Debate over whether to force large businesses to disclose their greenhouse gas (GHG) emissions has resurfaced this month after the U.S. Securities and Exchange Commission (SEC) issued a final rule on the matter. In a landmark decision on March 6, the SEC voted 3-2, along party lines, to adopt final rules requiring large publicly traded companies to disclose their GHG emissions in annual financial reporting and registration statements.

Under the newly adopted rules, impacted companies must disclose their material Scope 1 and Scope 2 GHG emissions. Scope 1 emissions include direct emissions caused by sources owned by a company like furnaces, vehicles, and boilers, whereas Scope 2 emissions cover indirect sources purchased by a company like electricity and heating. The final rules omitted, however, one of the more controversial provisions from the original proposed rules that required companies to disclose emissions generated from suppliers or assets not owned by a company, commonly referred to as Scope 3 emissions.

ICSC members, particularly owner/developers, should become familiar with the new rules if their companies voluntarily set corporate “targets” to reduce emissions in their buildings or portfolios, or own assets located in cities or states with building performance mandates. Companies that purchase renewable energy certificates (RECs) or carbon offsets may also be subject to SEC disclosures. Owners who have made significant investments in repairing a building after a storm or weather-proofing resiliency measures or bear increased costs due to waterfront locations prone to possible rising sea levels may be subject to these new regulations.

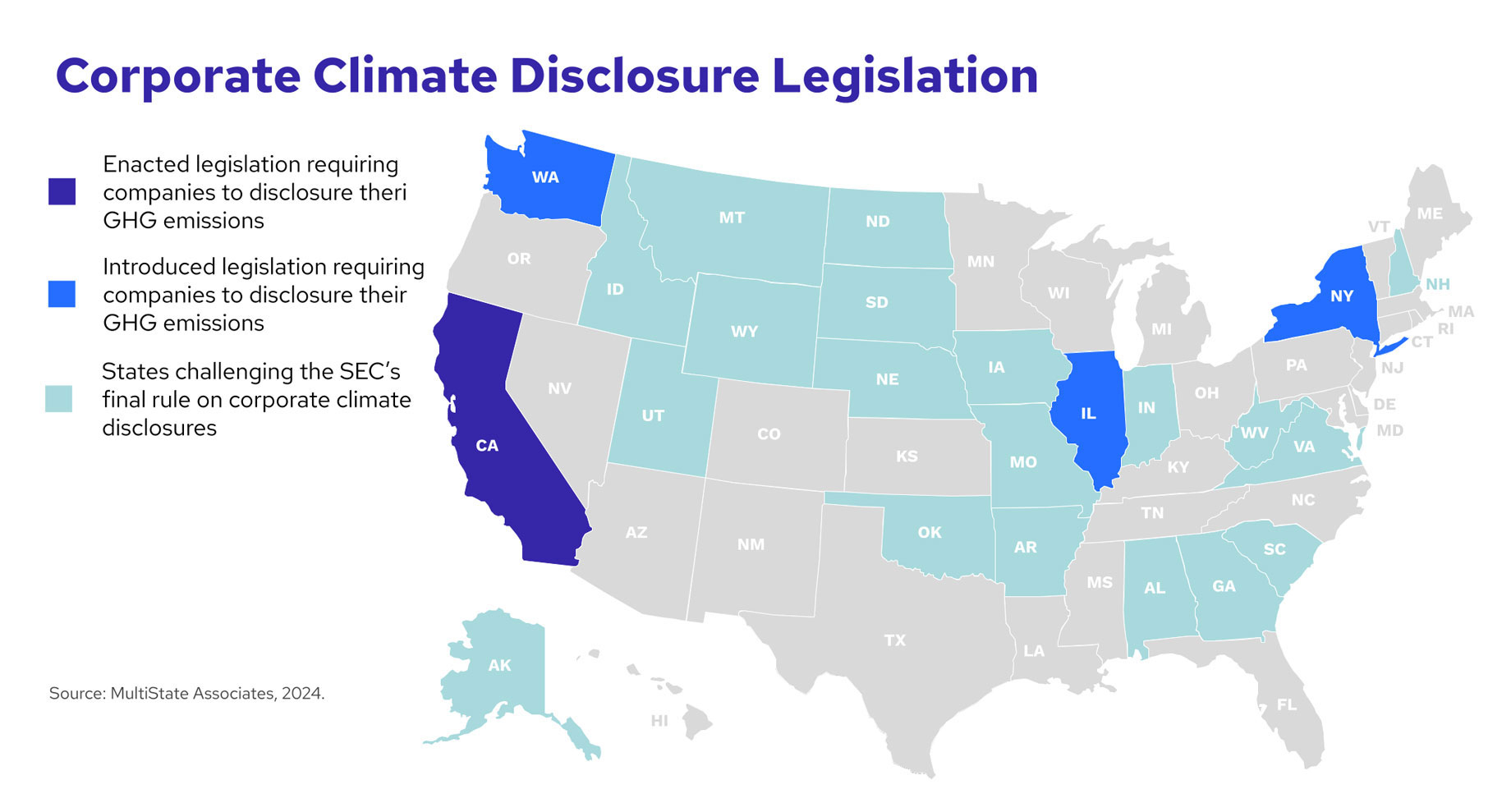

Republican state lawmakers have been quick to push back on the SEC over the past week. Attorneys General from 19 states have filed a lawsuit with the Court of Appeals for the 11th Circuit in Atlanta saying the rule “exceeds the agency’s statutory authority” and asked the court to vacate the new rules. Republicans have been particularly critical of efforts from governments and business to incorporate climate data in financial and investment decisions. This year alone, lawmakers in 13 states introduced over 50 bills that would bar state governments from doing work with companies that discriminate in their business practices based on climate concerns and other environmental, social and corporate governance (ESG) factors.

Meanwhile, progressive lawmakers have already been busy acting on legislation to require companies to disclose their GHG emissions. In 2023, California Governor Gavin Newsom (D) signed the nation’s first corporate climate disclosure legislation (CA SB 253) into law. The Climate Corporate Data Accountability Act requires public and private companies with over $1 billion in annual revenues that do business in the state to annually report Scope 1, 2, and 3 GHG emissions to the California Air Resources Board. In January, the U.S. Chamber of Commerce along with other business groups in the state filed a lawsuit challenging SB 253, arguing that the new law violates the First Amendment by forcing businesses to engage in subjective speech.

Before California enacted SB 253, New York lawmakers introduced their own corporate climate disclosure legislation (NY SB 897 & NY AB 4123) that would also require businesses with over $1 billion in revenues to report their direct and indirect carbon emissions to the New York Department of Conservation. Both New York bills have yet to clear a legislative chamber and lawmakers are aiming to adjourn session by early June.

Corporate climate disclosure bills have also been introduced in Illinois (IL HB 4268) and Washington (WA SB 6092). Washington lawmakers just adjourned their legislative session with SB 6092 stuck in the lower chamber, and Illinois’ bill, based on California’s SB 253, remains with the Rules Committee.

Since the SEC changed the scope of its final rules, it remains to be seen whether climate focused lawmakers continue pushing a more aggressive California-style (Scope 1-3) disclosure requirement or view the SEC rules as sufficient. In January, before the SEC issued its rule, Washington lawmakers amended SB 6092 to require the State’s Department of Ecology to study the emissions disclosure requirement made by the SEC so as to not duplicate efforts. Note that the SEC Rule does not pre-empt these state requirements.

As election season approaches, state lawmakers may be more careful with regard to their positions on climate issues, especially as companies try to distance themselves from climate goals and ESG-based decision making. Lawmakers who favor California’s approach could double down on more expansive disclosure requirements, while critics may tout anti-ESG legislation in campaign ads as the answer to pushback on climate-focused policies.

For more information contact gpp@icsc.com.