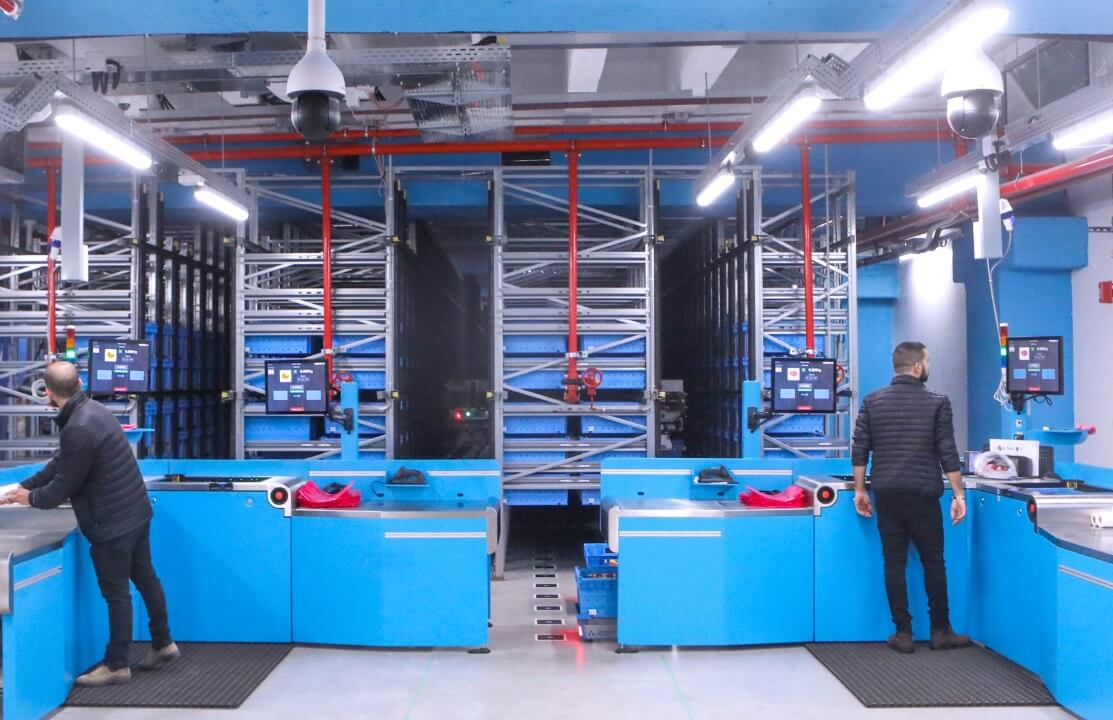

Startup firm Fabric may not be a retailer but is nonetheless backfilling dark stores and doing deals with retail landlords as part of a U.S. expansion. Its mission is to open “micro-fulfillment centers,” as Fabric calls them, in cities as a faster and cheaper way for brick-and-mortar chains to fulfill online orders, mostly using robots. “Imagine a giant vending machine with 20,000 totes in it and anywhere from 5,000 to 30,000 SKUs,” said Steve Hornyak, chief commercial officer. “An order comes in, the machine fulfills that order and spits it out, whether it is for click-and-collect or click-and-delivery. Very little human intervention is required.”

In Israel, Fabric fulfills hundreds of orders per day on behalf of drugstore chain Super-Pharm and grocer Rami Levy, operating out of a 6,000-square-foot former Adidas store and a former parking garage under a Tel Aviv high-rise. The company, which relocated its headquarters from Israel to New York in 2019, raised $136 million for its U.S. expansion before COVID-19 put online delivery and click-and-collect into even sharper focus. SCT contributing editor Joel Groover spoke with Hornyak about Fabric’s leasing potential. See their conversation below.

What’s happening with Fabric right now, especially with respect to real estate?

We have three sites under development in the New York City area, with the first one coming online in July. Our initial micro-fulfillment centers in New York will be multi-tenant, general merchandise. It’s providing on-demand, same-day and next-day fulfillment as a service to multiple customers in the market. We also have our first U.S. grocery site under development. It’s not yet announced due to a nondisclosure agreement with the client, but plans are to go live later this summer. We have several other grocery clients under contract, with planned deployments this year. I’d say we’ll have a minimum of 10 grocery sites at various stages of deployment this year in the United States, with two or three going live in 2020 and the rest going live in early 2021. In addition to our two sites in Israel that are already operating for Super-Pharm and Rami Levy, we have 12 more under contract, with two of those in initial stages of development.

What kind of space are you looking for in the U.S.?

Some of them are repurposed from prior retail users. Former big-box stores may be perfect for a micro-fulfillment center because they’re close to the customer. All I need is a minimum 12-foot ceiling height—16 feet high is better—and flooring that won’t require too much work. The rest of it, Fabric can add. While it’s not the case that just any tiny room somewhere will work, we can put micro-fulfillment centers in some pretty unconventional spaces.

Are we talking typically 5,000 or 6,000 square feet for these?

That’s on the small side. The high side would be 20,000 to 25,000 square feet.

(The story continues below.)

What do retailers get out of this?

By automating the process, we’re dropping their overall cost of fulfillment by 50 to 80 percent. Because of our robotics architecture, our unit economics are the same regardless of the size of the system. The key drivers are how much cheaper it is for a robot to automatically pick a tote and pull the items out of it to be presented and also how fast a robot can do it. We’re getting 10 times the output per square foot as the manual-based fulfillment systems. We can fulfill upwards of 8,000 orders a day — on-demand, automated — out of a 6,000-square-foot facility. That’s unheard of from the standpoint of density, profitability and units per square foot.

That’s a big departure from people handling fulfillment.

Having manual pickers running around, whether it’s your own employees or those working for a third-party provider, is way too expensive. We’re seeing grocers and retailers do this now and this will continue for a while, but ultimately it is unsustainable. For a typical grocery order, if you fulfill it manually, the cost range is between $14 and $20 for that order. That’s more than your typical profit on that order. Remember, it costs you zero when people come in and pick their own groceries themselves.

Are you doing any sublease deals with retailers?

We’re actually talking with several retailers that have spaces that are too big for what they ultimately need. They’re seeing that they could use Fabric not only to fulfill orders for their own products but also to do direct-to-consumer fulfillment for other retailers as a way to generate additional revenue from that store.

So in some cases, Fabric locates micro-fulfillment centers inside of operational stores, such as a supermarket that’s already right in shoppers’ neighborhoods. For a general-merchandise tenant with less market penetration, though, you could offer fee-based access to a micro-fulfillment center in an urban area?

That’s correct. Most general-merchandise retailers outsource to regional or national third-party logistic providers. These companies operate megawarehouses — they can be 500,000 square feet or more — that are at best semi-automated. They’re more expensive, particularly for the costliest part of the fulfillment, which is last-mile delivery.

It’s not hard to imagine a mall REIT teaming with you and putting in a micro-fulfillment center. Any landlords calling about this?

Yeah. We have active discussions with several mall operators and owners about placing micro-fulfillment centers in their existing locations. We’ve seen accelerated interest from warehouse owners, in addition to retail landlords. They’re investigating offering this as a service to whole new sets of customers. It would be more of a value-add proposition as part of a joint venture with us. COVID-19 is accelerating the interest.

So you’ve been getting more calls since the pandemic took hold?

I’ve been in the software and technology business for 30 years now and have been blessed and fortunate enough to be part of two IPOs, multiple acquisitions, successful divestitures, the dot-com boom, etc. I have never been busier in my life. This was a hot area to begin with, but in the past six weeks, the acceleration has been off the charts.