Some shopping center owners are already wondering if pandemic-related business disruption will put them behind a financial eight ball.

Not so fast, says Greg Maloney, JLL’s president and CEO of retail, offering up a dose of cautious optimism. “We have been through challenging issues in the past, and we will get through these issues as well,” Maloney said.

“There are some extenuating circumstances that the retail industry hasn’t experienced before on this type of national level, but owners have had other experiences on a local level, such as hurricanes or fires in California or the flooding in Houston.” Thus, he says, there is some know-how and general familiarity on ways to deal with retailers and lenders in regard to business disruption.

The concern among some is that the shutdown of stores, restaurants and, in some cases, entire shopping centers, will immediately lead to tenants not paying rent. And that would ripple through the broader retail industry, as property owners would then struggle to make their own debt-service payments.

“The operative word right now is uncertainty,” noted Manus Clancy, senior managing director of applied data, research and pricing at Trepp, a New York City–based analytics firm serving the securities and investment industries. “People are hopeful that we could see things open in a couple of weeks, but at the same time, people can’t rule out mall closures, school closures and people working from home three months from now.” Some retailers are already “running on fumes” and lack the financial ability to pay the rent, notes Clancy.

As for those that can pay, are they willing to? Some argue that if a shopping center has closed, its tenants should not be obligated to pay rent. Another argument is that tenants on percentage rent structures should not be obligated to pay rent if they have not sold anything. Among other questions: whether COVID-19 is an event that is covered under business insurance, and whether any tenant has the ability to withhold rent under the terms of its lease. “Some of those questions are easy,” said Clancy. “For others, it may be a question that needs to be figured out over time.”

Defaults in the future?

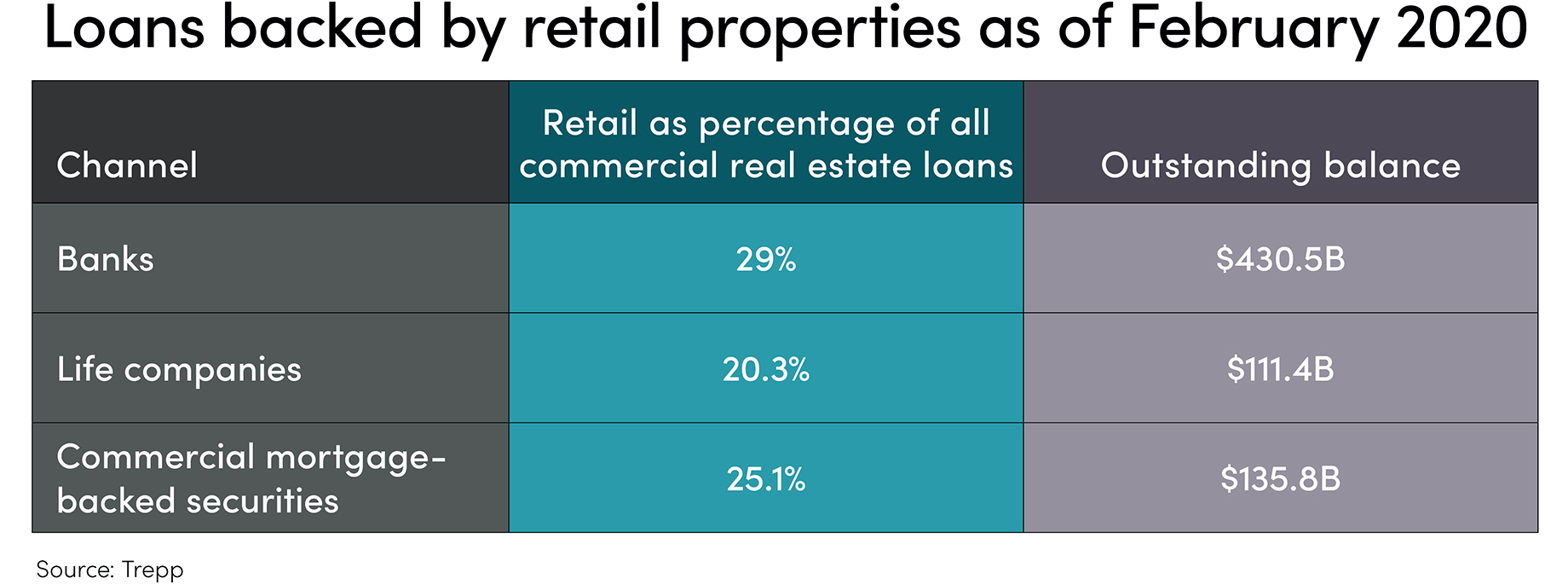

The bigger question is whether business disruption and a bigger shock to the economy will fuel an increase in loan delinquencies. According to Trepp’s February 2020 CMBS delinquency report, retail-backed loans had a delinquency rate of 3.62 percent. Given the emergence of closures in March, Trepp expects retail delinquencies to start showing up in data in April and then to accelerate the following month.

Most loans do have grace periods, so the thing to watch for in April is how many are using them, observers say. “If there is going to be a real uptick, which would not be shocking, we would probably see it in the number of loans that went 30-days delinquent in May,” said Clancy. Additionally, in April there is likely to be an increase in service comments with requests from borrowers for relief. Among the forms such relief could take are that borrowers are allowed to make interest-only payments, Clancy says, or it could mean a rate reduction.

A recent Morgan Stanley report had a fairly pessimistic outlook for the broader commercial and multifamily mortgage market, which as of the fourth quarter totaled $3.7 trillion in outstanding debt. The report notes that many landlords will be unable to service their debt if tenants cannot or will not pay rent as a consequence of COVID-19 hardships. “These borrowers will need forbearance from their respective lenders, but that will require a modification of loan documents, and we believe the system is simply not prepared to respond to the wave of requests that are likely to be received,” the Morgan Stanley report says. Moreover, such stress could cause accelerating defaults, a freeze of commercial real estate lending, widened spreads and a negative effect on property valuations.

Retailers can come forward and say they are not going to pay rent because they are in dire straits, and that does create a trickle-down effect to property owners and the bills and people they have to pay, says Maloney. “So without government intervention, it could be catastrophic,” he said. “But, hopefully, by the end of this week we will have more clarity on how we’re going to get through this. And we will get through this, but everyone has to be a little bit patient.” Generally, the retail industry is taking a bit of a wait-and-see approach to see what government assistance or subsidies will be available, he added.

Different properties, different impacts

COVID-19 is likely to magnify what was already a bifurcated market. The current crisis could be the final blow for retailers that were struggling with high debt and very little liquidity. According to a Moody’s report, the U.S. retail industry is “battening down for an unprecedented mix of woes.” Moody’s is forecasting a pullback in discretionary spending that will result in a roughly 3 percent decline in U.S. retail sales this year. The report notes too that “financial flexibility is a key weapon” as the retail industry battles a multitude of downside risks.

Those retail sectors and properties that will have an easier time bouncing back include the upper-end, class-A malls and the necessity-based, grocery- or drugstore-anchored retail centers. The crisis is likely to hasten the demise of those class-B malls that were already in a downward slide owing to the loss of anchors and other in-line tenants, Clancy says. But what about those malls in the middle — those that were hanging on to occupancy and finding ways to adapt to the new, experiential retail market? Well, those that were on the edge of making it then are now seeing a tough road ahead, and some may even decide to give the keys back to the lender, Clancy asserts.

On a positive note, there are lessons from the last recession that can help borrowers and lenders weather this current climate: Leverage levels and property valuations have not been nearly as frothy as they were in 2007 and 2008. “I think we are starting with a more stable foundation in that regard,” said Clancy. At the same time, a shutdown of operations and foot traffic for what could be 30, 60 or 90 days is unprecedented. This is new territory and a new risk, he cautions, and it could weigh on retail in ways that were not even considered 10 years ago.

By Beth Mattson-Teig

Contributor, Commerce + Communities Today