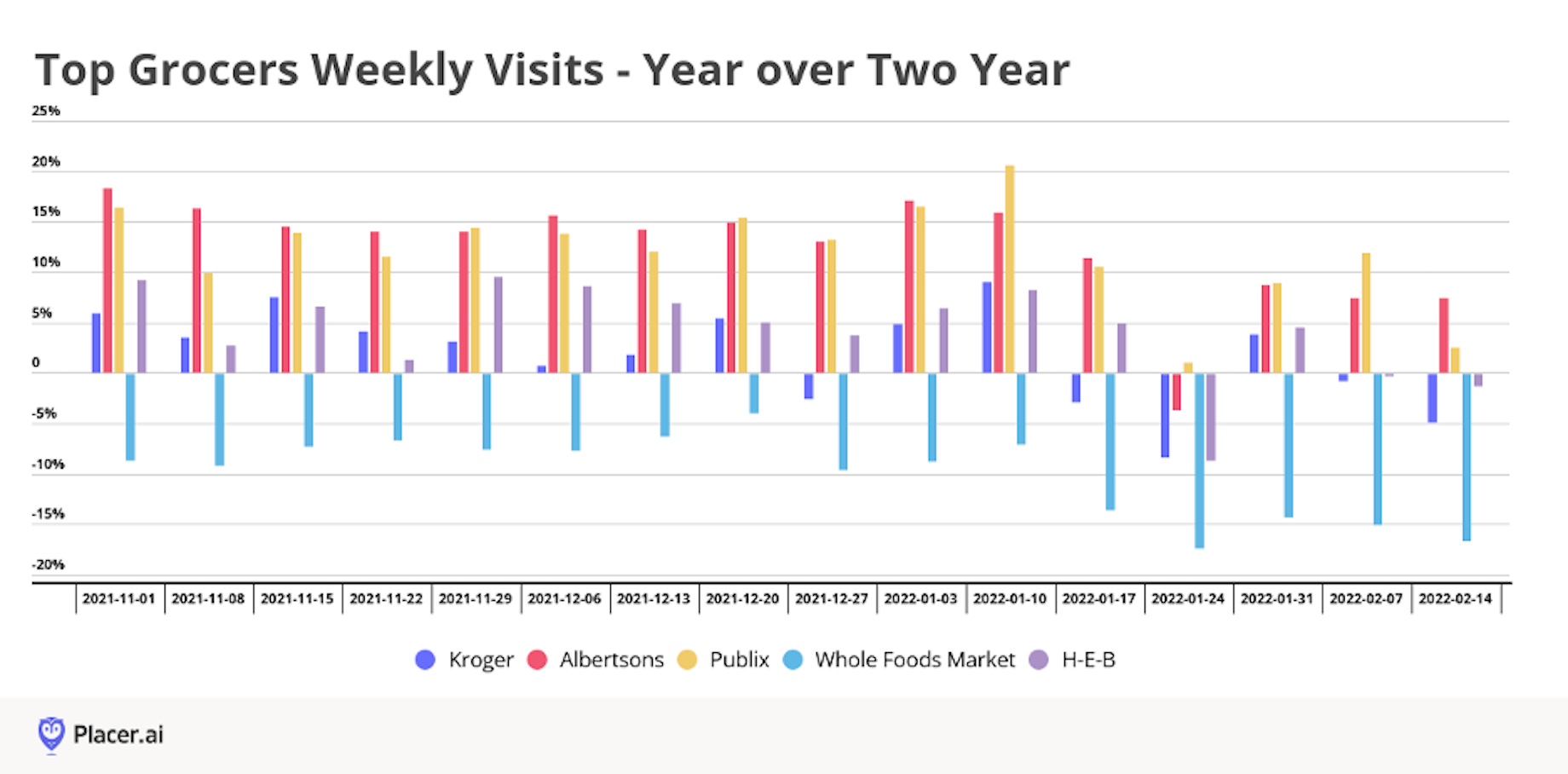

Grocers remain a key anchor for landlords, and foot traffic remains strong. Nationally, weekly grocery visits for the week of Feb. 28 were up marginally, at 0.9% year over year, according to Placer.ai. However, it remains to be seen how the rise in e-commerce sales could impact in-store traffic and store strategies.

COVID fueled a rise in online grocery sales, as it did in many other retail sectors. According to IBISWorld, annual growth in the U.S. averaged 25.7% from 2016 to 2021, and total revenue reached $36.7 billion in 2021. Moving forward, revenue growth for online grocery sales is expected to moderate to an annualized rate of 5.4%, reaching $47.8 billion by 2026. “The grocery segment is putting quite a bit of capital into e-commerce because they definitely see that as a great vehicle for them to increase sales and grow brand presence without opening 10 stores in a market,” said Solanki.

However, many are keeping their feet on the gas on new-store expansion, as well. Notably, Aldi announced in February that it plans to open 150 stores this year, focusing on the Southeastern U.S. The company will open a 564,000-square-foot regional distribution center in Loxley, Alabama, this year to support stores in Louisiana, Alabama, Mississippi and the Florida Panhandle. Seeing where these grocers have distribution centers provides some insights into their footprint and opportunities for additional store growth, noted Solanki.

Publix, Trader Joe’s, Whole Foods, Lidl and Amazon Fresh are among those expected to open between 10 and 30 stores this year. New local and regional players also are in growth mode. For example, Chicago destination grocer Dom’s Kitchen & Market opened its first location last June. In addition to the standard grocery fare, the store features a cafe and bar and several “show kitchens” that offer everything from made-to-order pizza and sandwiches to sushi. A second Chicago store is set to open this fall, and the company aims to have 15 stores in the Chicago metro by the end of 2025.

Grocers across the spectrum display robust demand for space, and they remain keenly focused on the particular demographic and customer profile they’re trying to serve, noted Weilminster. Landlords, meanwhile are mindful of the tipping point at which some markets could become oversaturated. “We are very careful in the operators that we choose to put in our portfolio and anchor our shopping centers,” he said. “It really boils down to the community that you’re serving to make sure you’re putting the right grocer in place, as well as looking at the capitalization of that grocer.”

By Beth Mattson-Teig

Contributor, Commerce + Communities Today