Only one month into the 2023 legislative session the fight between conservative lawmakers and financial firms over the practice of environmental, social and corporate governance (ESG) investing is heating up. Over the last few years, many Republican lawmakers have criticized banks and investment firms for taking into consideration ESG factors in their management of state investments and retirement funds.

In December, Florida pulled $2 billion worth of assets from the investment company BlackRock over the firm’s ESG investing practices. And last month a coalition of 25 state Attorneys General filed a lawsuit over the U.S. Department of Labor’s rulemaking that allows retirement plans to consider ESG factors when selecting investments.

Over the years businesses—including many retailers and commercial real estate companies—have made efforts to be more environmentally sustainable, socially responsible and ethically-minded in building their corporate governance structures. For ESG-minded investors, these non-financial factors are taken into consideration when assessing a company’s long-term risk exposure.

The legislative backlash against ESG investing has mainly focused on preventing trustees of state pension funds from basing investment decisions on non-pecuniary factors. But, as more lawmakers speak out against the practice, more bills are being introduced that go beyond setting fiduciary standards for state retirements and into regulating which businesses can work with the state.

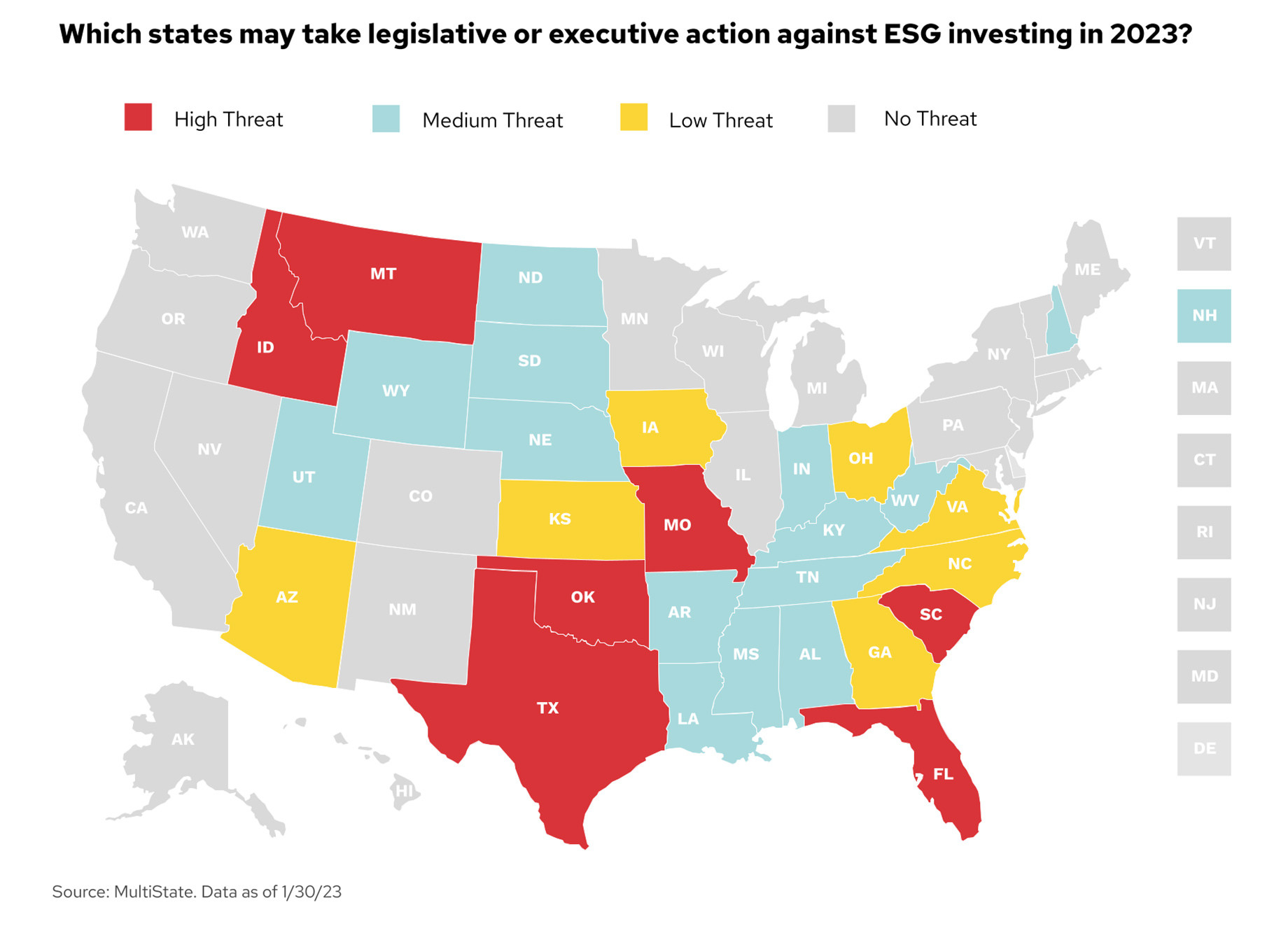

Currently, there are over 30 bills in 15 states — Arizona, Arkansas, Colorado, Florida, Iowa, Missouri, Montana, Nebraska, North Dakota, Oklahoma, South Carolina, Texas, West Virginia, Utah and Wyoming — that discourage the practice of ESG investing beyond state pensions. For example, a bill introduced in Montana (MT HB 228) would ban the state from basing any investment decision on non-pecuniary factors, i.e. ESG factors. Similarly, an Arkansas proposal (AR SB 62) prohibits the state from contracting with companies that boycott energy, fossil fuel, firearms and ammunition industries.

Some opponents of ESG have even introduced legislation that includes language allowing government officials to deny contracts to nearly any company that makes a business decision with which they disagree. A proposal in South Carolina (SC HB 3564) would require companies that contract with the state to certify that they do not boycott or discriminate against fossil fuel companies. And in Arizona, a bill (AZ SB 1138) introduced this year requires that financial firms may not discriminate against any person based on either political affiliation or other ESG factors.

It remains to be seen whether all or a significant number of these proposals will advance. The board of the American Legislative Exchange Council (ALEC) recently prevented an anti-ESG bill from being adopted as model policy, and some conservative clean energy advocates have looked for ways to depoliticize the issue.

The backlash over ESG investing does not always come in the form of terminating contracts or boycotting certain firms. Some state lawmakers have introduced legislation that uses tax incentives as a stick to pressure companies into either having or backing off ESG goals. A Virginia bill (VA SB 1248) was introduced last year that would restrict the state’s economic development organization from awarding tax incentives to employers that did not maintain a diverse board of directors.

Commercial property owners should be aware of how these issues evolve in states as they not only impact corporate tenants who have made climate pledges, but also financial institutions like community banks that make investment and lending decisions based on ESG factors.