When Toys R Us filed for bankruptcy protection in late 2017, many saw the move as further evidence of the demise of brick-and-mortar retail. Raider Hill Advisors saw opportunity.

In mid-2018, this private retail real estate investment and advisory firm became the exclusive real estate adviser to the retailer’s bankruptcy estate. The firm took on leasing, redevelopment and disposition of some 320 vacant big boxes across 46 states. To some, that might have seemed like a tall order, especially for the product type. “Big-box retail was very much an out-of-favor asset class at the time, given the head winds facing the space, including consolidation in such categories as office supplies and sporting goods,” recalls Joseph M. Tichar, president and COO of New York City–based Raider Hill.

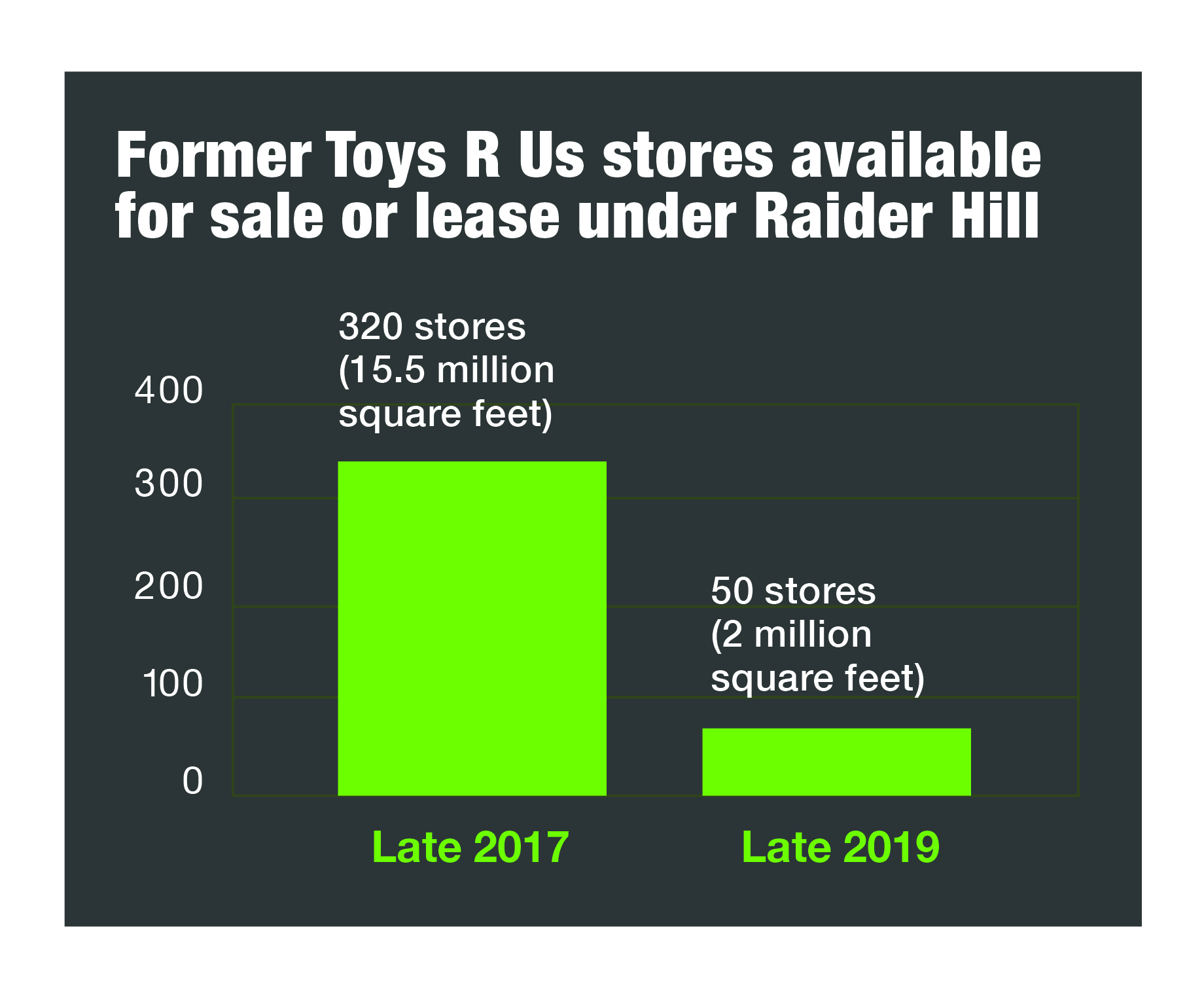

In less than two years, Raider Hill defied skeptics by re-leasing much of the Toys R Us portfolio to national credit tenants, including thriving off-price brands like Burlington and growing quick-service restaurant chains like Chili’s Grill & Bar and Chick-fil-A. It also has sold some of the space to retailers that prefer to own their real estate and to private investors that plan to repurpose it for retail or other uses. As of late last year, Raider Hill’s portfolio of former Toys R Us stores available for sale or lease had dwindled (see chart below). “We’ve demonstrated the fact that there is an appetite for big-box retail in this market,” said Tichar, who co-founded Raider Hill in 2015 with current ICSC Chairman Daniel B. Hurwitz, the firm’s CEO.

And if big-box retail properties can sell …

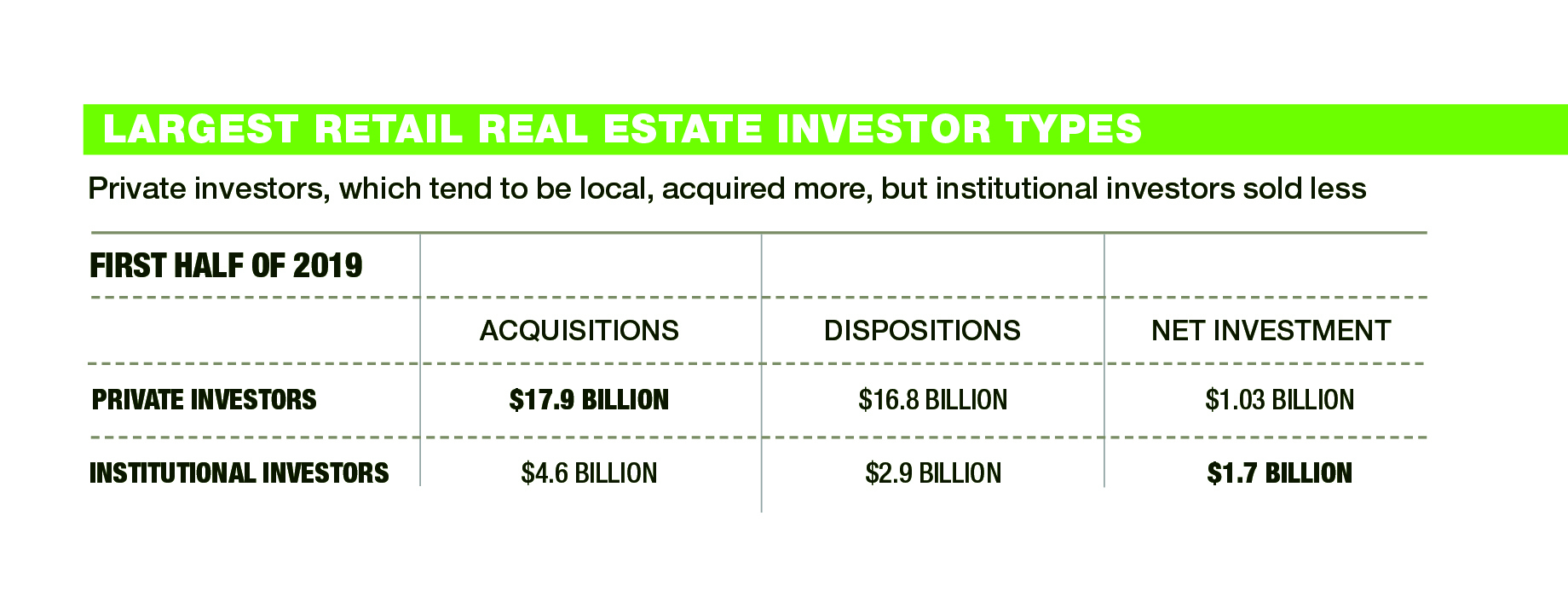

There are reasons to be optimistic about investor sentiment toward retail real estate. From month to month in 2019, year-over-year transaction-volume changes fluctuated between growth and decline, according to Real Capital Analytics. But demand for certain property types remained strong, and private capital sources emerged as some of the leading players in the sector. “Some of the biggest buyers over the past year have been private capital sources, who tend to be smaller investors focused on local markets,” said Jim Costello, a senior vice president at Real Capital Analytics. Sales for retail properties averaged slightly more than $9 million during the first half of 2019. For those six months, private investors formed the largest buyers of retail real estate by a wide margin, according to the firm, and that is a return to tradition. Private investors’ market share had been squeezed in 2018 by a spike in cross-border investment. Institutional players were the next-largest group of buyers for the first half of 2019.

In all, private investors acquired almost four times as many dollars in retail real estate as did institutions, but because private investors also sold more than institutions, institutions were actually the largest net investors in retail real estate, “to the tune of $1.7 billion,” Real Capital Analytics says (see table below). In the third quarter, institutions sold more retail real estate than they bought, and thus net investment among this group was negative, according to Real Capital Analytics. However, private entities’ net investment in the sector was positive, surpassing $2 billion.

Save on office supplies, meals, movie tickets, travel and more with ICSC’s Member Perks program

Discover moreBoth investor types have been keen on open-air shopping centers, particularly those leased to grocers and other necessity-oriented tenants. Deal volume for grocery-anchored centers increased by 15 percent in the second quarter of 2019, the most recent quarter for which data were available, to nearly $4 billion, according to Real Capital Analytics. The growth was driven by single-asset sales (versus one-off megadeals), which are a good indicator of the health of the market. Sales of drugstore assets have been robust too. Single-asset sales of drugstore properties surged by 33 percent year over year in the third quarter of 2019.

Investor focus on necessity-oriented retail reflects larger economic trends, says Manuel Martin, a managing director who heads the U.S. retail sector platform for Nuveen Real Estate, the investment-management arm of financial services giant TIAA. Wage growth has been fairly stagnant during the past decade, but prices for housing, health care and education have surged, notes Martin. As a result, many Americans have less disposable income today, which means they are not only price-sensitive but also less inclined to spend on nonessentials.

Worker pay has been slow to rise throughout the current expansion, according to Bankrate. Unemployment has been at historical lows for some time, but wages did not rise by more than 3 percent annually until October 2018. “Retail is not going away. What’s really changing is the consumer,” says Martin. “There has been a bifurcation in disposable income that benefits necessity retail on one end of the spectrum and premium retail at the other.”

Follow ICSC on Instagram. Our feed visualizes the latest trends in retail real estate

Learn moreHigh-quality malls continue to generate interest, including those that are good candidates for densification: the creation of value through addition of nonretail uses, such as hotels, offices and apartments. Experts say densification is not right for every property, but in markets with high-paying jobs and population growth, it can make economic sense.

Brookfield Property Partners appears to see such potential in some of its recent mall acquisitions, some observe. Brookfield, which acquired General Growth Properties in 2018, recently boosted its exposure to the mall sector when it bought JPMorgan Chase’s share in four malls where Brookfield was already a minority owner, reports Bloomberg. Brookfield Property Partners is the flagship listed real estate company of Toronto-based Brookfield Asset Management. That deal “is very much in line with their strategy when they acquired GGP: to create value through the mixed-use development of these retail properties,” said Vince Tibone, a retail analyst with Green Street Advisors.

“Retail is not going away. What’s really changing is the consumer. There has been a bifurcation in disposable income that benefits necessity retail on one end of the spectrum and premium retail at the other”

Tichar says he has seen greater interest in retail real estate among institutions, although their focus is open-air centers, particularly grocery-anchored properties. In 2017 and 2018, many large investors, including institutions and REITs, were net sellers of retail real estate, he notes, but that is changing, because operating performance has been better than expected. “While there have been store closures, bankruptcies and rapid changes in retail fundamentals, when you look at the operating results of the shopping center REITs, quarter after quarter they continue to exceed expectations,” he said. “Expectations have been low because generalists often think retail is no longer an investable asset class, when in fact these properties continue to throw off very attractive cash flows and generate attractive yields.”

Those attractive yields, combined with stable operating results and reduced borrowing costs, just may convince the investors that have been sitting on the sidelines to deploy some proverbial dry powder. Among institutional investors, the amount of such cash reserves available for deployment stood at record levels — $200 billion — in the third quarter of last year, according to Newmark Knight Frank.

“I would expect 2020 to be a year where you see transaction volume in retail real estate increase,” said Tichar, “and several institutions and REITs become net buyers.”

By Anna Robaton

Contributor, Commerce + Communities Today