The Short Version

- Industry veterans Sandeep Mathrani and Steven Levin are teaming up to acquire high-potential Class A malls that need significant reinvestment.

- Their approach prioritizes early capital deployment, even signing major tenants before closing an acquisition in one instance to build leasing momentum.

- The strategy has driven rapid turnarounds at properties like Annapolis Mall, which jumped from roughly 70% occupancy to 92% leased with tenants like Dick’s House of Sport, Dave & Buster’s and Tesla.

- Mathrani and Levin leverage their deep experience and decades-long relationships with top retailers to accelerate post-acquisition leasing and repositionings.

- The partners focus on a select set of dominant assets, pairing retail remerchandising with mixed-use redevelopment to strengthen long-term value and community relevance.

Mathrani and Levin’s Playbook for Repositioning Class A Malls

Friends and occasional business partners for decades, Atlas Hill RE founder Sandeep Mathrani and Centennial founder and CEO Steven Levin have developed their own playbook for ramping up the value and performance of U.S. shopping centers. “We are seeking great properties that have some of the tenants that define A-class assets like an Apple but that need substantial reinvestment,” said Mathrani, who has held CEO roles at GGP, Brookfield Properties Retail and WeWork.

He said their approach is the opposite of some of the “cash-flow plays” of the day in which investors snap up lower-tier malls, make little reinvestment and sit back to collect rents. “We’re interested in generational asset-building,” Mathrani said. “When Steven and I buy an asset, we’re going to invest $100 million or $150 million, whatever it happens to be, up front. We’re playing a different game, which is to create great destinations. It’s what we know how to do.”

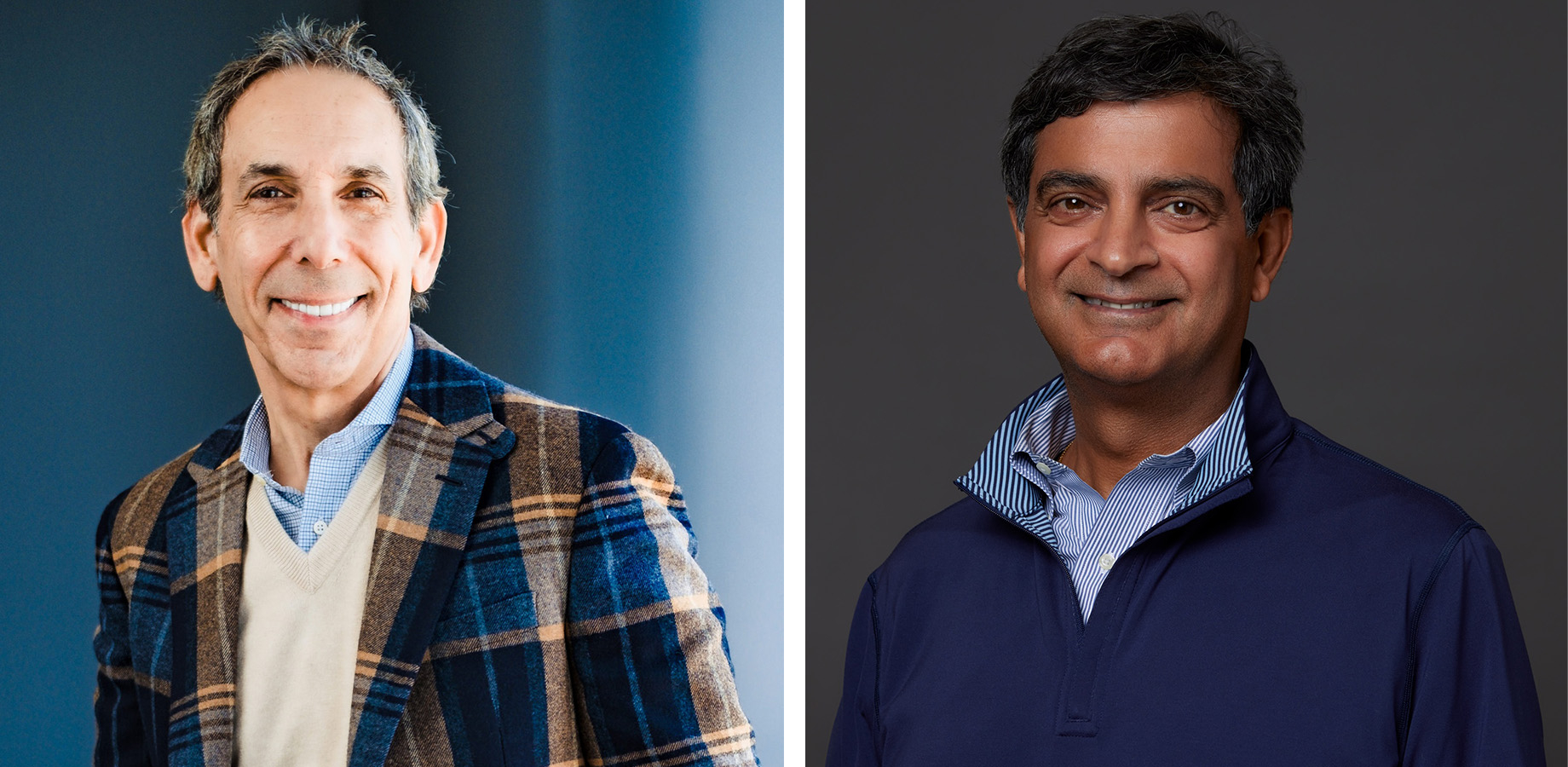

Centennial founder Steven Levin and Atlas Hill RE founder Sandeep Mathrani boast a combined 90 years of experience in the Marketplaces Industry. They have been occasional business partners for decades. “We have a great partnership and work well together,” Mathrani said. Added Levin: “We’re good friends and see the world the same way.” Photos courtesy of Centennial and Atlas Hill RE

Reinvestment and Remerchandising

Annapolis Mall is a recent beneficiary of the partners’ approach. Centennial and Atlas Hill RE have added more than 300,000 square feet of tenants since teaming with Kildare Partners to acquire the mall from Unibail-Rodamco-Westfield, which had pivoted to focus on a select few flagship properties, in July 2024. The new retailers brought in by Centennial and Atlas Hill RE include Uniqlo, Swarovski, Jack & Jones, Offline by Aerie, GOAT USA, Dave & Buster’s and Dick’s House of Sport. “We took an asset that was 70-ish percent occupied to 92% occupied, with leases signed,” Mathrani said.

Since last year’s acquisition of Annapolis Mall, located in Maryland’s Chesapeake Bay region close to the waterfront, Centennial and Atlas Hill RE have signed deals with a raft of new tenants. Photo courtesy of Centennial and Atlas Hill RE

Generating early momentum was the key to that push. While the center already boasted a high-performing Macy’s and top-tier tenants like Apple, Lululemon, Zara, H&M, Urban Outfitters and Crate & Barrel, its former Nordstrom and Sears boxes were vacant and JCPenney was underperforming. The partners zeroed in on those anchor dynamics. Even before the transaction closed, Mathrani said, they had signed new leases with Dick’s House of Sports and Dave & Buster’s.

As Levin sees it, this sent a clear signal of commitment to existing and prospective tenants. “When they see that you’re reinvesting in the shopping center, they’ll commit to it, too,” he explained. But the quality of those new operators mattered, as well. “Dick’s House of Sports is really the dominant tenant of its kind and Dave & Buster’s is best-in-class in entertainment, so adding them early on was vitally important,” Levin said.

FROM THE C+CT ARCHIVE: Dick’s Will Focus on Its Experiential House of Sport Concept — and Backfilling Mall Anchors

The momentum at Annapolis Mall accelerated from there. Tesla signed a lease for a 26,000-square-foot showroom and service center. Jack & Jones will open in fall 2026, one of the European chain’s first 10 U.S. stores. And more than 35 tenants have renewed, including Zara, Hollister, Janie and Jack, Tumi, Crate & Barrel, Michael Kors, Foot Locker and Pacsun.

The new owners replaced JCPenney with Onelife Fitness and opted to repurpose the Sears site with a 500-unit multifamily residential building, now entitled and in the planning stage. Dick’s House of Sport took the former Nordstrom box. “Not only have we evolved the inside of the mall with on-trend retailers, we’ve also completely reinvented those three anchors,” Mathrani said.

When choosing malls to buy and reinvent, Centennial and Atlas Hill RE pay close attention to the strength of the existing tenant lineup. Annapolis Mall’s Apple store, pictured above, as well as Urban Outfitters, Zara, H&M, Lululemon, Macy’s and others provided a solid foundation for the partners’ remerchandising campaign. Photo courtesy of Centennial and Atlas Hill RE

Decades of Experience Have Honed an Accelerated Post-Acquisition Progress

Levin and Mathrani focus on getting the timing right on acquisitions. When a Class A asset needs reinvestment, its top-tier tenants tend to get antsy. If lack of landlord action persists, they could bolt rather than renew. “There are these assets where you can jump in and provide that lifeline but you cannot afford to wait another year or two because at that point, you would be catching a falling knife,” Mathrani said.

The partners’ strategy also requires quick post-acquisition leasing progress. They said their decades of industry experience helps them make that early difference. “Our reputation, I think, has a lot to do with it,” Mathrani said. “I’ve been working in the industry for 40 years, and Steven, if you consider that he was about 20 when he got started, has built a reputation over the past 50 years. When we attach our names to a property, it adds credibility, and we have good relationships with senior leadership at many retail companies.”

In his tenure at Brookfield Properties and its predecessor GGP, Mathrani reinvented about 100 U.S. shopping centers, he said, including Ala Moana Center in Honolulu, The Shops at La Cantera in San Antonio, and Oakbrook Center in Illinois and Alderwood in Lynnwood, Washington. He also previously filled senior leadership roles at Forest City Ratner Cos. and Vornado Realty Trust.

Among Levin’s latest mall-densification projects is The Shops at Willow Bend in Plano, Texas. Centennial, along with Cawley Partners and Waterfall Asset Management, acquired the mall in 2022 aiming to redevelop it into The Bend. Centennial’s completed purchases of the Macy’s and Neiman Marcus anchor boxes and its plans to demise nearly half of the 1.4 million square foot mall will create room for a mixed-used destination to include apartments, townhomes, a hotel, offices, outward-facing retail and community green spaces.

The potential for a mixed-use reinvention spurred Centennial, Cawley Partners and Waterfall Asset Management to acquire the 1.4 million-square-foot Shops at Willow Bend in Plano, Texas. Plans call for apartments, townhomes, a hotel, offices, outward-facing retail and community green spaces, with the demolition of nearly half of the existing mall. Image above and at top courtesy of Centennial

Other examples of Centennial acquisitions and reinventions include Valencia Town Center in Los Angeles and Westland in Hialeah, Florida. “We’re always looking for these projects, but they require commitment, resources, capital and intensity, so we choose them very carefully,” Levin said.

More recently, Mathrani began working on the reinvention of Galleria Fort Lauderdale, a well-located Florida property acquired by Atlas Hill RE, GFO Investments, Prime Finance and InSite Group. “Steven’s managing that asset, which is another A-plus piece of real estate,” Mathrani said. “The center is half vacant, but you have an Apple store there that performs well. I think in the next six months, once again, we’ll be at 80 or 90% leased.”

In the case of Annapolis Mall, the partners also cite the importance of collaboration with their colleagues, including Centennial president Paul Kurzawa and executive vice president of property management Stephen White along with Atlas Hill RE’s leasing team for the property, Stephanie Mineo and Melinda Holland.

A Focus on High-Quality Malls Pays Dividends

Centennial’s national portfolio of shopping, dining, entertainment and mixed-use destinations keeps growing, as does its full-service property management platform serving third-party owners. But while the company operates more than 25 million square feet of mixed-use destinations across 18 states, Levin emphasizes that its focus is on quality, not just quantity. “If you buy good assets and keep investing in them, they get more dominant — better and better,” he said.

Mathrani and Levin are believers in the enduring relevance of the American mall, with the right amount of investment and savvy management. “When I was a kid in Dallas and NorthPark was my mall, I’d get up on Saturday morning and say: ‘I want to go to the mall,’” Levin recalled. “That wasn’t just because I needed a pair of jeans; I wanted to go. That’s what dominant malls bring back to the community and the market. A dominant mall is still Americana. It’s where people want to go.”

MORE FROM C+CT: From Southdale Center to Gen Z: Why the Core Appeal of Malls Endures

By Joel Groover

Contributor, Commerce + Communities Today