From interactive wayfinding kiosks to curbside pickup, from same-day delivery to centralized merchandise returns and varying degrees of online shopping, retail landlords are stepping up investment in shopping center-wide technologies. By offering customer-facing features and services, these property owners are connecting directly with shoppers to provide richer, more seamless retail experiences that drive foot traffic and sales to their tenants. Looking forward, innovation may bring new revenue streams to supplement landlords’ rental income as tenants increasingly rely on omnichannel sales.

The COVID connection

While some retailers already were offering conveniences like the option to buy online and pick up in store, or BOPIS, adoption accelerated during the pandemic as stores competed more intensely with e-commerce sellers. Many large shopping centers, including Mall of America, instituted curbside pickup stations to coordinate the growing volume of curbside exchanges between retailers and customers.

Now, Mall of America is exploring technology to bridge retailers’ systems and enable customers to collect, at a shared curbside station, merchandise from multiple tenants. At Mall of America, that may mean an employee will need to carry merchandise half a mile to a curbside station. "From a guest perspective, it is more convenient, but from the tenant perspective, it's not as easy to have to go across the mall," said Mall of America executive vice president of marketing and business development Jill Renslow. "Ultimately, we would love to have a partner for curbside that also has a delivery component. The more you align these technologies and have infrastructure to support multiple facets, the more you really find success."

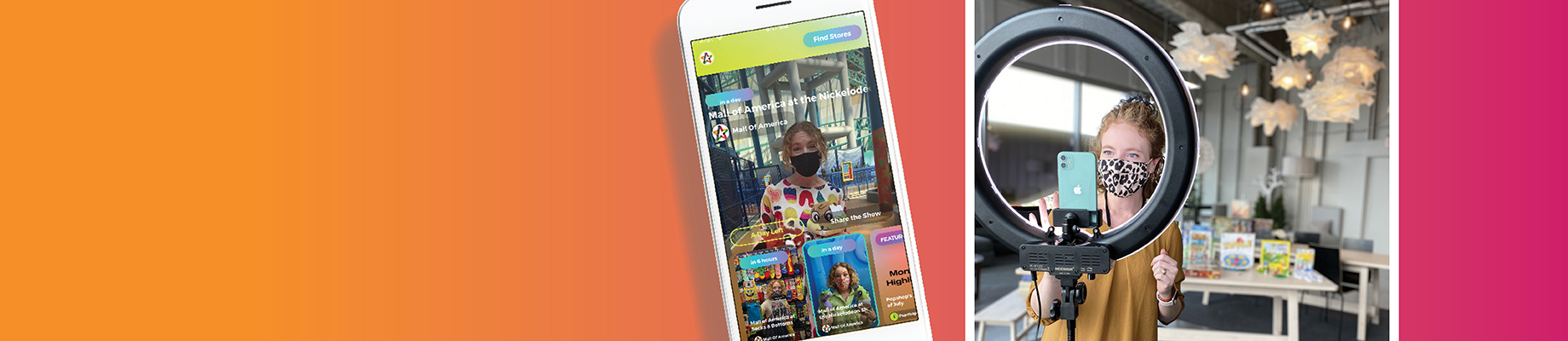

Mall of America rolled out centralized returns in partnership with Narvar in December 2020. Customers can return items at the drop-off spot for any retailer Narvar supports, even brands that don’t have a presence at the mall. Other innovations at the center include Livestream Shopping events via the Popshop Live app, which enables customers to view and interact with a host as he or she broadcasts live from stores in the mall. Livestream Shopping pre-dates the pandemic, Renslow said, but it gained a stronger following as customers sought alternative ways to shop. "The retailer benefits from Livestream Shopping because the purchase is happening in the brick-and-mortar store. It allows that direct connection with the customer, and they can send out marketing messages to incentivize customers through Livestream Shopping."

Mall of America tenants can request Livestream Shopping events. On the back end, when a viewer makes a purchase through the app, the mall buys the item from the retailer and ships it to the customer. The retailer provides a discount for that purchase to cover the shipping cost. "We are absorbing a lot of the administrative costs because that is a service we want to be able to provide," Renslow said. "It is an added value for the tenants at Mall of America."

Mall of America Livestream Shopping host Madelyne Riley

ICSC research shows consumers value many of the technology services landlords offer. In a survey of 1,003 U.S. consumers conducted between March 19 and 21, 18 percent said centralized pickup locations for merchandise ordered online would drive them to visit malls sooner or more frequently, and 17 percent would do so if malls offered central locations for product returns.

Respondents also expressed expectations for retailers; 28 percent cited touchless technology, 26 percent called for loyalty programs, 23 percent mobile apps, 23 percent more engaging/user-friendly websites, 14 percent personalized offers or recommendations and 14 percent the ability to shop through social media and/or livestreamed shows.

Capital expenditures

Aware of changing consumer expectations, retailers and landlords have grown more open to investing in technology and innovations for their bricks-and-mortar properties, according to several technology providers and advisors. Significantly, technology is becoming a capital expense at some organizations rather than a marketing budget line item. "They're realizing that cost for technology tools shouldn't necessarily fall on marketing," said Jesse Michael, managing director for artificial intelligence and e-commerce company Adeptmind. "In that respect, we're working more with COOs and CIOs."

John Dee, Americas president for retail technology platform provider Placewise, concurs that retail real estate owners feel urgency to upgrade the technology at their properties. He attributes that largely to consumer expectations for convenience and omnichannel services. "COVID was an eye-opener for a lot of shopping center owners, to see the ease with which the holdouts transitioned to e-commerce, and it made it clear that you have to be there. The need [to fund innovation] has absolutely hit the C-level at this point. They realize they need to be more participatory, and that change needs to happen sooner than later."

In fact, landlords' and retailers' increased spending on technology and innovation is one of three trends shaping the adoption of shopping center technology, according to Michael. The other dominant forces, he contends, are landlords' desire for visibility into tenants' online sales and the need to "future proof" shopping centers to succeed in a digitally connected world.

Omnichannel landlords

In an industry in which tenants commonly pay a portion of gross sales to landlords as percentage rent, landlords have been searching for ways to quantify omnichannel sales fulfilled by the retailers in their shopping centers. Some property owners are gaining visibility into those sales, however, by helping to fulfill their tenants' online orders. And competitive pressure from e-commerce is making many retailers put aside their traditional reluctance to share sales data, according to David Blumenfeld, co-founder of real estate technology advisory NextRivet. "Because everybody is in a more challenged position, there is more desire to collaborate than ever before, and when you talk about fulfillment, you start to tap a win-win for both the retailer and the mall operator — and the couriers, as well."

RELATED: Percentage rent leases: How could click-and-collect sales factor in?

Due to scale, a mall owner that coordinates curbside pickup and same-day delivery for its tenants will incur a lower cost per order than an individual retailer can achieve, Blumenfeld explained. Delivery drivers extract a similar benefit when they make multiple deliveries on each trip. "The consumer is forcing some of these small to medium-sized retailers to do same-day delivery, but they're doing it at a cost," he said. "They see the mall operator not as adversarial but in a supporting role."

Landlords like Centennial are providing retailers with end-to-end support in the form of online marketplaces. Centennial started the rollout of its Shop Now e-commerce platform in September. The first phase enabled shoppers to search a mall's website for merchandise from tenants' stores, add items to a cart and check out in a series of transactions using each retailer's e-commerce system. Shop Now’s second phase, set to begin rollout this month, will introduce single-cart, single-transaction checkout for items purchased across the mall’s retailers.

RELATED: The new elements in Centennial’s shopping center-level e-commerce platform

Centennial staff will fulfill the order, essentially purchasing the items from tenants' in-store inventory. That means shoppers can buy items from any retailer at the property, including those without their own e-commerce capabilities. "The logistics are intense, but we feel confident we will be able to deliver the service," Heydon said. "Based on the pilot, we will decide how to roll that out to multiple locations." Customers then will be able to collect their merchandise from a central facility at the mall or to schedule same-day local delivery.

As digital extensions of the shopping centers, these platforms let consumers shop online from the stores in their local malls and receive their purchases the same day. "It turns the mall into a mini, localized, Amazon-type of experience for customers," said Centennial senior vice president of marketing Colleen Heydon. "At the end of the day, it enables the shopping centers to compete head to head with top online retail platforms."

Online marketplaces need product feeds from tenants' stores to track accurately merchandise that’s available for same-day pickup or delivery, said Dee, which will launch an online marketplace for a shopping center in Norway in May. Not all retailers have real-time tracking of onsite merchandise, he said, but that capability has become more common in the past year. "Retailers have developed those feeds because they know they need to do things like curbside and BOPIS, and without that ability, customers are unable to look at the local inventory."

In addition to driving omnichannel sales and increasing tenants' visibility to online shoppers, digital marketplaces provide landlords with valuable sales data. Together with other forms of data analysis, this can help landlords prove tenant sales, observes Adeptmind’s Michael, whose company developed the digital marketplace behind Shop Now. "Historically, they have not had the same visibility into sales," he said. "That has an impact on rent and lease negotiations."

Future proofing

The industry is working to keep real estate relevant to a digitally enabled future. Part of the solution, Michael says, is to embrace new revenue sources and property-wide technology that will drive foot traffic. Digital marketplaces do both, offering local customers access to the group of retailers at a shopping center, and providing businesses with opportunities to reach local mall customers with targeted advertising.

"Traditionally, the revenue stream for landlords has been rent. It is our objective to give them the data and analytics to create a new media channel or to help the sale of digital real estate," Michael said, referring to a mall's digital marketplace. "This essentially becomes a profit center for the landlord and for the individual mall or for the marketing team. They can use this as a closed media channel to drive advertising revenue or for promoting products."

Scalable improvements

Landlords with large portfolios can reduce some costs associated with property-wide technology, but even owners of single shopping centers can employ relatively low-cost improvements to help their tenants succeed, said NextRivet’s Blumenfeld. An owner could operate centralized curbside pickup for its tenants with basic warehouse management software, for example.

Upgrading buildings’ mechanical and control systems could reduce energy costs, thus lowering tenants' operating costs, he said. And landlords can help themselves and their tenants by subscribing to data analysis services, which not only can map foot traffic but also can clarify foot traffic’s relationship to sales performance and the relative value of locations within a mall.

For more involved efforts like digital marketplaces, landlords can limit their costs by subscribing to a platform as a service rather than developing and own their own marketplaces, providers suggest.

At Colony Square, a mixed-use center under redevelopment in Midtown Atlanta that includes 160,000 square feet of retail, restaurant and entertainment space and a 10,000-square-foot green space called The Plaza, developer North American Properties has installed several consumer-facing technology improvements. A content management system controls 45 digital assets, including interactive and non-interactive LCD kiosks; a large-format LED display that streams concerts, sporting events and other content in The Plaza; and touchscreen elevator displays. Managers can access the cloud-based system from anywhere.

These systems elevate the customer experience and create a sense of community that draws visitors, says North American Properties digital and innovation manager Jay Yu. In turn, Colony Square's success as a gathering place attracts shoppers and diners and powers leasing for office, residential and retail space alike. While there are opportunities to sell advertising on some of these tech assets, such as the touch-screen elevator displays, the developer's return on its investment comes chiefly through the effect on leasing, Yu says. "We paid for all this technology through capital from our redevelopment, at no cost to guests or to tenants. For us, it is more about the heart share than market share. Providing these services free of charge helps us attract and retain the best tenants."

By Matt Hudgins

Contributor, Commerce + Communities Today