With a nearly 63% growth in retail rental rates from 2011 to 2021, Nashville is the U.S. market with the most rental rate momentum, according to JLL Capital Markets’ analysis of Costar Group data. South Florida is No. 2 at 47.1% rental rate growth, and Austin and Tampa are both at 39%, the firm reported.

RELATED: Tenants Are “Knocking Down Doors” in Nashville

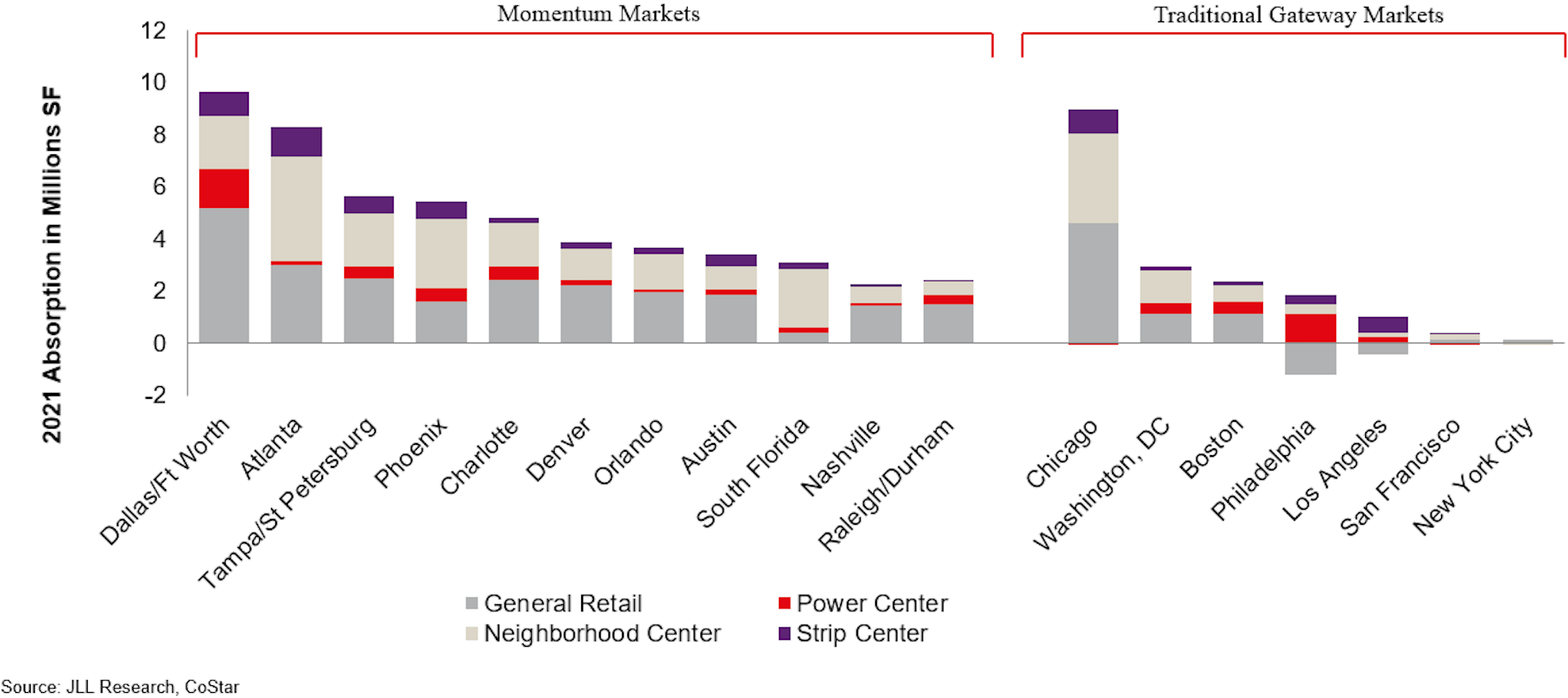

Other top markets for rental growth include Denver with 37% and Charlotte, North Carolina; Dallas-Fort Worth; and Raleigh-Durham, North Carolina, each around 30%.

RELATED: All the Ways the Carolinas Are a Hot Market

2021 Absorption

These momentum markets’ retail rents grew faster over 10 years than the national average of 27.7%. Their populations also grew faster than the 10-year national average of 7.4%. “Retail follows consumers, rent growth follows both, and investors follow all three,” said JLL senior managing director and retail capital markets co-leader Danny Finkle. “When we look at the traditional underwriting of retail, we look at 10-year cash flows and aim to be able to predict about 2 to 3% annual rent increases. These markets are already outperforming right now, and their market dynamics suggest they will continue to do so.”

Outsize rental rate growth is likely in more markets. Populations are booming in Las Vegas, Orlando, Salt Lake City and the Boise, Idaho, metro area, and JLL predicted rental rates in those markets will grow between 12% and 21% by 2025.

Small Businesses, Meanwhile, Have Trouble Making Rent

Consumer spending may be recovering, but many small and independent retailers still have trouble paying rent. Small business research firm Alignable found that 34% of small retailers couldn’t make rent in April. Respondents blamed inflation, gas prices, supply chain issues and labor shortages for their financial straits. They blamed rent increases, too. Of the 2,279 small businesses surveyed by Alignable, 46% said their rent was higher than six months ago.

A New Take on Small Business

Central California’s Santa Maria Town Center recently hosted pop-ups of perhaps the smallest businesses in the state. Children around sixth grade who participated in a Santa Maria Valley Chamber of Commerce-sponsored Junior CEO program unveiled their businesses selling strawberry-themed desserts in the mall on April 30. Leading up to the pop-ups, the kids learned marketing, cost modeling, logo creation and other business basics. Another six-week session will run this fall. See the the chamber of commerce’s pictures of the mall pop-ups here.

ICSC Small Business Center executive editor Will Swarts contributed to this report.

By Brannon Boswell

Executive Editor, Commerce + Communities Today