Almost a year into the pandemic that changed our lives, we are seeing the light at the end of the tunnel. Geolocation data allows us to monitor on a daily basis how the pandemic has affected every retailer and more.

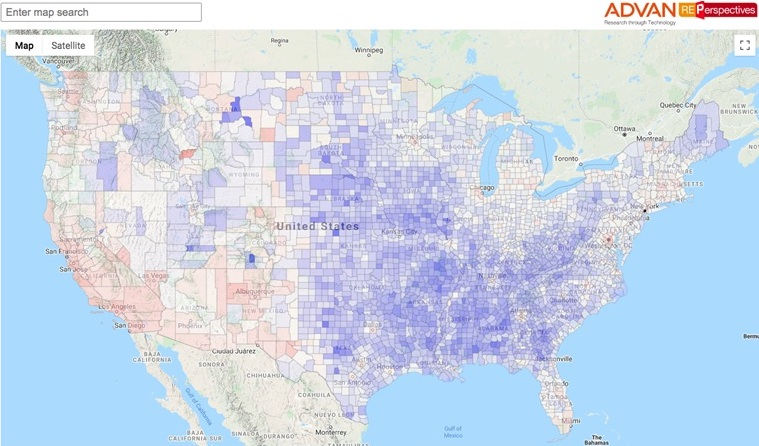

The big picture is that the U.S. population has moved to rural areas, as measured by Advan’s REPerpsectives tool. While the picture below visually displays this for the last 12 months — blue where people have moved to and red where people have moved from — the results are not that different if we look at the first three months of this year. It is still the same counties that experience the most significant growth/decline.

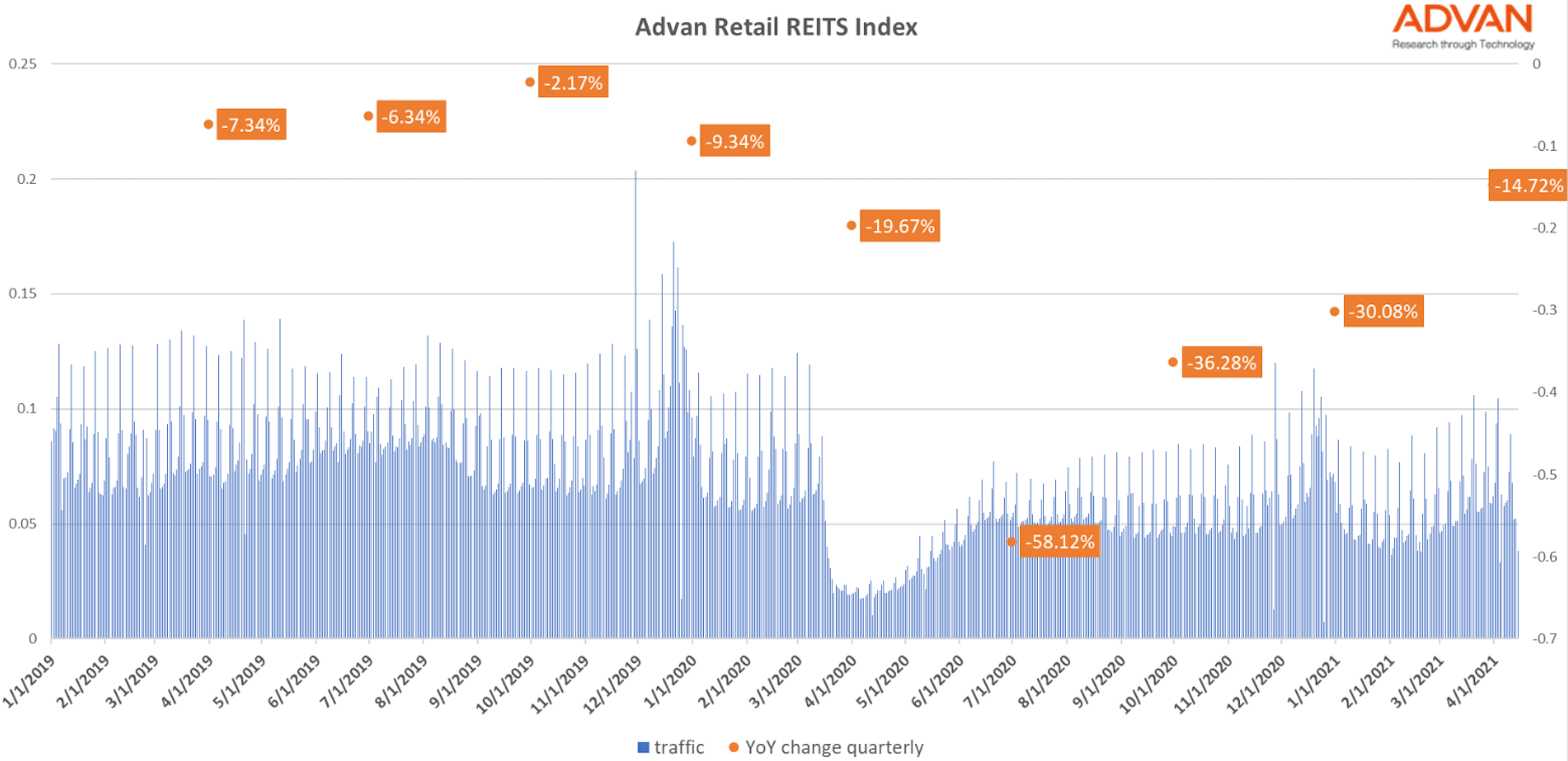

The Advan Retail REIT foot traffic index that is composed of all the retail REIT properties in the country is, at the first quarter of 2021, down 14.72 percent compared to the same period last year. There is significant difference, though, between growth states like Missouri, Indiana, Washington and Massachusetts that are overperforming and other states mainly throughout coastal America that are still down 50 percent compared to pre-pandemic levels.

The leaders and followers as measured by foot traffic retail indices

Restaurants

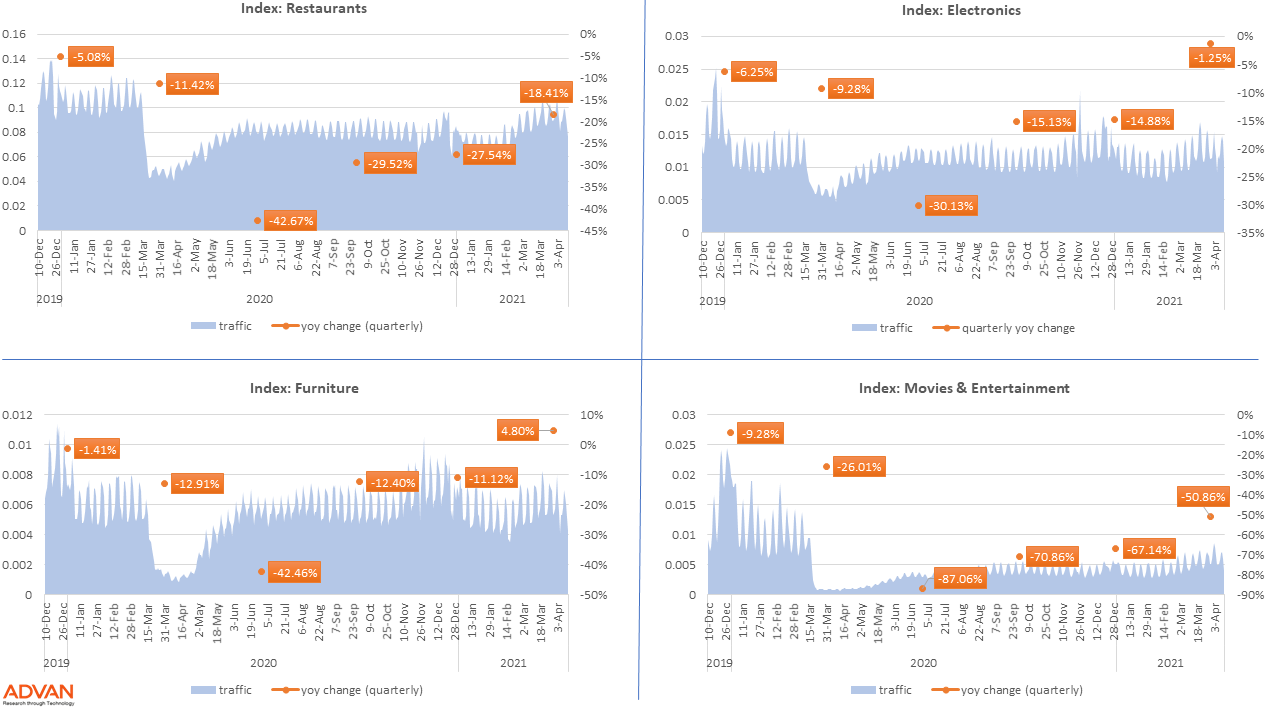

Restaurants are slowly approaching normality, with visitation being almost at pre-pandemic levels. The foot traffic for this past quarter was down 18.41 percent compared with the same period last year. It’s worth noting that the Advan Restaurants index is correlated at 0.97 with the FRED Advance Retail Sales: Food Services and Drinking Places index.

Furniture stores

There was a significant trend during the pandemic in which Americans spent time on home improvement. Advan captured record visits at homebuilder/home improvement sites. The Advan Furniture stores index is a good example; foot traffic rose 4.8 percent year over year in the first quarter. It’s worth noting that the Advan Furnitures index is correlated at 0.96 with the FRED: Retail Sales: Furniture and Home Furnishings Stores index.

Movie theaters

Movie theaters are significantly lagging on the recovery, making them one of the worst retail performers thus far. Foot traffic declined 50.8 percent year over year in the first quarter. Cineworld just announced it will reopen about 500 Regal theaters starting this month with up to 50 percent capacity, so we expect a significant increase in traffic across all such theaters throughout the country and will be monitoring it closely. It’s worth noting that the Advan Movies & Entertainment index is correlated at 0.942 with the IMDB official box office tickets data.

Electronics

Electronics store foot traffic is almost where it was before the pandemic. Considering that many consumers purchased a lot of electronic goods online last year, it is surprising to see how well these stood throughout the pandemic and that they are currently almost flat at the pre-pandemic levels. The results vary, though, when analyzed on a per-state basis, with some states significantly outperforming others.